Spirit Airlines 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

79

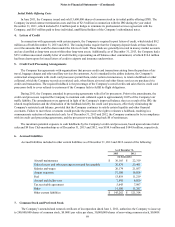

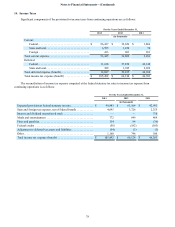

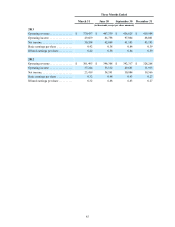

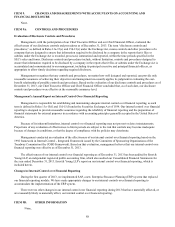

The Company accounts for income taxes using the asset and liability method. Deferred taxes are recorded based on

differences between the financial statement basis and tax basis of assets and liabilities and available tax loss and credit

carryforwards. At December 31, 2013 and 2012, the significant components of the Company's deferred taxes consisted of the

following:

December 31,

2013 2012

(in thousands)

Deferred tax assets:

Net operating loss. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 188 $ 83

Deferred loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,428 —

Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,241 5,829

Nondeductible accruals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,734 6,744

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,767 1,073

Deferred tax assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,358 13,729

Deferred tax liabilities:

Capitalized interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 736 1,125

Deferred gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 364

Fuel hedging. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 97

Accrued engine maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45,911 29,497

Property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,384 3,271

Deferred tax liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53,031 34,354

Net deferred tax assets (liabilities) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (32,673) $ (20,625)

Deferred taxes included within:

Assets:

Other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 16,243 $ 12,591

Liabilities:

Other long-term liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 48,916 $ 33,216

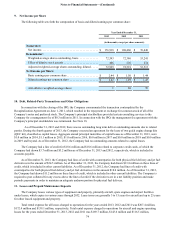

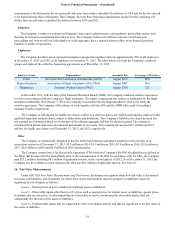

In assessing the realizability of the deferred tax assets, management considered whether it is more likely than not that

some or all of the deferred tax assets would be realized. In evaluating the Company’s ability to utilize its deferred tax assets, it

considered all available evidence, both positive and negative, in determining future taxable income on a jurisdiction by jurisdiction

basis. Management does not believe that the realization of deferred tax assets is in jeopardy and thus a valuation allowance for

2013 will not be necessary.

During 2013, the Company filed an amended 2009 income tax return in order to correct its net operating loss

carryforward (NOL) as of December 31, 2009. See Note 18. The amendment of the 2009 tax return resulted in a decrease to the

Company's NOL of $7.9 million as of December 31, 2009. In addition, during the preparation of its 2012 tax return, the

Company uncovered certain adjustments relating to the NOL carryforward balance as of December 31, 2011. These

adjustments resulted in an increase to the NOL carryforward of $3.7 million. The net decrease to the NOL carryforwards of

$4.2 million changed the NOL carryforwards as of December 31, 2011 from $20.8 million, as previously reported in 2012 and

2011, to $16.6 million. At December 31, 2011, the Company had available for federal income tax purposes an alternative

minimum tax (AMT) credit carryforward of $3.2 million and federal NOL carryforwards of $16.6 million which were fully

utilized against federal taxable income during 2012. As of December 31, 2013 and 2012, the Company did not have any NOLs

or AMT credits to utilize against federal taxable income. As of December 31, 2013, the Company had approximately $4.7

million of State NOLs which can be used to offset future state taxable income. State net operating losses begin to expire in

2017.

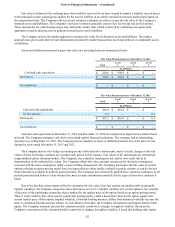

Excess tax benefits are recognized in the financial statements upon actual realization of the related tax benefit which

occurred in 2012 upon utilization of the remaining NOLs and AMT credit carryforwards during the year. During 2013, the

Company recognized a windfall tax benefit of $1.9 million which was recorded as a reduction to income tax payable and a

corresponding entry to additional paid in capital.