Spirit Airlines 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

2012 compared to 2011

Operating revenues increased by $247.2 million, or 23.1%, to $1,318.4 million in 2012 compared to 2011 as increased

traffic by 20.7% and improved our average yield by 1.9% to 13.64 cents.

Our results for 2012 were driven by growing capacity 21.3% compared to 2011 while maintaining a high load factor of

85.2% and a network reorientation in mid-2011 that added capacity in Dallas-Fort Worth, Chicago and Las Vegas. In October

2012, we canceled 136 flights, or 19.9 million available seat miles, as a result of adverse weather conditions and airport

closures in connection with Hurricane Sandy. The negative impact of the storm on 2012 revenue was approximately $25

million. We generated greater demand in 2012 by lowering our average ticket revenue per passenger flight segment to $75.11,

or by 7.2% compared to 2011, while increasing our non-ticket revenue per passenger flight segment from $44.79 to $51.39, a

14.7% increase compared to 2011. Total revenue per passenger flight segment increased 0.6% from $125.76 in 2011 to $126.50

in 2012.

We experienced a 40.4% increase in non-ticket revenues in 2012 compared to 2011, reflecting the continued development

and optimization of ancillary revenues and a 22.4% increase in passenger flight segments. During the fourth quarter of 2011

and continuing into 2012, we further standardized our passenger usage fee across all markets and fare classes, which drove

much of the increases in non-ticket revenue in 2012 compared to 2011. Non-ticket revenue represented 40.6% of total revenue

in 2012 compared to 35.6% in 2011.

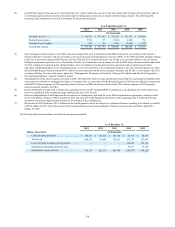

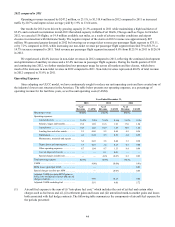

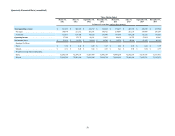

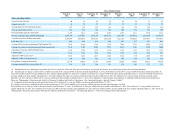

Operating Expenses

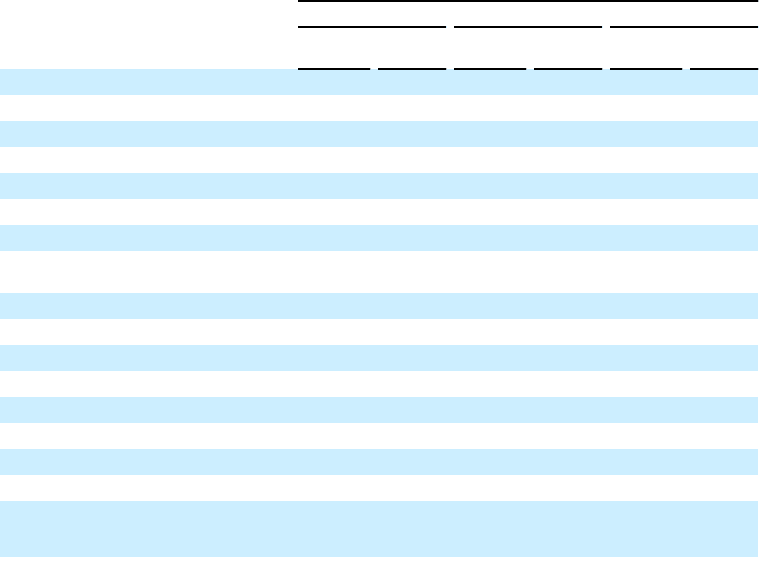

Since adopting our ULCC model, we have continuously sought to reduce our unit operating costs and have created one of

the industry's lowest cost structures in the Americas. The table below presents our operating expenses, as a percentage of

operating revenue for the last three years, as well as unit operating costs (CASM).

Year Ended December 31,

2013 2012 2011

% of

Revenue CASM % of

Revenue CASM % of

Revenue CASM

Operating revenue 100.0% 100.0% 100.0%

Operating expenses:

Aircraft fuel (1) . . . . . . . . . . . . . . . . . . 33.4% 3.98¢ 35.8% 4.16¢ 36.2% 4.15¢

Salaries, wages and benefits. . . . . . . . . 15.8 1.89 16.6 1.93 17.0 1.94

Aircraft rent . . . . . . . . . . . . . . . . . . . . . 10.3 1.22 10.9 1.27 10.9 1.25

Landing fees and other rentals . . . . . . . 5.1 0.60 5.2 0.60 4.9 0.56

Distribution. . . . . . . . . . . . . . . . . . . . . . 4.1 0.49 4.3 0.50 4.8 0.55

Maintenance, materials and repairs . . . 3.6 0.43 3.8 0.44 3.3 0.38

Depreciation and amortization . . . . . . . 1.9 0.23 1.2 0.13 0.7 0.08

Other operating expenses . . . . . . . . . . . 8.7 1.04 9.7 1.13 8.4 0.96

Loss on disposal of assets. . . . . . . . . . . — — 0.1 0.01 — —

Special charges (credits) (2). . . . . . . . . — — (0.6) (0.07) 0.3 0.03

Total operating expense 82.9% 86.8% 86.5%

CASM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.90¢ 10.09¢ 9.91¢

MTM losses (gains)per ASM . . . . . . . . . . . . — — 0.03

Special charges (credits) per ASM . . . . . . . . — (0.07) 0.03

Adjusted CASM (excludes MTM gains or

losses, loss on disposal of assets and special

charges (credits)). . . . . . . . . . . . . . . . . . . . . . 9.89 10.15 9.84

Adjusted CASM excluding fuel . . . . . . . . . . 5.91 6.00 5.72

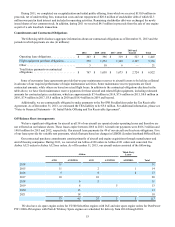

(1) Aircraft fuel expense is the sum of (i) “into-plane fuel cost,” which includes the cost of jet fuel and certain other

charges such as fuel taxes and oil, (ii) settlement gains and losses and (iii) unrealized mark-to-market gains and losses

both associated with fuel hedge contracts. The following table summarizes the components of aircraft fuel expense for

the periods presented: