TCF Bank 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Deposit Account Overdrafts Deposit account

overdrafts are reported in consumer or commercial loans.

Net losses on uncollectible overdrafts are reported as net

charge-offs in the allowance for loan and lease losses

within 60 days from the date of overdraft. Uncollectible

deposit fees are reversed against fees and service charges

and a related reserve for uncollectible deposit fees is

maintained in other liabilities. Other deposit account

losses are reported in other non-interest expense.

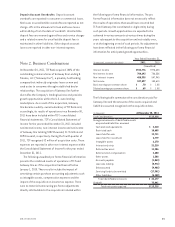

Note 2. Business Combinations

On November 30, 2011, TCF Bank acquired 100% of the

outstanding common shares of Gateway One Lending &

Finance, LLC (“Gateway One”), a privately held lending

company that indirectly originates loans on new and

used autos to consumers through established dealer

relationships. The acquisition of Gateway One further

diversifies the Company’s lending business and provides

growth opportunities within the U.S. auto lending

marketplace. As a result of the acquisition, Gateway

One became a wholly-owned subsidiary of TCF Bank and,

accordingly, its results of operations since November 30,

2011 have been included within TCF’s consolidated

financial statements. TCF’s Consolidated Statement of

Income for the year ended December 31, 2011 included

net interest income, non-interest income and net income

of Gateway One totaling $282 thousand, $1.9 million and

$89 thousand, respectively. During the fourth quarter of

2011, TCF recognized $2 million of acquisition costs. These

expenses are reported in other non-interest expense within

the Consolidated Statement of Income for the year ended

December 31, 2011.

The following unaudited pro forma financial information

presents the combined results of operations of TCF and

Gateway One as if the acquisition had been effective

January 1, 2010. These results include the impact of

amortizing certain purchase accounting adjustments such

as intangible assets, compensation expenses and the

impact of the acquisition on income tax expense. There

were no material nonrecurring pro forma adjustments

directly attributable to the acquisition included within

the following pro forma financial information. The pro

forma financial information does not necessarily reflect

the results of operations that would have occurred had

TCF and Gateway One constituted a single entity during

such periods. Growth opportunities are expected to be

achieved in various amounts at various times during the

years subsequent to the acquisition and not ratably over,

or at the beginning or end of such periods. No adjustments

have been reflected in the following pro forma financial

information for anticipated growth opportunities.

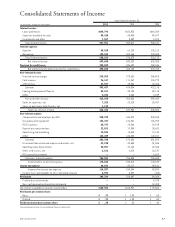

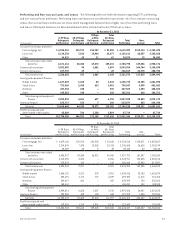

Year Ended December 31,

(In thousands, except per-share data) 2011 2010

(Unaudited)

Interest income $943,776 $978,623

Net interest income 704,693 706,556

Non-interest income 458,998 547,940

Net income 107,597 150,613

Basic earnings per common share $ .70 $ 1.08

Diluted earnings per common share $ .69 $ 1.08

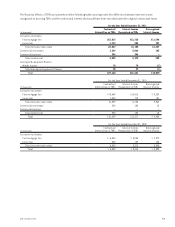

The following table summarizes the consideration paid for

Gateway One and the amounts of the assets acquired and

liabilities assumed recognized at the acquisition date.

(In thousands) At November 30, 2011

Cash Consideration $115,218

Recognized amounts of identifiable assets

acquired and liabilities assumed:

Cash and cash equivalents $ 2,210

Restricted cash 18,685

Loans held for sale 13,711

Loans held for investment 3,779

Intangible assets 6,170

Interest only strip 21,210

Deferred tax asset 11,286

Deferred stock compensation 2,600

Other assets 1,588

Accounts payable (1,043)

Loan sale liability (5,972)

Debt assumed (9,988)

Servicing funds to be remitted (17,901)

Other liabilities (4,158)

Total identifiable net assets $ 42,177

Goodwill 73,041

Total net assets acquired $115,218

652011 Form 10-K