Spirit Airlines 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

81

commitments with third parties for seven aircraft deliveries from Airbus, scheduled for delivery in 2014 and for the five aircraft

to be leased directly from a third party. The Company does not have financing commitments in place for the remaining 105

Airbus firm aircraft orders scheduled for delivery between 2014 and 2021.

Litigation

The Company is subject to commercial litigation claims and to administrative and regulatory proceedings and reviews

that may be asserted or maintained from time to time. The Company believes the ultimate outcome of such lawsuits,

proceedings and reviews will not, individually or in the aggregate, have a material adverse effect on its financial position,

liquidity or results of operations.

Employees

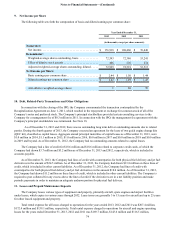

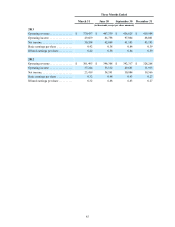

The Company has three union-represented employee groups that together represent approximately 59% of all employees

at December 31, 2013 and 54% of all employees at December 31, 2012. The table below sets forth the Company's employee

groups and status of the collective bargaining agreements as of December 31, 2013.

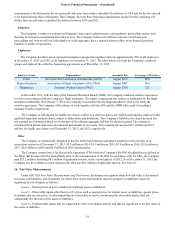

Employee Groups Representative Amendable Date Percentage of Workforce

Pilots Air Line Pilots Association, International (ALPA) August 2015 24%

Flight Attendants Association of Flight Attendants (AFA-CWA) August 2007 34%

Dispatchers Transport Workers Union (TWU) August 2018 1%

In December 2013, with the help of the National Mediation Board (NMB), the Company reached a tentative agreement

for a five-year contract with the Company's flight attendants. The tentative agreement was subject to ratification by the flight

attendant membership. On February 7, 2014, the Company was notified that the flight attendants voted to not ratify the

tentative agreement. The Company will continue to work together with the AFA and the NMB with a goal of reaching a

mutually beneficial agreement.

The Company is self-insured for health care claims, subject to a stop-loss policy, for eligible participating employees and

qualified dependent medical claims, subject to deductibles and limitations. The Company’s liabilities for claims incurred but

not reported are determined based on an estimate of the ultimate aggregate liability for claims incurred. The estimate is

calculated from actual claim rates and adjusted periodically as necessary. The Company has accrued $2.1 million and $1.9

million, for health care claims as of December 31, 2013, and 2012, respectively.

Other

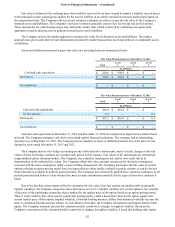

The Company is contractually obligated to pay the following minimum guaranteed payments to the provider of its

reservation system as of December 31, 2013: $3.9 million in 2014, $3.9 million in 2015, $3.9 million in 2016, $3.9 million in

2017, $2.6 million in 2018 and $0.0 million in 2019 and thereafter.

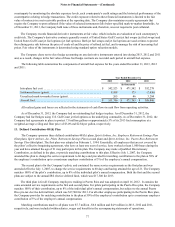

The Company entered into a Tax Receivable Agreement (TRA) with the Company's Pre-IPO Stockholders (as defined in

the TRA) that became effective immediately prior to the consummation of the IPO. In accordance with the TRA, the Company

paid $27.2 million, including $0.3 million of applicable interest, in the second quarter of 2012. As of December 31, 2013, the

Company has $5.6 million accrued related to the TRA and $0.2 million of applicable interest. See Note 18.

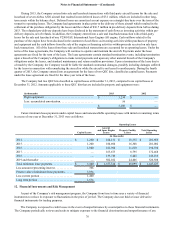

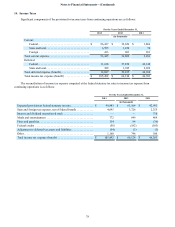

16. Fair Value Measurements

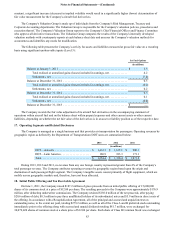

Under ASC 820, Fair Value Measurements and Disclosures, disclosures are required about how fair value is determined

for assets and liabilities, and a hierarchy for which these assets and liabilities must be grouped is established, based on

significant levels of inputs, as follows:

Level 1—Quoted prices in active markets for identical assets or liabilities.

Level 2—Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices

in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for

substantially the full term of the assets or liabilities.

Level 3—Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of

the assets or liabilities.