Spirit Airlines 2013 Annual Report Download - page 68

Download and view the complete annual report

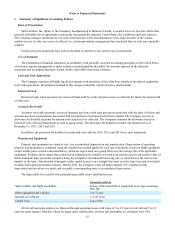

Please find page 68 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Financial Statements—(Continued)

68

consumption. Any disruption to the oil production or refinery capacity in the Gulf Coast, as a result of weather or any other

disaster, or disruptions in supply of jet fuel, dramatic escalations in the costs of jet fuel and/or the failure of fuel providers to

perform under fuel arrangements for other reasons could have a material adverse effect on the Company’s financial condition

and results of operations.

The Company’s operations will continue to be vulnerable to weather conditions (including hurricane season or snow and

severe winter weather), which could disrupt service, create air traffic control problems, decrease revenue and increase costs.

Due to the relatively small size of the fleet and high utilization rate, the unavailability of one or more aircraft and

resulting reduced capacity could have a material adverse effect on the Company’s business, results of operations and financial

condition.

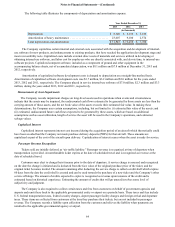

The Company has three union-represented employee groups that together represent approximately 59% and 54% of all

employees at December 31, 2013 and 2012, respectively. A strike or other significant labor dispute with the Company’s

unionized employees is likely to adversely affect the Company’s ability to conduct business. Additional disclosures are

included in Note 15.

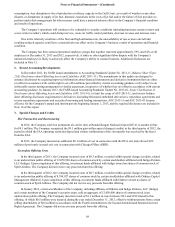

2. Recent Accounting Developments

In December 2011, the FASB issued amendments to Accounting Standards Update No. 2011-11, Balance Sheet (Topic

210); Disclosures about Offsetting Assets and Liabilities (ASU 2011-11). The amendments in this update are designed to

enhance disclosures by requiring improved information about financial instruments and derivative instruments that are either

(a) offset in accordance with certain right to set-off conditions prescribed by current accounting guidance or (b) subject to an

enforceable master netting arrangement or similar agreement, irrespective of whether they are offset in accordance with current

accounting guidance. In January 2013, the FASB issued Accounting Standards Update No. 2013-01, Scope Clarification of

Disclosures about Offsetting Assets and Liabilities (ASU 2013-01), to limit the scope of ASU 2011-11, and its new balance

sheet offsetting disclosure requirements to derivatives (including bifurcated embedded derivatives), repurchase agreements and

reverse repurchase agreements and securities borrowing and lending transactions. ASU 2011-11 and ASU 2013-01 became

effective for the Company's annual and interim periods beginning January 1, 2013, and the required disclosures are included in

Note 16 of this report.

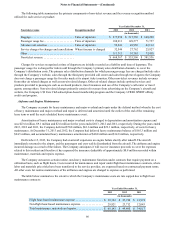

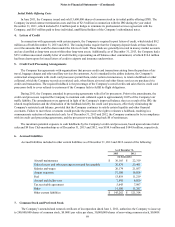

3. Special Charges and Credits

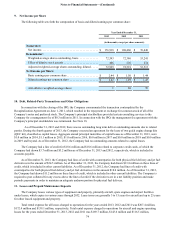

Slot Transaction and Restructuring

In 2012, the Company sold four permanent air carrier slots at Ronald Reagan National Airport (DCA) to another airline

for $9.1 million. The Company recognized the $9.1 million gain within special charges (credits) in the third quarter of 2012, the

period in which the FAA operating restriction lapsed and written confirmation of the slot transfer was received by the buyer

from the FAA.

In 2013, the Company incurred an additional $0.1 million of cost in connection with the DCA exit and relieved $0.2

million of previously accrued exit cost in connection with Chicago O'Hare (ORD).

Secondary Offering Costs

In the third quarter of 2013, the Company incurred costs of $0.3 million, recorded within special charges (credits), related

to an underwritten public offering of 12,070,920 shares of common stock by certain stockholders affiliated with Indigo Partners

LLC (Indigo). Upon completion of this offering, investment funds affiliated with Indigo owned no shares of common stock of

Spirit Airlines. The Company did not receive any proceeds from this offering.

In the third quarter of 2012, the Company incurred costs of $0.7 million, recorded within special charges (credits), related

to an underwritten public offering of 9,394,927 shares of common stock by certain stockholders affiliated with Oaktree Capital

Management (Oaktree). Upon completion of this offering, investment funds affiliated with Oaktree owned no shares of

common stock of Spirit Airlines. The Company did not receive any proceeds from this offering.

In January 2012, certain stockholders of the Company, including affiliates of Oaktree and Indigo Partners, LLC (Indigo)

and certain members of the Company's executive team, sold an aggregate of 12,650,000 shares of common stock in an

underwritten public offering. The Company incurred a total of $1.3 million in costs between 2011 and 2012 related to this

offering, of which $0.5 million were incurred during the year ended December 31, 2012, offset by reimbursements from certain

selling shareholders of $0.6 million in accordance with the Fourth Amendment to the Second Amended and Restated Investor

Rights Agreement. The Company did not receive any proceeds from this offering.