Spirit Airlines 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

During 2011, we completed our recapitalization and initial public offering, from which we received $150.0 million in

proceeds, net of underwriting fees, transaction costs and our repayment of $20.6 million of stockholder debt of which $2.3

million was paid in kind interest and included in operating activities. Remaining stockholder debt was exchanged for newly

issued shares of our common stock. In addition, during 2011 we received $4.5 million in proceeds from the sale of one engine

as part of a sale leaseback transaction.

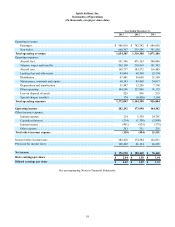

Commitments and Contractual Obligations

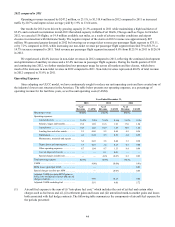

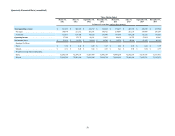

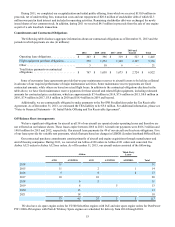

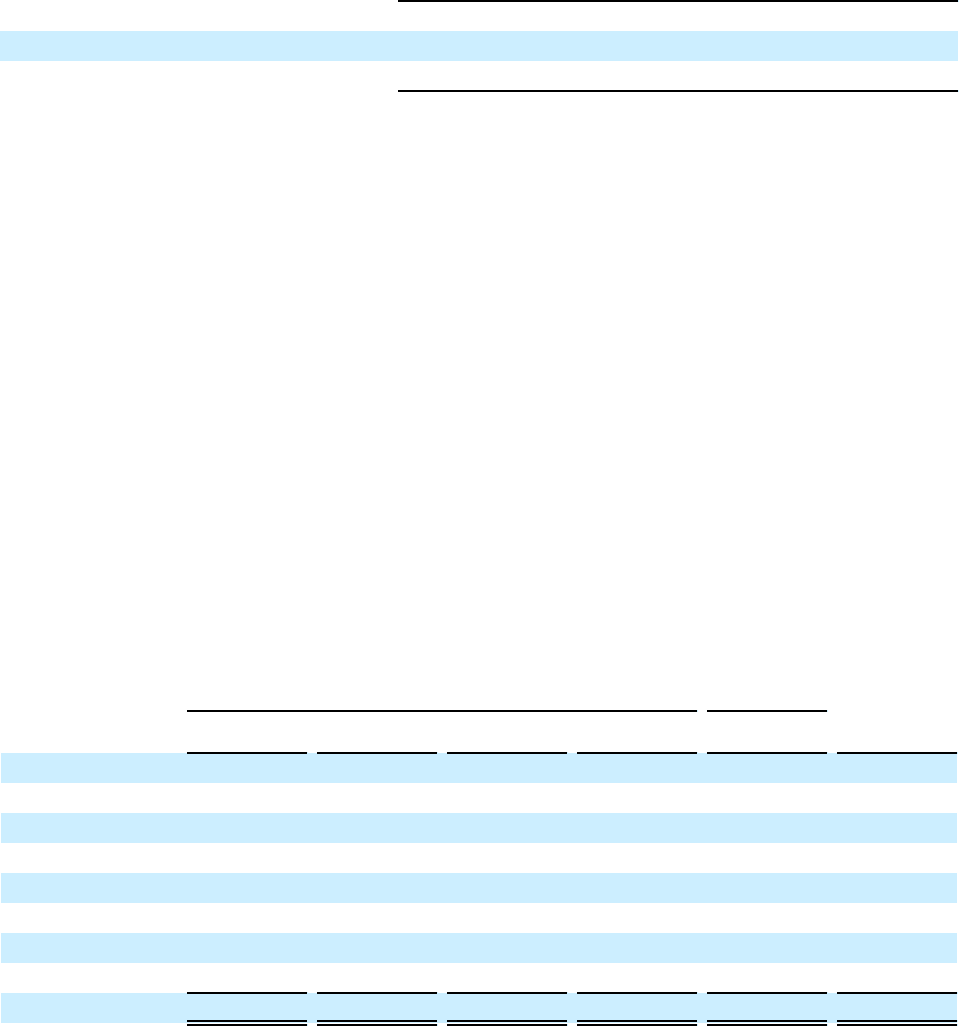

The following table discloses aggregate information about our contractual obligations as of December 31, 2013 and the

periods in which payments are due (in millions):

