Red Lobster 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 Darden Restaurants, Inc. Annual Report 2007

Notes to Consolidated Financial Statements

N

Note16

Retirement Plans

Defined Benefit Plans and Postretirement

Benefit Plan

Substantially all of our employees are eligible to participate in a

retirement plan. We sponsor non-contributory defined benefit

pension plans for our salaried employees, in which benefits are

based on various formulas that include years of service and

compensation factors and for a group of hourly employees, in

which a fixed level of benefits is provided. Pension plan assets are

primarily invested in U.S., international and private equities, long

duration fixed-income securities and real assets. Our policy is to

fund, at a minimum, the amount necessary on an actuarial basis to

provide for benefits in accordance with the requirements of the

Employee Retirement Income Security Act of 1974, as amended.

We also sponsor a contributory postretirement benefit plan that

provides health care benefits to our salaried retirees. During fiscal

2007, 2006 and 2005, we funded the defined benefit pension plans

in the amount of $0.5 million, $0.3 million and $0.1 million, respec-

tively. We expect to contribute approximately $0.4 million to our

defined benefit pension plans during fiscal 2008. During fiscal

2007, 2006 and 2005, we funded the postretirement benefit plan

in the amount of $0.8 million, $0.4 million and $0.5 million, respec-

tively. We expect to contribute approximately $0.4 million to our

postretirement benefit plan during fiscal 2008.

Effective May 27, 2007, we implemented the recognition and

measurement provisions of SFAS No. 158. The purpose of SFAS No.

158 is to improve the overall financial statement presentation of

pension and other postretirement plans, but SFAS No. 158 does not

impact the determination of net periodic benefit cost or measure-

ment of plan assets or obligations. SFAS No. 158 requires companies

to recognize the over or under-funded status of the plan as an asset

or liability as measured by the difference between the fair value of

the plan assets and the benefit obligation and requires any unrecog-

nized prior service costs and actuarial gains and losses to be recog-

nized as a component of accumulated other comprehensive

income (loss).

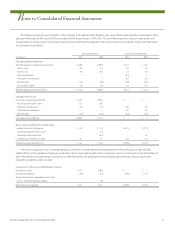

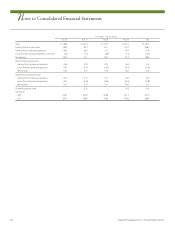

The following table illustrates the incremental effect of the

adoption of SFAS No. 158 on individual financial statement captions in

our accompanying consolidated balance sheet as of May 27, 2007.

Before Application SFAS No. 158 After Application

(in millions) of SFAS No. 158 Adjustments of SFAS No. 158

Other assets $ 185.8 $ (34.8) $ 151.0

Total assets 2,915.6 (34.8) 2,880.8

Other liabilities $ 50.8 $ 16.6 $ 67.4

Deferred income taxes 45.4 (19.6) 25.8

Total liabilities 1,789.3 (3.0) 1,786.3

Accumulated other comprehensive

income (loss) (1.0) (31.8) (32.8)

Total stockholders’ equity $1,126.3 $ (31.8) $1,094.5

The effect of the adoption of SFAS No. 158 on our consolidated

financial statements was primarily attributable to our defined

benefit pension plans and our postretirement health plan.

However, we also accrue for postemployment severance costs

in accordance with SFAS No. 112, “Employers’ Accounting for

Postemployment Benefits – an amendment of FASB statements

No. 5 and 43,” and use guidance found in SFAS No. 106, “Employers’

Accounting for Postretirement Benefits Other Than Pensions,” to

measure the cost recognized in our consolidated financial state-

ments. As a result, we used the provisions of SFAS No. 158 to reclas-

sify the unrecognized actuarial gains and losses related to our

postemployment severance accrual from liabilities to a compo-

nent of other accumulated comprehensive income (loss).

Accordingly, of the $31.8 million adjustment to accumulated other

comprehensive income (loss) noted above, $24.8 million related to

our defined benefit pension and postretirement health plans,

while the remaining $7.0 million related to our postemployment

severance accrual.