Spirit Airlines 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

78

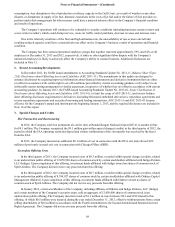

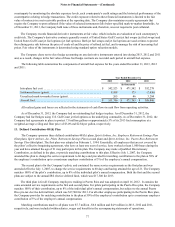

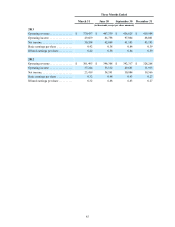

14. Income Taxes

Significant components of the provision for income taxes from continuing operations are as follows:

For the Years Ended December 31,

2013 2012 2011

(in thousands)

Current:

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 86,437 $ 32,656 $ 1,866

State and local. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,595 3,250 74

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 413 963 263

Total current expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93,445 36,869 2,203

Deferred:

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,658 27,870 42,148

State and local. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 389 1,385 2,032

Total deferred expense (benefit). . . . . . . . . . . . . . . . . . . . 12,047 29,255 44,180

Total income tax expense (benefit) . . . . . . . . . . . . . . . . . $ 105,492 $ 66,124 $ 46,383

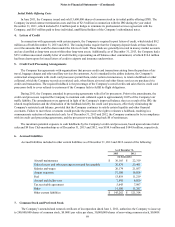

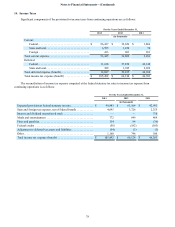

The reconciliation of income tax expense computed at the federal statutory tax rates to income tax expense from

continuing operations is as follows:

For the Years Ended December 31,

2013 2012 2011

(in thousands)

Expected provision at federal statutory tax rate. . . . . . . . . . . . . . . . $ 98,843 $ 61,104 $ 42,991

State and foreign tax expense, net of federal benefit . . . . . . . . . . . . 4,695 3,726 2,255

Interest and dividend on preferred stock . . . . . . . . . . . . . . . . . . . . . — — 710

Meals and entertainment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 772 649 469

Fines and penalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 134 84 (36)

Federal credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (58)(182)(103)

Adjustment to deferred tax assets and liabilities . . . . . . . . . . . . . . . (54)(3)(3)

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,160 746 100

Total income tax expense (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . $ 105,492 $ 66,124 $ 46,383