Red Lobster 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 Darden Restaurants, Inc. Annual Report 2007

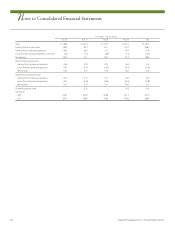

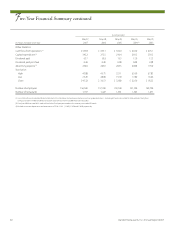

Notes to Consolidated Financial Statements

N

Note17

Stock-Based Compensation

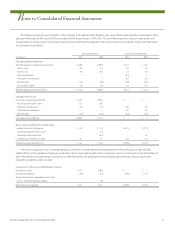

We maintain one active stock option and stock grant plan under

which new awards may still be issued, the 2002 Stock Incentive Plan

(2002 Plan). We also have three other stock option and stock grant

plans under which we no longer can grant new awards, although

awards outstanding under the plans may still vest and be exercised

in accordance with their terms: the Stock Plan for Directors (Director

Stock Plan), the Stock Option and Long-Term Incentive Plan of 1995

(1995 Plan) and the Restaurant Management and Employee Stock

Plan of 2000 (2000 Plan). All of the plans are administered by the

Compensation Committee of the Board of Directors. The 2002 Plan

provides for the issuance of up to 9.55 million common shares in

connection with the granting of non-qualified stock options, incen-

tive stock options, stock appreciation rights, restricted stock,

restricted stock units (RSUs), stock awards and other stock-based

awards to key employees and non-employee directors. The Director

Stock Plan provided for the issuance of up to 0.375 million common

shares out of our treasury in connection with the granting of non-

qualified stock options, restricted stock and RSUs to non-employee

directors. No new awards could be granted under the Director Stock

Plan after September 30, 2005. The 1995 Plan provided for the issu-

ance of up to 33.3 million common shares in connection with the

granting of non-qualified stock options, restricted stock or RSUs to

key employees. The 2000 Plan provided for the issuance of up to 5.4

million shares of common stock out of our treasury as non-qualified

stock options, restricted stock or RSUs. Under all of the plans, stock

options are granted at a price equal to the fair value of the shares at

the date of grant for terms not exceeding ten years and have various

vesting periods at the discretion of the Compensation Committee.

Outstanding options generally vest over one to four years. Restricted

stock and RSUs granted under the 1995 Plan, 2000 Plan and 2002

Plan generally vest over periods ranging from three to five years and

no sooner than one year from the date of grant. The restricted period

for certain grants may be accelerated based on performance goals

established by the Compensation Committee.

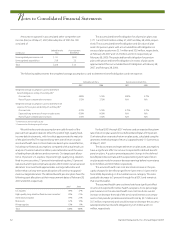

On June 16, 2006, the Board of Directors adopted amendments

to the 2002 Plan, which were approved by our shareholders at the

September 2006 annual meeting of shareholders. The amendments,

among other things: (a) increased the maximum number of shares

that are authorized for issuance under the 2002 Plan from 8.55 million

to 9.55 million; (b) implemented a “fungible share pool” approach to

manage authorized shares in order to improve the flexibility of awards

going forward, and eliminated the limits on the number of restricted

stock and RSU awards and the number of awards to non-employee

directors; and (c) provided that, in determining the number of shares

available for grant, a formula will be applied such that all future awards

other than stock options and stock appreciation rights will be counted

as double the number of shares covered by such award.

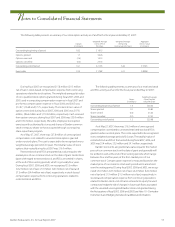

We also maintain the Compensation Plan for Non-Employee

Directors. This plan provided that non-employee directors could elect

to receive their annual retainer and meeting fees in any combination

of cash, deferred cash or our common shares and authorized the issu-

ance of up to 106.0 thousand common shares out of our treasury for

this purpose. The common shares were issued under the plan in

consideration of foregone retainer and meeting fees, and were issued

at a value equal to the market price of our common stock on the date

of grant. No new awards could be made under the Compensation

Plan for Non-Employee Directors after September 30, 2005.

On December 15, 2005, the Board of Directors approved the

Director Compensation Program, effective as of October 1, 2005,

which replaced the Director Stock Plan and the Compensation Plan

for Non-Employee Directors. The Director Compensation Program

provides for payments to non-employee directors of: (a) an annual

retainer and meeting fees for regular or special Board meetings and

committee meetings; (b) an initial award of non-qualified stock

options to purchase 12.5 thousand shares of common stock upon

becoming a director of the Company for the first time; (c) an addi-

tional award of non-qualified stock options to purchase 3.0 thou-

sand shares of common stock annually upon election or re-election

to the Board; and (d) an annual award of common stock with a fair

market value of $0.1 million on the date of grant. Directors may elect

to have their cash compensation paid in any combination of current

or deferred cash, common stock or salary replacement options.

Deferred cash compensation may be invested on a tax-deferred

basis in the same manner as deferrals under our non-qualified

deferred compensation plan. Directors may elect to have their

annual stock award paid in the form of common stock or cash, or a

combination thereof, or deferred. All stock options and other stock

or stock-based awards that are part of the compensation paid or

deferred pursuant to the Director Compensation Program are

awarded under the 2002 Plan.