Red Lobster 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 Darden Restaurants, Inc. Annual Report 2007

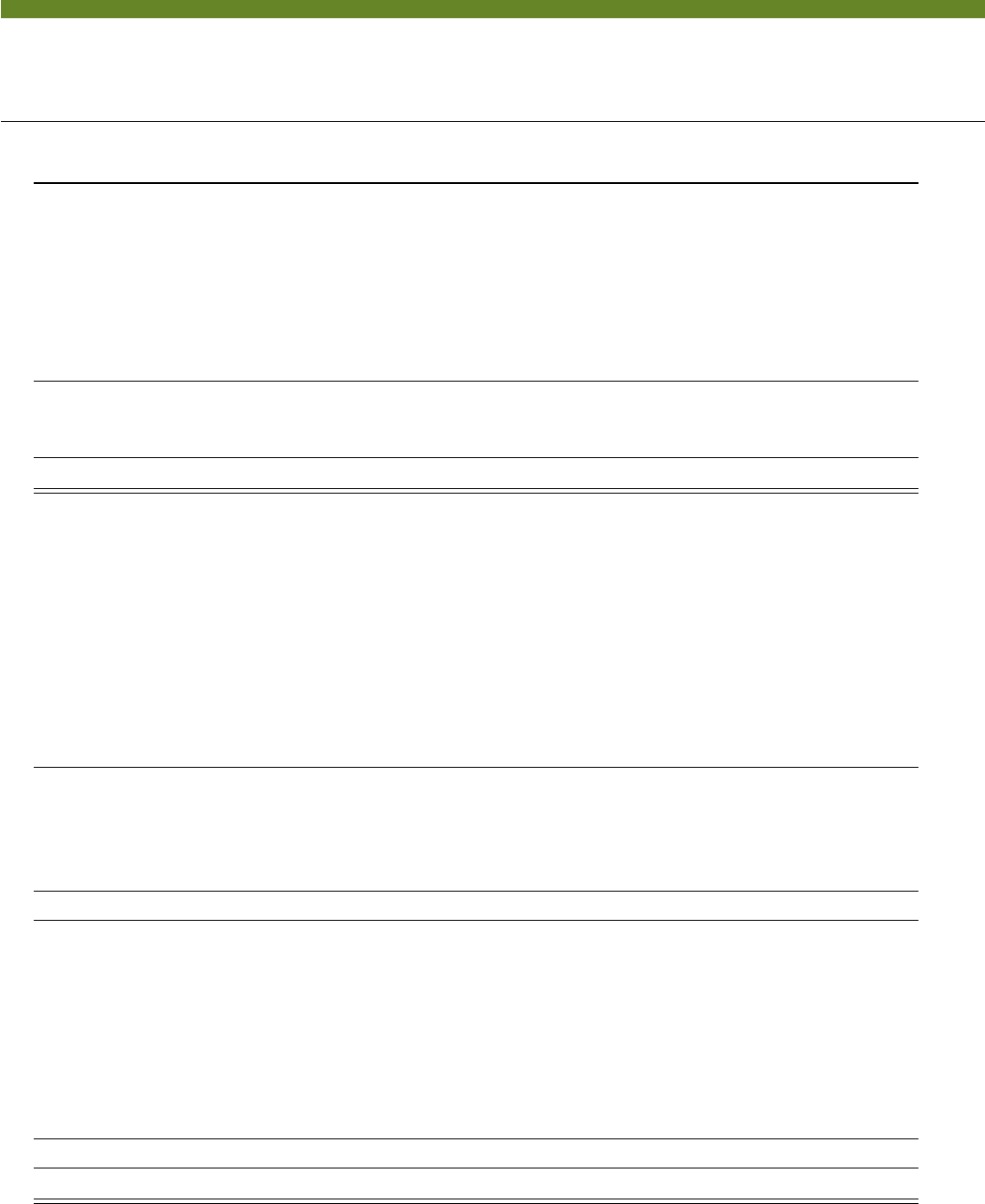

Consolidated Balance Sheets C

(In millions) May 27, 2007 May 28, 2006

Assets

Current assets:

Cash and cash equivalents $ 30.2 $ 42.3

Receivables, net 46.4 37.1

Inventories, net 209.6 198.7

Prepaid expenses and other current assets 33.5 29.9

Deferred income taxes 81.7 69.6

Assets held

for sale (

Note 2) 144.0 –

Total current assets $ 545.4 $ 377.6

Land, buildings and equipment, net 2,184.4 2,446.0

Other

asset

s 151.0 186.6

Total ass

ets $ 2,880.8 $ 3,010.2

Liabilities and Stockholders’ Equity

Current liabilities:

Accounts payable $ 178.0 $ 213.2

Short-term debt 211.4 44.0

Accrued payroll 108.5 123.2

Accrued income taxes 75.9 64.8

Other accrued taxes 43.4 46.9

Un

earned revenues 109.9 100.8

Current portion of long-term debt – 149.9

Other current liabilities 305.0 283.3

Liabilities

associated w

ith assets held for sale (Note 2) 42.3 –

Total current liabilities $ 1,074.4 $ 1,026.1

Long-term debt, less current portion 491.6 494.7

Deferred income taxes 25.8 90.6

Deferred rent 127.1 138.5

Other li

abilities 67.4 30.5

Total liabili

ties $ 1,786.3 $ 1,780.4

Stockholders’ equity:

Common stock and surplus, no par value. Authorized 500.0 shares; issued 277.7

and 274.7 shares, respectively; outstanding 141.4 and 147.0 shares, respectively $ 1,904.3 $ 1,806.4

Preferred stock, no par value. Authorized 25.0 shares; none issued and outstanding – –

Retained earnings 1,820.4 1,684.7

Treasury stock, 136.3 and 127.7 shares, at cost, respectively (2,576.5) (2,211.2)

Accumulated other comprehensive income (loss) (32.8) (5.5)

Unearned compensation (20.6) (44.2)

Officer

notes receivable (0.3) (0.4)

Total stockholder

s’ equity $ 1,094.5 $ 1,229.8

Total liabilities and stoc

kholders’ eq

uity $ 2,880.8 $ 3,010.2

See accompanying notes to consolidated financial statements.