Spirit Airlines 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

76

During 2013, the Company entered into sale and leaseback transactions with third-party aircraft lessors for the sale and

leaseback of seven Airbus A320 aircraft that resulted in net deferred losses of $3.1 million, which are included in other long-

term assets within the balance sheet. Deferred losses are amortized as rent expense on a straight-line basis over the term of the

respective operating leases. The Company had agreements in place prior to the delivery of these aircraft which resulted in the

settlement of the purchase obligation by the lessor and the refund of $36.7 million in pre-delivery deposits from Airbus during

2013. The refunded pre-delivery deposits have been disclosed in the statement of cash flows as investing activities within pre-

delivery deposits, net of refunds. In addition, the Company entered into a sale and leaseback transaction with a third-party

lessor for the sale and leaseback of one V2500 IAE International Aero Engines AG engine. Cash outflows related to the

purchase of the engine have been disclosed in the statement of cash flows as investing activities within purchases of property

and equipment and the cash inflows from the sale of the engine as financing activities within proceeds received on sale lease

back transactions. All of the leases from these sale and leaseback transactions are accounted for as operating leases. Under the

terms of the lease agreements, the Company will continue to operate and maintain the aircraft. Payments under the lease

agreements are fixed for the term of the lease. The lease agreements contain standard termination events, including termination

upon a breach of the Company's obligations to make rental payments and upon any other material breach of the Company's

obligations under the leases, and standard maintenance and return condition provisions. Upon a termination of the lease due to

a breach by the Company, the Company would be liable for standard contractual damages, possibly including damages suffered

by the lessor in connection with remarketing the aircraft or while the aircraft is not leased to another party. During the fourth

quarter of 2013, the Company entered into an agreement for the lease of two QEC kits, classified as capital leases. Payments

under the lease agreement are fixed for the three year term of the lease.

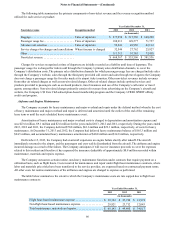

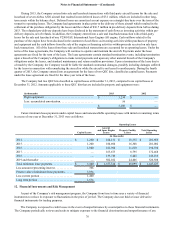

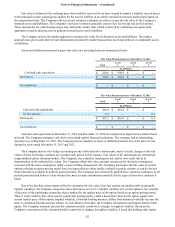

The Company had two QEC kits classified as capital leases at December 31, 2013, compared to no capital leases at

December 31, 2012. Amounts applicable to these QEC kits that are included in property and equipment were:

(in thousands) 2013 2012

Flight equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,234 $ —

Less: accumulated amortization. . . . . . . . . . . . . . . . . . . . . . . 54 —

$ 3,180 $ —

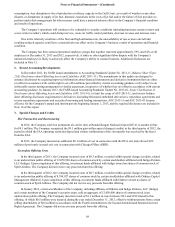

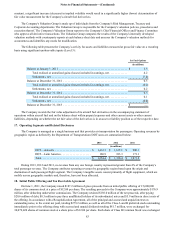

Future minimum lease payments under capital leases and noncancellable operating leases with initial or remaining terms

in excess of one year at December 31, 2013 were as follows:

Operating Leases

Capital Leases

Aircraft

and Spare Engine

Leases Property Facility

Leases Total Operating

Leases

(in thousands)

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,200 $ 184,131 $ 18,535 $ 202,666

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,200 184,694 16,308 201,002

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000 182,984 11,610 194,594

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 163,673 8,795 172,468

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 139,740 6,445 146,185

2019 and thereafter . . . . . . . . . . . . . . . . . . . . . . . — 502,102 24,406 526,508

Total minimum lease payments . . . . . . . . . . . . . . $ 3,400 $ 1,357,324 $ 86,099 $ 1,443,423

Less amount representing interest . . . . . . . . . . . . 366

Present value of minimum lease payments . . . . . 3,034

Less current portion . . . . . . . . . . . . . . . . . . . . . . . 1,400

Long term portion . . . . . . . . . . . . . . . . . . . . . . . . 1,634

12. Financial Instruments and Risk Management

As part of the Company’s risk management program, the Company from time to time uses a variety of financial

instruments to reduce its exposure to fluctuations in the price of jet fuel. The Company does not hold or issue derivative

financial instruments for trading purposes.

The Company is exposed to credit losses in the event of nonperformance by counterparties to these financial instruments.

The Company periodically reviews and seeks to mitigate exposure to the financial deterioration and nonperformance of any