Red Lobster 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

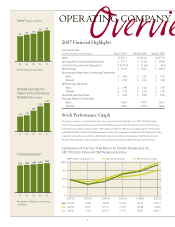

Financial Highlights

Financially, our results from continuing operations for scal

2007 were competitively superior in what was clearly a chal-

lenging industry environment. Financial highlights include

the following:

• Sales from continuing operations increased 4.0 percent

to $5.57 billion for scal 2007, driven by new restaurant

growth at Olive Garden and same-restaurant sales growth

at Olive Garden and Red Lobster.

• Net earnings from continuing operations for scal 2007

were $377.1 million, a 7.2 percent increase from scal 2006

net earnings from continuing operations of $351.8 million.

Diluted net earnings per share from continuing operations

were $2.53, a 13 percent increase from diluted net earnings

per share from continuing operations of $2.24 in scal 2006.

• Olive Garden’s total sales were a record $2.79 billion, up

6.6 percent from scal 2006. This reected record average

annual sales per restaurant of $4.7 million, the addition of

32 net new restaurants and U.S. same-restaurant sales

growth of 2.7 percent. Olive Garden also reported their

51st consecutive quarter of U.S. same-restaurant sales

increases in the fourth quarter of scal 2007.

• Red Lobster’s total sales were a record $2.60 billion, an

increase of 0.9 percent from scal 2006. Average annual

sales per restaurant were $3.8 million, and U.S. same-

restaurant sales growth for scal 2007 was 0.2 percent.

• Bahama Breeze’s sales from continuing operations were

$138 million in scal 2007, which was 0.9 percent above

scal 2006. Same-restaurant sales at Bahama Breeze

increased 0.9 percent in scal 2007 and average annual

sales per restaurant were $6.0 million. Bahama Breeze’s

operating results from continuing operations were

strong with unit-level returns approaching those of our

larger brands.

• Seasons 52’s total sales were nearly $40 million in

scal 2007. Two additional restaurants opened in scal

2007, bringing the total number in operation to seven.

In March 2007, we announced that Seasons 52 would

begin the next phase of its development, which includes

continuing to operate its seven existing restaurants with

excellence while developing the real estate and talent

pipelines for another three or so openings over the next

two years.

• With our strong cash ows and balance sheet, we spent

$371 million to repurchase 9.4 million shares of our

common stock in scal 2007. Since beginning our share

repurchase program in 1995, we have repurchased

more than 141.9 million shares of our common stock

for $2.62 billion.

We are focused

on accelerating

profitable sales growth

to further leverage the

competitively superior

and increasingly strong

operating platform

we’ve built.