TCF Bank 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

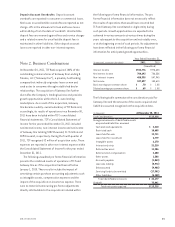

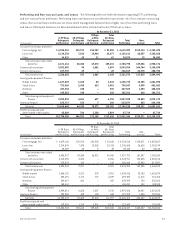

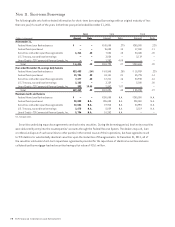

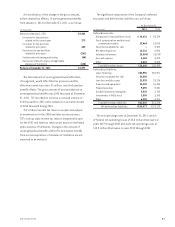

The following table provides interest income recognized on loans and leases in non-accrual status and contractual interest

that would have been recorded had the loans and leases performed in accordance with their original contractual terms.

For the Year Ended December 31,

(In thousands) 2011 2010 2009

Contractual interest due on non-accrual loans and leases $37,645 $40,016 $31,368

Interest income recognized on loans and leases in non-accrual status 7,371 6,773 3,010

Unrecognized interest income $30,274 $33,243 $28,358

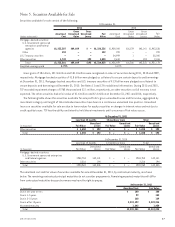

The following table summarizes consumer real estate loans to customers in bankruptcy.

At December 31,

(In thousands) 2011 2010

Consumer real estate loans to customers in bankruptcy:

0-59 days delinquent and accruing $74,347 $66,166

60+ days delinquent and accruing 1,112 1,849

Non-accrual 17,531 22,782

Total consumer real estate loans to customers in bankruptcy $92,990 $90,797

For the years ended December 31, 2011 and 2010,

interest income would have been reduced by approximately

$70 thousand and $79 thousand, respectively, had the

accrual of interest income been discontinued upon

notification of bankruptcy.

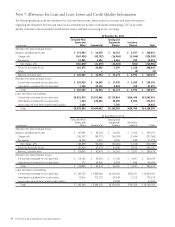

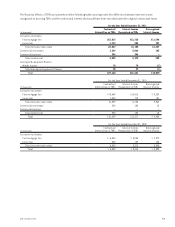

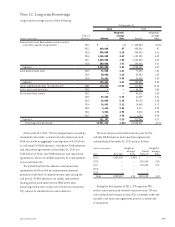

Loan Modifications for Borrowers with Financial

Difficulties Included within loans and leases are certain

loans that have been modified in order to maximize

collection of loan balances. If, for economic or legal

reasons related to a customer’s financial difficulties, TCF

grants a concession from the original terms and conditions

on the loan, the modified loan is classified as a TDR.

During the third quarter of 2011, TCF adopted

Accounting Standards Update (“ASU”) 2011-02,

A Creditor’s Determination of Whether a Restructuring is a

Troubled Debt Restructuring (Topic 310), which modified

guidance for identifying modifications of receivables that

constitute a TDR. As a result of adopting the provisions of

ASU 2011-02, TCF reassessed all loan modifications that

occurred after December 31, 2010 for identification as

TDRs. TCF adopted the provisions of the ASU that require

impaired loan accounting and reporting for newly identified

TDRs as of July 1, 2011. The total of newly identified TDRs

was $46.3 million, of which $20.7 million were accruing

consumer real estate loans and $23.7 million were accruing

commercial loans. Due to the increase in accruing TDRs,

the consumer real estate provision for credit losses on

impaired loans increased $2.2 million in the third quarter

of 2011. There was no increase in commercial provision as a

result of the newly identified TDRs.

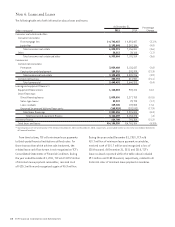

TCF held consumer real estate loan TDRs of $479.8

million and $367.9 million at December 31, 2011 and

December 31, 2010, respectively, of which $433.1 million

and $337.4 million were accruing at December 31, 2011

and December 31, 2010, respectively. TCF also held $181.6

million and $66.3 million of commercial loan TDRs at

December 31, 2011 and December 31, 2010, respectively,

of which $98.4 million and $48.8 million were accruing at

December 31, 2011 and December 31, 2010, respectively.

The amount of additional funds committed to commercial

borrowers in TDR status was $8.5 million and $2.2 million

at December 31, 2011 and December 31, 2010, respectively.

When a loan is modified as a TDR, there is not a direct,

material impact on the loans within the Consolidated

Statements of Financial Condition, as principal balances

are generally not forgiven. Loan modifications are not

reported in calendar years after modification if the loans

were modified at an interest rate equal to the yields of

new loan originations with comparable risk and the loans

are performing based on the terms of the restructuring

agreements. All loans classified as TDRs are considered

to be impaired.

72 TCF Financial Corporation and Subsidiaries