TCF Bank 2011 Annual Report Download - page 110

Download and view the complete annual report

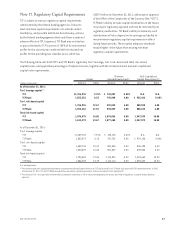

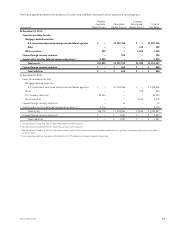

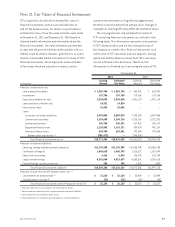

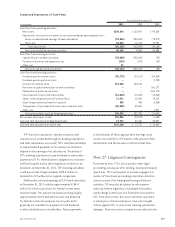

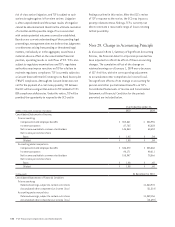

Please find page 110 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 20. Fair Value Measurement

Fair values represent the estimated price that would

be received from selling an asset or paid to transfer a

liability, otherwise known as an “exit price.” The following

is a descrip tion of valuation methodologies used for

assets recorded at fair value on a recurring basis at

December 31, 2011.

Securities Available for Sale Securities available

for sale consist primarily of U.S. Government sponsored

enterprise securities and federal agencies and U.S. Treasury

securities. The fair value of U.S. Government sponsored

enterprise securities is recorded using prices obtained

from independent asset pricing services that are based on

observable transactions, but not quoted markets, and are

classified as Level 2 assets. The fair value of U.S. Treasury

bills and notes is recorded using prices obtained from

independent asset pricing services that obtain prices from

brokers and active market participants, and are classified as

Level 1 assets. Management reviews the prices obtained from

independent asset pricing services for unusual fluctuations

and comparisons to current market trading activity.

However, management does not adjust these prices.

Other securities, for which there is little or no market

activity, are categorized as Level 3 assets. Other securities

classified as Level 3 assets include equity investments in

other thinly traded financial institutions and foreign debt

securities. The fair value of these assets is determined by

using quoted prices, when available, and incorporating

results of internal pricing techniques and observable

market information, which is adjusted for security specific

information, such as financial statement strength, earnings

history, disclosed fair value measurements, recorded

impairments and key financial ratios, to determine fair

value. Other securities, for which there are active markets

and routine trading volume, are categorized as Level 1 assets.

Forward Foreign Currency Contracts Forward foreign

currency contract assets and liabilities are carried at fair

value, which is net of the related cash collateral received

and paid when a legally enforceable master netting

agreement exists between TCF and the counterparty.

Assets Held in Trust for Deferred Compensation

Assets held in trust for deferred compensation plans

include investments in publicly traded stocks, excluding

TCF common stock reported in treasury and other equity,

and U.S. Treasury notes. The fair value of these assets is

based upon prices obtained from independent asset pricing

services based on active markets.

92 TCF Financial Corporation and Subsidiaries