Spirit Airlines 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

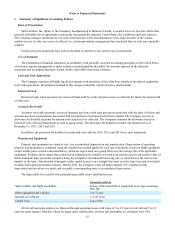

Notes to Financial Statements—(Continued)

64

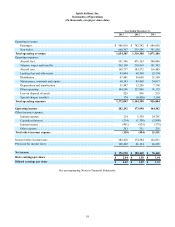

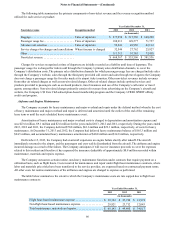

The following table illustrates the components of depreciation and amortization expense:

Year Ended December 31,

2013 2012 2011

(in thousands)

Depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,340 $ 6,156 $ 5,186

Amortization of heavy maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,607 9,100 2,574

Total depreciation and amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 31,947 $ 15,256 $ 7,760

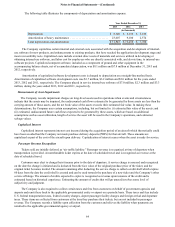

The Company capitalizes certain internal and external costs associated with the acquisition and development of internal-

use software for new products, and enhancements to existing products, that have reached the application development stage and

meet recoverability tests. Capitalized costs include external direct costs of materials and services utilized in developing or

obtaining internal-use software, and labor cost for employees who are directly associated with, and devote time, to internal-use

software projects. Capitalized computer software, included as a component of ground and other equipment in the

accompanying balance sheets, net of accumulated depreciation, was $8.1 million and $7.8 million at December 31, 2013 and

2012, respectively.

Amortization of capitalized software development costs is charged to depreciation on a straight-line method basis.

Amortization of capitalized software development costs was $3.7 million, $3.2 million and $2.0 million for the years ended

2013, 2012 and 2011, respectively. The Company placed in service internal-use software of $7.0 million, $2.3 million and $3.3

million, during the years ended 2013, 2012 and 2011, respectively.

Measurement of Asset Impairments

The Company records impairment charges on long-lived assets used in operations when events and circumstances

indicate that the assets may be impaired, the undiscounted cash flows estimated to be generated by those assets are less than the

carrying amount of those assets, and the net book value of the assets exceeds their estimated fair value. In making these

determinations, the Company uses certain assumptions, including, but not limited to: (i) estimated fair value of the assets; and

(ii) estimated, undiscounted future cash flows expected to be generated by these assets, which are based on additional

assumptions such as asset utilization, length of service the asset will be used in the Company’s operations, and estimated

salvage values.

Capitalized Interest

Capitalized interest represents interest cost incurred during the acquisition period of an aircraft which theoretically could

have been avoided had the Company not made purchase delivery deposits (PDPs) for that aircraft. These amounts are

capitalized as part of the cost of the aircraft upon delivery. Capitalization of interest ceases when the asset is ready for service.

Passenger Revenue Recognition

Tickets sold are initially deferred as “air traffic liability.” Passenger revenue is recognized at time of departure when

transportation is provided. A nonrefundable ticket expires at the date of scheduled travel and is recognized as revenue at the

date of scheduled travel.

Customers may elect to change their itinerary prior to the date of departure. A service charge is assessed and recognized

on the date the change is initiated and is deducted from the face value of the original purchase price of the ticket, and the

original ticket becomes invalid. The amount remaining after deducting the service charge is called a credit shell which expires

60 days from the date the credit shell is created and can be used towards the purchase of a new ticket and the Company’s other

service offerings. The amount of credits expected to expire is recognized as revenue upon issuance of the credit and is

estimated based on historical experience. Estimating the amount of credits that will go unused involves some level of

subjectivity and judgment.

The Company is also required to collect certain taxes and fees from customers on behalf of government agencies and

airports and remit these back to the applicable governmental entity or airport on a periodic basis. These taxes and fees include

U.S. federal transportation taxes, federal security charges, airport passenger facility charges and foreign arrival and departure

taxes. These items are collected from customers at the time they purchase their tickets, but are not included in passenger

revenue. The Company records a liability upon collection from the customer and relieves the liability when payments are

remitted to the applicable governmental agency or airport.