Spirit Airlines 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

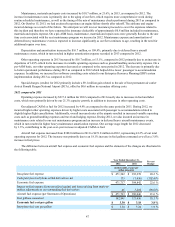

Other Operating Expenses. Other operating expenses include airport operations expense and fees charged by third-party

vendors for ground handling services and food and liquor supply service expenses, passenger re-accommodation expense, the

cost of passenger liability and aircraft hull insurance, all other insurance policies except for employee health insurance, travel

and training expenses for crews and ground personnel, professional fees, personal property taxes and all other administrative

and operational overhead expenses. No individual item included in this category represented more than 5% of our total

operating expenses.

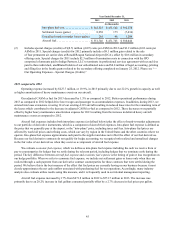

Special Charges (Credits). Special charges (credits) include termination costs, secondary offering costs and the gain on

the sale of take-off and landing slots.

In 2012, we sold four permanent air carrier slots at Ronald Reagan National Airport (DCA) to another airline for $9.1

million. We recognized the $9.1 million gain within special charges (credits) in the third quarter of 2012, the period in which

the FAA operating restriction lapsed and written confirmation of the slot transfer was received by the buyer from the FAA.

During the third quarter of 2013, certain stockholders affiliated with Indigo Partners LLC (Indigo) sold an aggregate of

12,070,920 shares of common stock in an underwritten public offering. We incurred $0.3 million in costs related to this offering

in 2013. Upon completion of this secondary offering, investment funds affiliated with Indigo owned no shares of our common

stock.

On July 31, 2012, certain stockholders affiliated with Oaktree Capital Management (Oaktree) sold an aggregate of

9,394,927 shares of common stock in an underwritten public offering. We incurred $0.7 million in costs related to this offering

in 2012. Upon completion of this secondary offering, investment funds affiliated with Oaktree owned no shares of our common

stock.

On January 25, 2012, certain stockholders of the Company, including affiliates of Oaktree and Indigo and certain

members of our executive team, sold an aggregate of 12,650,000 shares of common stock in an underwritten public offering.

We incurred a total of $1.3 million in costs between 2011 and 2012 related to this secondary offering, offset by reimbursements

from certain selling stockholders of $0.6 million in accordance with the Fourth Amendment to the Second Amended and

Restated Investor Rights Agreement.

We did not receive any proceeds from any of these secondary offerings.

In the second quarter of 2011, we incurred $2.3 million of termination costs in connection with the IPO comprised of

amounts paid to Indigo to terminate its professional services agreement with us and fees paid to three individual, unaffiliated

holders of our subordinated notes.

Our Other Expense (Income)

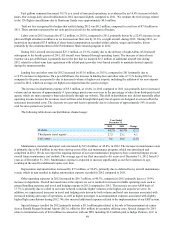

Interest Expense. Paid-in-kind interest on notes due to related parties and preferred stock dividends due to related parties

account, on average, for over 80% of interest expense incurred in 2011. Non-related party interest expense accounted for the

remainder of interest expense in 2011. All of the notes and preferred stock were repaid or redeemed, or exchanged for common

stock, in connection with the 2011 Recapitalization. Interest expense in 2012 primarily relates to interest on PDPs and interest

related to the Tax Receivable Agreement, or TRA. Interest expense in 2013 primarily relates to interest on the TRA.

Capitalized Interest. Capitalized interest represents interest cost incurred during the acquisition period of an aircraft

which theoretically could have been avoided had we not made PDPs for that aircraft. These amounts are capitalized as part of

the cost of the aircraft upon delivery. Capitalization of interest ceases when the asset is ready for service. Capitalized interest

for 2011 primarily relates to the interest incurred on debt due to related parties. Capitalized interest for 2012 and 2013 primarily

relates to interest incurred in connection with payments owed under the TRA.

Our Income Taxes

We account for income taxes using the liability method. We record a valuation allowance to reduce the deferred tax assets

reported if, based on the weight of the evidence, it is more likely than not that some portion or all of the deferred tax assets will

not be realized. Deferred taxes are recorded based on differences between the financial statement basis and tax basis of assets

and liabilities and available tax loss and credit carryforwards. In assessing the realizability of the deferred tax assets, we

consider whether it is more likely than not that some or all of the deferred tax assets will be realized. In evaluating the ability to

utilize our deferred tax assets, we consider all available evidence, both positive and negative, in determining future taxable

income on a jurisdiction by jurisdiction basis.

In connection with the IPO, we entered into the TRA and thereby distributed immediately prior to the completion of the

IPO to the holders of common stock as of such time, or the Pre-IPO Stockholders, the right to receive an amount equal to 90%