TCF Bank 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

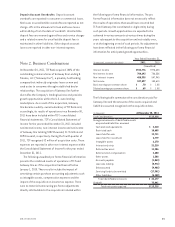

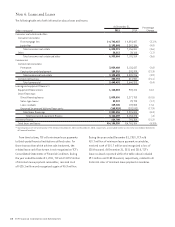

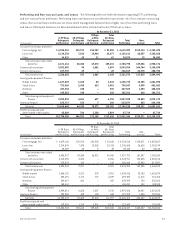

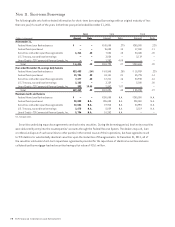

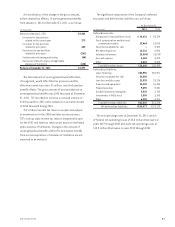

Performing and Non-accrual Loans and Leases The following tables set forth information regarding TCF’s performing

and non-accrual loans and leases. Performing loans and leases are considered to have a lower risk of loss and are on accruing

status. Non-accrual loans and leases are those which management believes have a higher risk of loss than performing loans

and leases. Delinquent balances are determined based on the contractual terms of the loan or lease.

At December 31, 2011

(In thousands)

0-59 Days

Delinquent

and Accruing

60-89 Days

Delinquent

and Accruing

90 Days

or More

Delinquent

and Accruing

Total

60+ Days

Delinquent

and Accruing Total

Performing Non-

accrual Total

Consumer real estate and other:

First mortgage lien $ 4,525,951 $32,571 $54,787 $ 87,358 $ 4,613,309 $129,114 $ 4,742,423

Junior lien 2,110,334 7,813 14,464 22,277 2,132,611 20,257 2,152,868

Other 34,829 20 21 41 34,870 15 34,885

Total consumer real estate

and other 6,671,114 40,404 69,272 109,676 6,780,790 149,386 6,930,176

Commercial real estate 3,092,855 98 1,001 1,099 3,093,954 104,744 3,198,698

Commercial business 227,970 49 – 49 228,019 22,775 250,794

Total commercial 3,320,825 147 1,001 1,148 3,321,973 127,519 3,449,492

Leasing and equipment finance:

Middle market 1,627,369 1,260 84 1,344 1,628,713 13,185 1,641,898

Small ticket 792,566 2,368 613 2,981 795,547 5,535 801,082

Winthrop 447,334 235 – 235 447,569 1,253 448,822

Other 185,563 198 – 198 185,761 610 186,371

Total leasing and equipment

finance 3,052,832 4,061 697 4,758 3,057,590 20,583 3,078,173

Inventory finance 623,717 153 7 160 623,877 823 624,700

Subtotal 13,668,488 44,765 70,977 115,742 13,784,230 298,311 14,082,541

Portfolios acquired with

deteriorated credit quality 65,820 766 1,128 1,894 67,714 – 67,714

Total $13,734,308 $45,531 $72,105 $117,636 $13,851,944 $298,311 $14,150,255

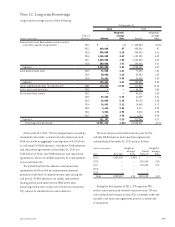

At December 31, 2010

(In thousands)

0-59 Days

Delinquent

and Accruing

60-89 Days

Delinquent

and Accruing

90 Days

or More

Delinquent

and Accruing

Total

60+ Days

Delinquent

and Accruing Total

Performing Non-

accrual Total

Consumer real estate and other:

First mortgage lien $ 4,679,168 $30,910 $42,938 $ 73,848 $ 4,753,016 $140,871 $ 4,893,887

Junior lien 2,214,805 7,398 13,365 20,763 2,235,568 26,626 2,262,194

Other 39,099 30 9 39 39,138 50 39,188

Total consumer real estate

and other 6,933,072 38,338 56,312 94,650 7,027,722 167,547 7,195,269

Commercial real estate 3,215,055 8,856 – 8,856 3,223,911 104,305 3,328,216

Commercial business 279,879 165 – 165 280,044 37,943 317,987

Total commercial 3,494,934 9,021 – 9,021 3,503,955 142,248 3,646,203

Leasing and equipment finance:

Middle market 1,606,125 3,221 330 3,551 1,609,676 23,153 1,632,829

Small ticket 695,491 3,172 727 3,899 699,390 11,018 710,408

Winthrop 529,467 462 – 462 529,929 134 530,063

Other 158,431 – – – 158,431 102 158,533

Total leasing and equipment

finance 2,989,514 6,855 1,057 7,912 2,997,426 34,407 3,031,833

Inventory finance 790,955 189 155 344 791,299 1,055 792,354

Subtotal 14,208,475 54,403 57,524 111,927 14,320,402 345,257 14,665,659

Portfolios acquired with

deteriorated credit quality 119,529 1,215 1,901 3,116 122,645 – 122,645

Total $14,328,004 $55,618 $59,425 $115,043 $14,443,047 $345,257 $14,788,304

712011 Form 10-K