Spirit Airlines 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

74

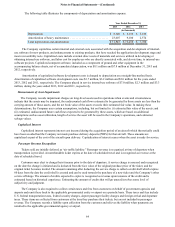

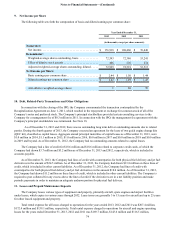

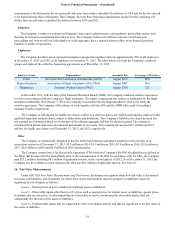

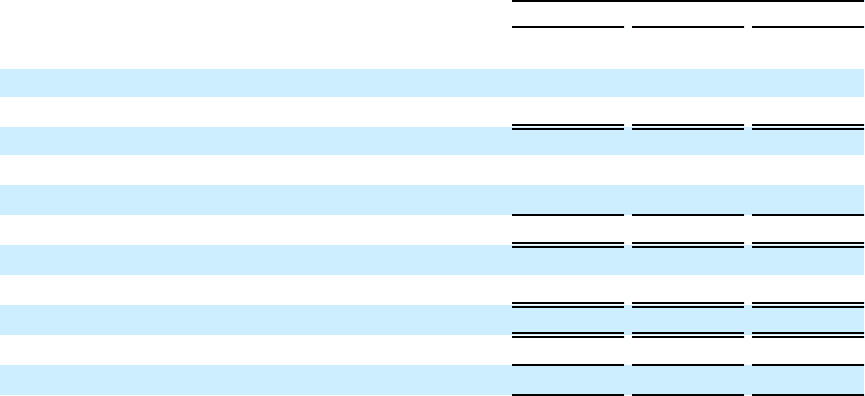

9. Net Income per Share

The following table sets forth the computation of basic and diluted earnings per common share:

Year Ended December 31,

2013 2012 2011

(in thousands, except per share amounts)

Numerator:

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 176,918 $ 108,460 $ 76,448

Denominator:

Weighted-average shares outstanding, basic. . . . . . . . . . . . . . 72,593 72,386 53,241

Effect of dilutive stock awards . . . . . . . . . . . . . . . . . . . . . . . . 406 205 274

Adjusted weighted-average shares outstanding, diluted . . . . . 72,999 72,591 53,515

Net Income per Share:

Basic earnings per common share. . . . . . . . . . . . . . . . . . . . . . $ 2.44 $ 1.50 $ 1.44

Diluted earnings per common share . . . . . . . . . . . . . . . . . . . . $ 2.42 $ 1.49 $ 1.43

Anti-dilutive weighted-average shares 1 88 70

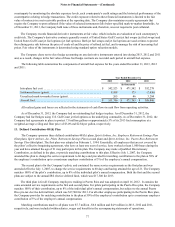

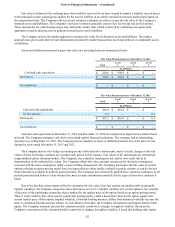

10. Debt, Related-Party Transactions and Other Obligations

In connection with the closing of the IPO, the Company consummated the transaction contemplated by the

Recapitalization Agreement on June 1, 2011, which resulted in the repayment or exchange for common stock of all of the

Company’s notes and preferred stock. The Company’s principal stockholders provided certain consulting services to the

Company for a management fee of $0.3 million in 2011. In connection with the IPO, the management fee agreement with the

Company's principal stockholders was terminated. See Note 18.

As of December 31, 2013 and 2012, there was no outstanding long term debt or outstanding amounts due to related

parties. During the fourth quarter of 2013, the Company executed an agreement for the lease of two quick engine change kits

(QEC kit), classified as capital leases. Aggregate annual principal maturities of capital leases as of December 31, 2013, were

$1.0 million in 2014, $1.1 million in 2015, $1.0 million in 2016, $0.0 million in 2017 and $0.0 million in 2018 and $0.0 million

in 2019 and beyond. As of December 31, 2012, the Company had no outstanding amounts related to capital leases.

The Company had a line of credit for $18.6 million and $18.6 million related to corporate credit cards, of which the

Company had drawn $3.7 million and $3.2 million as of December 31, 2013 and 2012, respectively, which is included in

accounts payable.

As of December 31, 2013, the Company had lines of credit with counterparties for both physical fuel delivery and jet fuel

derivatives in the amount of $34.5 million. As of December 31, 2013, the Company had drawn $13.8 million on these lines of

credit, which is included in other current liabilities. As of December 31, 2012, the Company had lines of credit with

counterparties for both physical fuel delivery and jet fuel derivatives in the amount $18.0 million. As of December 31, 2012,

the Company had drawn $11.2 million on these lines of credit, which is included in other current liabilities. The Company is

required to post collateral for any excess above the lines of credit if the derivatives are in a net liability position and make

periodic payments in order to maintain an adequate undrawn portion for physical fuel delivery.

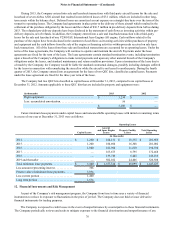

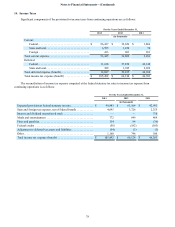

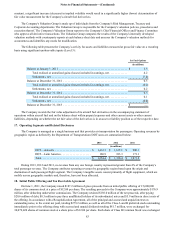

11. Leases and Prepaid Maintenance Deposits

The Company leases various types of equipment and property, primarily aircraft, spare engines and airport facilities

under leases, which expire in various years through 2032. Lease terms are generally 3 to 15 years for aircraft and up to 25 years

for other leased equipment and property.

Total rental expense for all leases charged to operations for the years ended 2013, 2012 and 2011 was $207.4 million,

$172.4 million and $139.1 million, respectively. Total rental expense charged to operations for aircraft and engine operating

leases for the years ended December 31, 2013, 2012 and 2011 was $169.7 million, $143.6 million and $116.5 million,