Spirit Airlines 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

71

liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of such series,

any or all of which may be greater than the rights of common stock. The Company’s issuance of preferred stock could

adversely affect the voting power of holders of common stock and the likelihood that such holders will receive dividend

payments and payments upon liquidation. In addition, the issuance of preferred stock could have the effect of delaying,

deferring or preventing a change of control of the Company or other corporate action. As of December 31, 2013 and 2012,

there were no shares of preferred stock outstanding.

8. Stock-Based Compensation

The Company has stock plans under which directors, officers, key employees and consultants of the Company may be

granted restricted stock awards, stock options and other equity-based instruments as a means of promoting the Company’s

long-term growth and profitability. The plans are intended to encourage participants to contribute to and participate in the

success of the Company.

The Company's board of directors adopted, and the Company's stockholders approved, the Amended and Restated 2005

Incentive Stock Plan, or the 2005 Stock Plan, effective January 1, 2008. The total number of shares of common stock

authorized for issue pursuant to awards granted under the 2005 Stock Plan was 2,500,000 shares. The 2005 Stock Plan provided

for the grant of non-qualified stock options, stock appreciation rights, restricted stock, performance shares, phantom stock,

restricted stock units and other awards that are valued in whole or in part by reference to the Company's stock.

On May 9, 2011, the Company's board of directors adopted, and the Company's stockholders approved, the 2011 Equity

Incentive Award Plan, or 2011 Plan. Under the 2011 Plan, 3,000,000 new shares of common stock are reserved for issuance

pursuant to a variety of stock-based compensation awards, including stock options, stock appreciation rights or SARs, restricted

stock awards, restricted stock unit awards, deferred stock awards, dividend equivalent awards, stock payment awards and

performance share awards and other stock-based awards, plus the number of shares remaining available for future awards under

the Company's 2005 Stock Plan. The number of shares reserved for issuance or transfer pursuant to awards under the 2011 Plan

will be increased by the number of shares represented by awards outstanding under the Company's 2005 Stock Plan that are

forfeited or lapse unexercised and which, following the effective date of the 2011 Plan, are not issued under the Company's

2005 Stock Plan. No further awards will be granted under the 2005 Stock Plan, and all outstanding awards will continue to be

governed by their existing terms. As of December 31, 2013 and December 31, 2012, 2,685,029 and 2,689,490 shares of the

Company’s common stock, respectively, remained available for future issuance under the 2011 Plan.

Stock-based compensation cost is included within salaries, wages and benefits in operating expenses in the

accompanying statements of operations. Stock-based compensation cost amounted to $5.7 million, $4.3 million and $0.5

million for 2013, 2012 and 2011, respectively. During 2013, 2012 and 2011, there was $2.1 million, $1.6 million and $0.2

million tax benefit recognized in income related to stock-based compensation, respectively.

Restricted Stock

Restricted stock and restricted stock unit awards are valued at the fair value of the shares on the date of grant. Generally,

granted shares and units vest 25% per year on each anniversary of issuance. Each restricted stock unit represents the right to

receive one share of common stock upon vesting of such restricted stock unit. Compensation expense, net of forfeitures, is

recognized on a straight-line basis over the requisite service period.

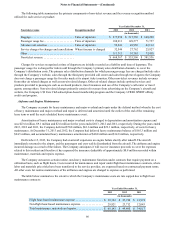

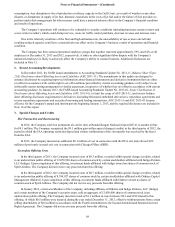

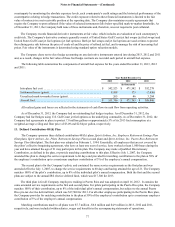

A summary of the status of the Company’s restricted stock shares (restricted stock awards and restricted stock unit

awards) as of December 31, 2013 and changes during the year ended December 31, 2013 is presented below:

Number of

Shares

Weighted-

Average

Grant Date Fair

Value ($)

Outstanding at December 31, 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 449,629 16.94

Granted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 151,202 27.70

Vested. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (168,514) 13.19

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (96,269) 19.28

Outstanding at December 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 336,048 22.99

There were 151,202 and 391,418 restricted stock shares granted during the years ended December 31, 2013 and

December 31, 2012, respectively. As of December 31, 2013 and December 31, 2012, there was $6.1 million and $6.1 million,

respectively, of total unrecognized compensation cost related to nonvested restricted stock to be recognized over 2.7 years and

3.2 years, respectively.