Spirit Airlines 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

of the cash savings in federal income tax realized by it by virtue of the use of the federal net operating loss, deferred interest

deductions and alternative minimum tax credits held by us as of March 31, 2011, which is defined as the Pre-IPO NOL. Cash

tax savings generally will be computed by comparing actual federal income tax liability to the amount of such taxes that we

would have been required to pay had such Pre-IPO NOLs (as defined in the TRA) not been available. Upon consummation of

the IPO and execution of the TRA, we recorded a liability with an offsetting reduction to additional paid in capital. The amount

and timing of payments under the TRA will depend upon a number of factors, including, but not limited to, the amount and

timing of taxable income generated in the future and any future limitations that may be imposed on our ability to use the Pre-

IPO NOLs. The term of the TRA will continue until the first to occur (a) the full payment of all amounts required under the

agreement with respect to utilization or expiration of all of the Pre-IPO NOLs, (b) the end of the taxable year including the

tenth anniversary of the IPO or (c) a change in control of the Company.

In accordance with the TRA, we are required to submit a Tax Benefit Schedule showing the proposed TRA payout

amount to the Stockholder Representatives within 45 calendar days after we file our tax return. Stockholder Representatives are

defined as Indigo Pacific Partners, LLC and OCM FIE, LLC, representing the two largest ownership interest of pre-IPO shares.

The Tax Benefit Schedule shall become final and binding on all parties unless a Stockholder Representative, within 45 calendar

days after receiving such schedule, provides us with notice of a material objection to such schedule. If the parties, for any

reason, are unable to successfully resolve the issues raised in any notice within 30 calendar days of receipt of such notice, we

and the Stockholder Representatives have the right to employ the reconciliation procedures as set forth in the TRA. If the Tax

Benefit Schedule is accepted, then we have five days after acceptance to make payments to the Pre-IPO stockholders. Pursuant

to the TRA's reconciliation procedures, any disputes that cannot be settled amicably, are settled by arbitration conducted by a

single arbitrator jointly selected by both parties.

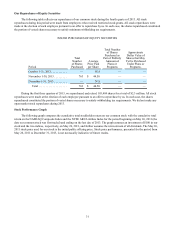

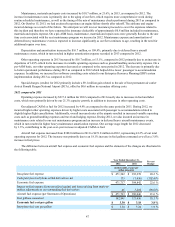

During the second quarter of 2012, we paid $27.2 million, or 90% of the 2011 tax savings realized from the utilization of

NOLs, including $0.3 million of applicable interest. During 2012, management adjusted for an immaterial error in the original

estimate of the liability. This adjustment reduced the liability with an offset to additional paid in capital.

During 2013, we filed an amended 2009 income tax return in order to correct its NOL carry forward as of December 31,

2009. As a result, our NOL carry forward as of March 31, 2011 was consequently reduced by $7.8 million, which corresponds

to a reduction in the estimated TRA benefit of $2.4 million with an offset to additional paid in capital. On September 13, 2013,

we filed our 2012 federal income tax return, and on October 14, 2013, we submitted a Tax Benefit Schedule to the Stockholder

Representatives. On November 27, 2013, pursuant to the TRA, we received an objection notice to the Tax Benefit Schedule

from the Stockholder Representatives. As of December 31, 2013, we estimated the TRA liability to be $5.6 million. We are in

discussions with the Stockholder Representatives attempting to resolve the objection related to the Tax Benefit Schedule and

thus have not employed the TRA's reconciliation procedures.

Trends and Uncertainties Affecting Our Business

We believe our operating and business performance is driven by various factors that affect airlines and their markets,

trends affecting the broader travel industry and trends affecting the specific markets and customer base that we target. The

following key factors may affect our future performance.

Competition. The airline industry is highly competitive. The principal competitive factors in the airline industry are fare

pricing, total price, flight schedules, aircraft type, passenger amenities, number of routes served from a city, customer service,

safety record and reputation, code-sharing relationships and frequent flier programs and redemption opportunities. Price

competition occurs on a market-by-market basis through price discounts, changes in pricing structures, fare matching, target

promotions and frequent flier initiatives. Airlines typically use discount fares and other promotions to stimulate traffic during

normally slower travel periods to generate cash flow and to maximize unit revenue. The prevalence of discount fares can be

particularly acute when a competitor has excess capacity that it is under financial pressure to sell.

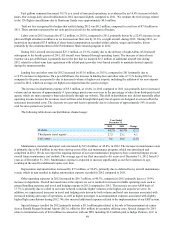

Seasonality and Volatility. Our results of operations for any interim period are not necessarily indicative of those for the

entire year because the air transportation business is subject to significant seasonal fluctuations. We generally expect demand to

be greater in the second and third quarters compared to the rest of the year. The air transportation business is also volatile and

highly affected by economic cycles and trends. Consumer confidence and discretionary spending, fear of terrorism or war,

weakening economic conditions, fare initiatives, fluctuations in fuel prices, labor actions, changed in governmental regulations

on taxes and fees, weather and other factors have resulted in significant fluctuations in revenues and results of operations in the

past. We believe demand for business travel historically has been more sensitive to economic pressures than demand for low-

price travel. Finally, a significant portion of our operations are concentrated in markets such as South Florida, the Caribbean,

Latin America and the Northeast and northern Midwest regions of the United States, which are particularly vulnerable to

weather, airport traffic constraints and other delays.