Red Lobster 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 Darden Restaurants, Inc. Annual Report 2007

Notes to Consolidated Financial Statements

N

then acquired, each right will entitle the holder (other than the

acquiring company) to receive, upon exercise, common stock of

either us or the acquiring company having a value equal to two

times the exercise price of the right. The rights are redeemable by

our Board of Directors under certain circumstances and expire on

May 25, 2015.

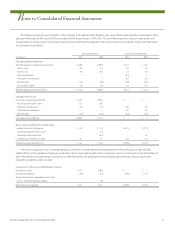

Accumulated Other

Comprehensive Income (Loss)

The components of accumulated other comprehensive income

(loss) are as follows:

(in millions) May 27, 2007 May 28, 2006

Foreign currency translation adjustment $ (4.3) $(4.8)

Unrealized gains (losses) on derivatives, net of tax 3.8 (0.2)

Minimum pension liability adjustment, net of tax – (0.5)

Adoption of SFAS No. 158, net of tax (32.3) –

Total accumulated other comprehensive

income (loss) $(32.8) $(5.5)

Reclassification adjustments associated with pre-tax net

derivative income (losses) realized in net earnings for fiscal 2007,

2006 and 2005 amounted to ($1.3) million, $5.0 million and $0.2 million,

respectively. The amortization of the unrecognized net actuarial loss

component of our fiscal 2008 net periodic benefit cost for the defined

benefit plans and postretirement benefit plan is expected to be

approximately $4.3 million and $0.3 million, respectively.

Note13

Leases

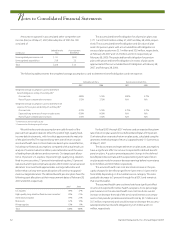

An analysis of rent expense incurred under operating leases related

to restaurants in continuing operations is as follows:

Fiscal Year

(in millions) 2007 2006 2005

Restaurant minimum rent $64.3 $59.9 $57.0

Restaurant percentage rent 4.6 4.6 4.0

Restaurant rent averaging expense (2.5) 5.4 5.1

Transportation equipment 2.8 2.3 2.8

Office equipment 1.1 1.1 1.2

Office space 5.3 1.3 1.1

Warehouse space 0.3 0.3 0.3

Total rent expense $75.9 $74.9 $71.5

Rent expense included in discontinued operations was

$4.4 million, $9.2 million and $8.0 million for fiscal 2007, 2006 and

2005, respectively. The annual non-cancelable future lease commit-

ments, including those related to restaurants reported as discon-

tinued operations, for each of the five fiscal years subsequent to

May 27, 2007 and thereafter are: $81.5 million in 2008, $73.7 million

in 2009, $61.3 million in 2010, $53.1 million in 2011, $43.2 million

in 2012 and $122.5 million thereafter, for a cumulative total of

$435.3 million.

Note14

Interest, Net

The components of interest, net, are as follows:

Fiscal Year

(in millions) 2007 2006 2005

Interest expense $43.6 $48.9 $47.7

Capitalized interest (2.9) (1.9) (1.6)

Interest income (0.6) (3.1) (1.4)

Interest, net $40.1 $43.9 $44.7

Capitalized interest was computed using our average borrowing

rate. We paid $35.8 million, $40.3 million and $39.1 million for interest

(net of amounts capitalized) in fiscal 2007, 2006 and 2005, respectively.

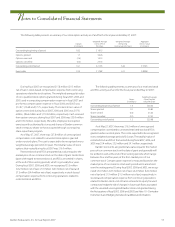

Note15

Income Taxes

Total income tax expense for fiscal 2007, 2006 and 2005 was allocated

as follows:

Fiscal Year

(in millions) 2007 2006 2005

Earnings from continuing operations $ 153.7 $156.3 $141.7

Losses from discontinued operations (112.9) (12.1) (8.3)

Total consolidated income tax expense $ 40.8 $144.2 $133.4