Spirit Airlines 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

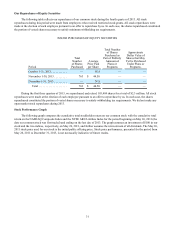

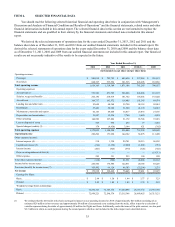

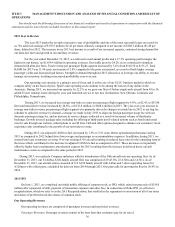

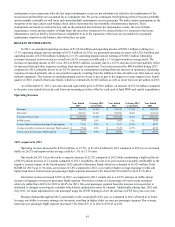

ITEM 6. SELECTED FINANCIAL DATA

You should read the following selected historical financial and operating data below in conjunction with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements, related notes and other

financial information included in this annual report. The selected financial data in this section are not intended to replace the

financial statements and are qualified in their entirety by the financial statements and related notes included in this annual

report.

We derived the selected statements of operations data for the years ended December 31, 2013, 2012 and 2011 and the

balance sheet data as of December 31, 2013 and 2012 from our audited financial statements included in this annual report. We

derived the selected statements of operations data for the years ended December 31, 2010 and 2009 and the balance sheet data

as of December 31, 2011, 2010 and 2009 from our audited financial statements not included in this annual report. Our historical

results are not necessarily indicative of the results to be expected in the future.

Year Ended December 31,

2013 2012 2011 2010 (1) 2009

(in thousands except share and per share data)

Operating revenues:

Passenger $ 986,018 $ 782,792 $ 689,650 $ 537,969 $ 536,181

Non-ticket 668,367 535,596 381,536 243,296 163,856

Total operating revenue 1,654,385 1,318,388 1,071,186 781,265 700,037

Operating expenses:

Aircraft fuel (2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 551,746 471,763 388,046 248,206 181,107

Salaries, wages and benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 262,150 218,919 181,742 156,443 135,420

Aircraft rent. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 169,737 143,572 116,485 101,345 89,974

Landing fees and other rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83,604 68,368 52,794 48,118 42,061

Distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67,481 56,668 51,349 41,179 34,067

Maintenance, materials and repairs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60,143 49,460 34,017 27,035 27,536

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31,947 15,256 7,760 5,620 4,924

Other operating . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 144,586 127,886 91,172 83,748 72,921

Loss on disposal of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 525 956 255 77 1,010

Special charges (credits) (3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 174 (8,450) 3,184 621 (392)

Total operating expenses 1,372,093 1,144,398 926,804 712,392 588,628

Operating income 282,292 173,990 144,382 68,873 111,409

Other expense (income):

Interest expense (4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 214 1,350 24,781 50,313 46,892

Capitalized interest (5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (214) (1,350) (2,890) (1,491) (951)

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (401) (925) (575) (328) (345)

Gain on extinguishment of debt (6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — — — (19,711)

Other expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 283 331 235 194 298

Total other expense (income). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (118) (594) 21,551 48,688 26,183

Income before income taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 282,410 174,584 122,831 20,185 85,226

Provision (benefit) for income taxes (7). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105,492 66,124 46,383 (52,296) 1,533

Net income $ 176,918 $ 108,460 $ 76,448 $ 72,481 $ 83,693

Earnings Per Share:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2.44 $ 1.50 $ 1.44 $ 2.77 $ 3.23

Diluted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2.42 $ 1.49 $ 1.43 $ 2.72 $ 3.18

Weighted average shares outstanding:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72,592,765 72,385,574 53,240,898 26,183,772 25,910,766

Diluted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72,999,221 72,590,574 53,515,348 26,689,855 26,315,121

(1) We estimate that the 2010 pilot strike had a net negative impact on our operating income for 2010 of approximately $24 million consisting of an

estimated $28 million in lost revenues and approximately $4 million of incremental costs resulting from the strike, offset in part by a reduction of

variable expenses during the strike of approximately $8 million for flights not flown. Additionally, under the terms of the pilot contract, we also paid

$2.3 million in return-to-work payments during the second quarter, which are not included in the strike impact costs described above.