Spirit Airlines 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

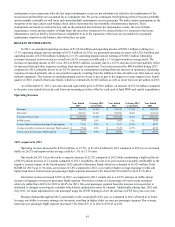

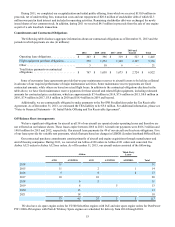

LIQUIDITY AND CAPITAL RESOURCES

Our primary source of liquidity is cash on hand and cash provided by operations. Primary uses of liquidity are for

working capital needs, capital expenditures, aircraft pre-delivery deposits (PDPs) and maintenance reserves. Our total cash at

December 31, 2013 was $530.6 million, an increase of $113.8 million from December 31, 2012.

Currently our single largest capital need is to fund the acquisition costs of our aircraft. PDPs relating to future deliveries

under our agreement with Airbus are required at various times prior to each delivery date. During 2013, $36.7 million of PDPs

have been returned related to delivered aircraft in the period, and we have paid $107.0 million in PDPs for future deliveries of

aircraft and spare engines. As of December 31, 2013, we have secured financing commitments with third parties for seven

aircraft deliveries from Airbus, scheduled for delivery in 2014, and for five aircraft to be leased directly from a third party,

scheduled for delivery between 2015 and 2016. We do not have financing commitments in place for the remaining 105 Airbus

firm aircraft orders scheduled for delivery between 2014 and 2021.

In addition to funding the acquisition of our future fleet, we are required to make maintenance reserve payments for a

majority of our current fleet. Maintenance reserves are paid to aircraft lessors and are held as collateral in advance of our

performance of major maintenance activities. In 2013, we recorded an increase of $24.1 million in maintenance reserves, net of

reimbursements, and as of December 31, 2013, we have $220.7 million ($59.2 million in prepaid expenses and other current

assets and $161.5 million in aircraft maintenance deposits) on our balance sheet, representing the amount paid in reserves since

inception, net of reimbursements.

As of December 31, 2013, we are compliant with our credit card processing agreements, and not subject to any credit

card holdbacks. The maximum potential exposure to cash holdbacks by our credit card processors, based upon advance ticket

sales and $9 Fare Club memberships as of December 31, 2013 and December 31, 2012, was $188.6 million and $144.8 million,

respectively.

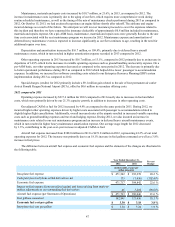

During 2011, we completed our IPO, which raised net proceeds of $150.0 million after repayment of debt, payment of

transaction expenses and payments of fees to certain unaffiliated holders of our notes. Additionally, during 2011, the IPO

allowed us to amend our agreements with our credit card processors enabling us to eliminate our restricted cash balance

(holdback) and increase our unrestricted cash balance.

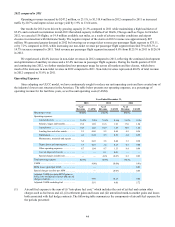

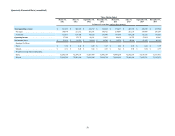

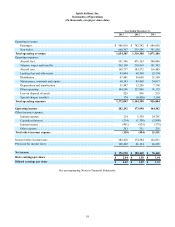

Net Cash Flows Provided By Operating Activities. Operating activities in 2013 provided $195.4 million in cash compared

to $113.6 million provided in 2012. The increase is primarily due to larger operating profits in 2013 as compared to 2012. In

addition, a slightly higher air traffic liability year-over-year led to higher cash inflows at the end of 2013. This increase is

driven by higher capacity and future bookings.

Operating activities in 2012 provided $113.6 million in cash compared to $171.2 million provided in 2011. The decrease

is primarily due to $72.7 million received from the release of all credit card holdbacks in 2011 coupled with significantly higher

heavy scheduled maintenance costs in 2012, slightly offset by cash inflows received on future travel as of December 31, 2012.

Net Cash Flows Used In Investing Activities. During 2013, investing activities used $90.1 million, compared to $27.3

million used in 2012. The increase is mainly due to an increase in paid PDPs, net of refunds, during 2013, compared to 2012,

driven by the timing of aircraft deliveries and our amended order with Airbus. This was offset by $9.1 million received as a

result of proceeds from the sale of slots at Ronald Reagan National Airport (DCA). Capital expenditures decreased year-over-

year mainly due to higher expenses incurred in 2012 related to the implementation of our ERP system.

During 2012, investing activities used $27.3 million, compared to $67.2 million used in 2011. The decrease is mainly due

to the refund of $40.5 million in PDPs related to the delivery of seven aircraft from Airbus and corresponding sale and

leaseback transactions, and the sale of airport slots for $9.1 million. These effects were offset by higher capital expenditures,

including the purchase of two spare engines for $10.3 million during 2012.

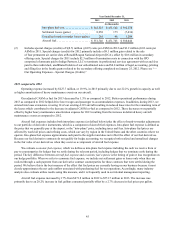

Net Cash Provided By Financing Activities. During 2013, financing activities provided $8.5 million. We received $6.9

million in proceeds from the sale of one spare engine as part of sale and leaseback transactions, retained $1.9 million as a result

of excess tax benefits related to share-based payments and received cash as a result of exercised stock options. Additional cash

used in financing activities consisted of cash used to purchase treasury stock. As of December 31, 2013, an estimated

remaining cash benefit of $5.6 million is expected to be paid to our Pre-IPO Stockholders under the terms of the TRA.

During 2012, $12.8 million was used for financing activities driven mostly by the payment to Pre-IPO Stockholders

pursuant to the TRA offset by the proceeds received from the sale of two spare engines as part of sale and leaseback

transactions.