2014 2015 - 2016 2017 - 2018 2019 and

beyond Total

Operating lease obligations. . . . . . . . . . . . . . . . . $ 203 $ 396 $ 319 $ 527 $ 1,445

Flight equipment purchase obligations . . . . . . . . 559 1,252 1,348 2,197 5,356

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 10 6 — 21

Total future payments on contractual

obligations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 767 $ 1,658 $ 1,673 $ 2,724 $ 6,822

Some of our master lease agreements provide that we pay maintenance reserves to aircraft lessors to be held as collateral

in advance of our required performance of major maintenance activities. Some maintenance reserve payments are fixed

contractual amounts, while others are based on actual flight hours. In addition to the contractual obligations disclosed in the

table above, we have fixed maintenance reserve payments for these aircraft and related flight equipment, including estimated

amounts for contractual price escalations, which are approximately $7.4 million in 2014, $7.6 million in 2015, $8.0 million in

2016, $7.4 million in 2017, $5.8 million in 2018 and $18.4 million in 2019 and beyond.

Additionally, we are contractually obligated to make payments to the Pre-IPO Stockholders under the Tax Receivable

Agreement. As of December 31, 2013, we estimated the TRA liability to be $5.6 million. For additional information, please see

“Notes to Financial Statements—18. Initial Public Offering and Tax Receivable Agreement".

Off-Balance Sheet Arrangements

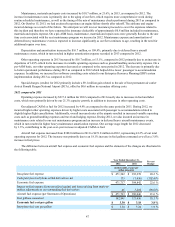

We have significant obligations for aircraft as all 54 of our aircraft are operated under operating leases and therefore are

not reflected on our balance sheets. These leases expire between 2016 to 2025. Aircraft rent payments were $166.3 million and

140.8 million for 2013 and 2012, respectively. Our aircraft lease payments for 49 of our aircraft are fixed-rate obligations. Five

of our leases provide for variable rent payments, which fluctuate based on changes in LIBOR (London Interbank Offered Rate).

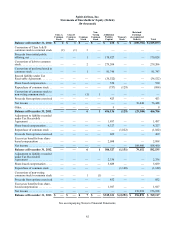

Our contractual purchase commitments consist primarily of aircraft and engine acquisitions through manufacturer and

aircraft leasing companies. During 2013, we converted ten Airbus A320 orders to Airbus A321 orders and converted five

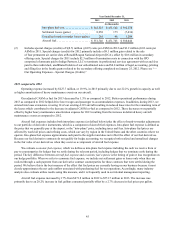

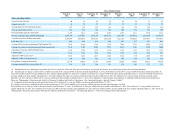

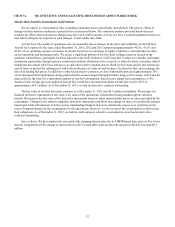

Airbus A321 orders to Airbus A321neo orders. As of December 31, 2013, our aircraft orders consisted of the following:

Airbus Third-Party

Lessor

A320 A320NEO A321 A321NEO A320NEO Total

2014 11 11

2015 11 2 1 14

2016 5 8 4 17

2017 10 10 20

2018 6 5 11

2019 8 5 13

2020 13 13

2021 18 18

37 45 25 5 5 117

We also have six spare engine orders for V2500 SelectOne engines with IAE and nine spare engine orders for PurePower

PW 1100G-JM engines with Pratt & Whitney. Spare engines are scheduled for delivery from 2014 through 2024.