Spirit Airlines 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

the last few years of the leases as compared to the costs in earlier periods. Please see “—Critical Accounting Policies and

Estimates—Aircraft Maintenance, Materials, Repair Costs and Related Heavy Maintenance Amortization.”

Maintenance Reserve Obligations. The terms of some of our aircraft lease agreements require us to post deposits for

future maintenance, also known as maintenance reserves, to the lessor in advance of and as collateral for the performance of

major maintenance events, resulting in our recording significant prepaid deposits on our balance sheet. As a result, the cash

costs of scheduled major maintenance events are paid well in advance of the recognition of the maintenance event in our results

of operations. Please see “—Critical Accounting Policies and Estimates—Aircraft Maintenance, Materials, Repair Costs and

Related Heavy Maintenance Amortization” and “—Maintenance Reserves.”

Critical Accounting Policies and Estimates

The following discussion and analysis of our financial condition and results of operations is based on our financial

statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The

preparation of these financial statements requires us to make estimates and judgments that affect the reported amount of assets

and liabilities, revenues and expenses and related disclosure of contingent assets and liabilities at the date of our financial

statements. For a detailed discussion of our significant accounting policies, please see “Notes to Financial Statements—1.

Summary of Significant Accounting Policies”.

Critical accounting policies are defined as those policies that reflect significant judgments or estimates about matters that

are both inherently uncertain and material to our financial condition or results of operations.

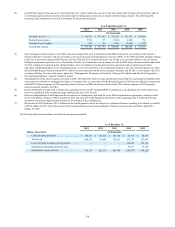

Revenue Recognition. Revenues from tickets sold are initially deferred as ATL. Passenger revenues are recognized when

transportation is provided. An unused non-refundable ticket expires at the date of scheduled travel and is recognized as

revenue for the expired ticket value at the date of scheduled travel.

Our most significant non-ticket revenues include revenues generated from air travel-related services paid for baggage,

bookings through our call center or third-party vendors, advance seat selection, itinerary changes and loyalty programs, and are

recognized at the time products are purchased or ancillary services are provided. These revenues also include commissions

from the sales of hotel rooms, trip insurance and rental cars recognized at the time the service is rendered. Non-ticket revenues

also include revenues from our subscription-based $9 Fare Club, recognized on a straight-line basis over 12 months.

Customers may elect to change their itinerary prior to the date of departure. A service charge is assessed and recognized

on the date the change is initiated and is deducted from the face value of the original purchase price of the ticket, and the

original ticket becomes invalid. The amount remaining after deducting the service charge is called a credit shell which expires

60 days from the date the credit shell is created and can be used towards the purchase of a new ticket and our other service

offerings. The amount of credits expected to expire is recognized as revenue upon issuance of the credit and is estimated based

on historical experience. Estimating the amount of credits that will go unused involves some level of subjectivity and judgment.

Frequent Flier Program. We accrue for mileage credits earned through travel, including mileage credits for members

with an insufficient number of mileage credits to earn an award, under our FREE SPIRIT program based on the estimated

incremental cost of providing free travel for credits that are expected to be redeemed. Incremental costs include fuel, insurance,

security, ticketing and facility charges reduced by an estimate of amounts required to be paid by the passenger when redeeming

the award.

Under our affinity card program, funds received for the marketing of a co-branded Spirit credit card and delivery of

award miles are accounted for as a mulitple-deliverable arrangement. At the inception of the arrangement, we evaluated all

deliverables in the arrangement to determine whether they represent separate units of accounting. We determined the

arrangement had three separate units of accounting: (i) travel miles to be awarded, (ii) licensing of brand and access to member

lists and (iii) advertising and marketing efforts. At inception of the arrangement, we established the relative selling price for all

deliverables that qualified for separation, as arrangement consideration should be allocated based on relative selling price. The

manner in which the selling price was established was based on the applicable hierarchy of evidence. Total arrangement

consideration was then allocated to each deliverable on the basis of the deliverable's relative selling price. In considering the

hierarchy of evidence, we first determined whether vendor-specific objective evidence of selling price or third-party evidence

of selling price existed. We determined that neither vendor-specific objective evidence of selling price nor third-party evidence

existed due to the uniqueness of our program. As such, we developed our best estimate of the selling price for all deliverables.

For the selling price of travel, we considered a number of entity-specific factors including the number of miles needed to

redeem an award, average fare of comparable segments, breakage, restrictions and other charges. For licensing of brand and

access to member lists, we considered both market-specific factors and entity-specific factors, including general profit margins

realized in the marketplace/industry, brand power, market royalty rates and size of customer base. For the advertising and

marketing element, we considered market-specific factors and entity-specific factors including, our internal costs (and