Red Lobster 2007 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 Darden Restaurants, Inc. Annual Report 2007

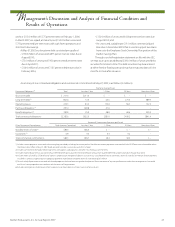

Management’s Discussion and Analysis of Financial Condition and

Results of Operations

M

This discussion and analysis below for Darden Restaurants, Inc.

(Darden, the Company, we, us or our) should be read in conjunction

with our consolidated financial statements and related financial

statement notes found elsewhere in this report.

We operate on a 52/53 week fiscal year, which ends on the last

Sunday in May. Fiscal 2007, 2006, 2005 each consisted of 52 weeks

of operation.

Overview of Operations

Our business operates in the casual dining segment of the restaurant

industry, primarily in the United States. At May 27, 2007, we operated

1,397 Red Lobster®, Olive Garden®, Bahama Breeze®, Smokey Bones

Barbeque & Grill® and Seasons 52® restaurants in the United States

and Canada. As of May 31, 2007, we also licensed 32 Red Lobster

restaurants in Japan. Through subsidiaries, we own and operate

all of our restaurants in the United States and Canada. None of our

restaurants are franchised.

On May 5, 2007, we announced the closure of 54 Smokey

Bones and two Rocky River Grillhouse restaurants as well as our

intention to offer for sale the remaining 73 operating Smokey Bones

restaurants. Softening of sales at Smokey Bones led us to reevaluate

our new restaurant opening strategy and test a new direction for

the business. In fiscal 2007, we opened a new repositioned Smokey

Bones restaurant named Rocky River Grillhouse, and a second Rocky

River Grillhouse from a converted Smokey Bones. However, the

Smokey Bones concept and related business model was designed

to be a nationally advertised brand, and since it was not on a path to

achieving that vision, we concluded it was not a meaningful growth

vehicle for the Company. As a result of these actions, we recognized

$229.5 million and $13.7 million of long-lived asset impairment

charges and closing costs, respectively, during the fourth quarter

of fiscal 2007. Additionally, on April 28, 2007, we closed nine

under-performing Bahama Breeze restaurants. We have classified

the results of operations, impairment charges and closing costs of

Smokey Bones, Rocky River Grillhouse and the nine closed Bahama

Breeze restaurants as discontinued operations in our consolidated

statements of earnings for all periods presented. We have similarly

presented our consolidated statements of earnings and cash

flows for all periods presented to reflect the classification of these

restaurants as discontinued operations.

Our sales from continuing operations were $5.57 billion in

fiscal 2007 and $5.35 billion in fiscal 2006, a 4.0 percent increase. Net

earnings from continuing operations for fiscal 2007 were $377.1 million

($2.53 per diluted share) compared with net earnings from continuing

operations for fiscal 2006 of $351.8 million ($2.24 per diluted share).

Net earnings from continuing operations for fiscal 2007 increased

7.2 percent and diluted net earnings per share from continuing opera-

tions increased 13.0 percent compared with fiscal 2006. The primary

drivers of our increases in net earnings from continuing operations

were Olive Garden’s same-restaurant sales increases in each quarter

of fiscal 2007, bringing its string of consecutive quarters with

same-restaurant sales growth to 51, annual same-restaurant

sales increases at Red Lobster and new restaurant growth at Olive

Garden. Bahama Breeze significantly improved same-restaurant

performance in fiscal 2007, positioning the brand to restart new

restaurant growth. In addition to achieving a second straight year of

same-restaurant sales growth from continuing operations, Bahama

Breeze also meaningfully improved restaurant-level returns and

guest satisfaction. Additionally, with the closure of the nine under-

performing Bahama Breeze restaurants in the fourth quarter of fiscal

2007 we will be able to re-focus efforts and resources on continuing

to build business in its most profitable restaurants, while also building

a site pipeline for new restaurant growth.

Our net losses from discontinued operations were $175.7 million,

$13.6 million and $9.3 million, respectively, for fiscal 2007, 2006 and

2005. Our diluted net losses per share from discontinued operations

were $1.18, $0.08 and $0.06, respectively, for fiscal 2007, 2006 and

2005. When combined with results from continuing operations, our

diluted net earnings per share were $1.35, $2.16 and $1.78, respec-

tively, for fiscal 2007, 2006 and 2005.

We adopted the provisions of Statement of Financial Accounting

Standards (SFAS) No. 123 (Revised) “Share-Based Payment” (SFAS No.

123R) in the first fiscal quarter of fiscal 2007. SFAS No. 123R requires

us to recognize the cost of employee services received in exchange

for awards of equity instruments based on the grant date fair value of

those awards in our consolidated statements of earnings. We adopted

the provisions of SFAS No. 123R according to the modified prospective

transition method and therefore, did not restate our consolidated

financial statements for periods prior to adoption. The adoption of

SFAS No. 123R reduced diluted net earnings per share from continuing

operations by $0.08 in fiscal 2007 from fiscal 2006.

In fiscal 2008, we expect a net increase of approximately 40

restaurants, excluding the disposition of the 73 Smokey Bones that

continue to operate. We expect combined U.S. same-restaurant sales

growth in fiscal 2008 of between 2 to 4 percent at Olive Garden and

Red Lobster. We also expect further earnings improvement at Bahama

Breeze in fiscal 2008 as we continue to focus on strengthening restau-

rant level returns by removing costs and complexity that do not add

value for their guests. On a consolidated basis, we expect diluted net

earnings per share growth from continuing operations of 10 percent

to 12 percent in fiscal 2008.

Additionally, over the course of fiscal 2008 we plan to increase

the range of our target debt leverage ratio to 55 to 65 percent, up

from our previous target range of 40 to 50 percent. We believe

that this modification of our capital structure will enable us to invest

appropriately in our existing business, preserve financial flexibility to

pursue acquisitions that meet our criteria and return excess cash to

our shareholders. In June 2007 we announced that we would pay a

quarterly dividend of 18 cents per share on August 1, 2007. Previously,

we paid a semi-annual dividend of 23 cents per share, or 46 cents per

share on an annual basis. Based on the 18-cent quarterly dividend