Red Lobster 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 Darden Restaurants, Inc. Annual Report 2007

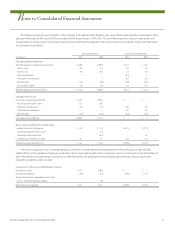

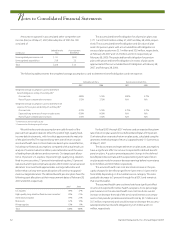

Notes to Consolidated Financial Statements

N

Note9

Note10

The results of operations for all Red Lobster and Olive Garden

restaurants permanently closed in fiscal 2007, 2006 and 2005, that

would otherwise have met the criteria for discontinued operations

reporting are not material to our consolidated financial position,

results of operations or cash flows and, therefore, have not been

presented as discontinued operations.

Note5

Land, Buildings and Equipment, Net

The components of land, buildings and equipment, net, are

as follows:

(in millions) May 27, 2007 May 28, 2006

Land $ 595.8 $ 603.2

Buildings 2,299.7 2,472.2

Equipment 996.5 1,052.2

Construction in progress 69.4 100.9

Total land, buildings and equipment 3,961.4 4,228.5

Less accumulated depreciation and amortization (1,777.0) (1,782.5)

Land, buildings, and equipment, net $ 2,184.4 $ 2,446.0

On August 24, 2006, we completed the sale and leaseback of

our Restaurant Support Center (RSC) for $45.2 million. The RSC

houses all of our executive offices, shared service functions and

concept administrative personnel. The transaction was completed in

anticipation of moving the RSC to a new facility approximately four

years from the date of sale. As a result of the sale and subsequent

leaseback of the RSC, we recorded a $15.2 million deferred gain,

which is being recognized over the four-year leaseback period on a

straight-line basis. During fiscal 2007, we recognized $2.8 million of

gain on the sale of the RSC, which is included as a reduction of

selling, general and administrative expenses in our consolidated

statements of earnings.

Note6

Other Assets

The components of other assets are as follows:

(in millions) May 27, 2007 May 28, 2006

Pension over-funding $ 17.1 $ –

Prepaid pension costs – 58.4

Trust-owned life insurance 60.3 49.9

Capitalized software costs, net 30.4 31.0

Liquor licenses 23.6 25.0

Loan costs 8.6 9.7

Miscellaneous 11.0 12.6

Total other assets $151.0 $186.6

Note7

Short-Term Debt

Short-term debt at May 27, 2007 and May 28, 2006 consisted of

$211.4 million and $44.0 million, respectively, of unsecured commer-

cial paper borrowings with original maturities of one month or less.

The debt bore an interest rate of 5.34 percent at May 27, 2007.

Note8

Other Current Liabilities

The components of other current liabilities are as follows:

(in millions) May 27, 2007 May 28, 2006

Non-qualified deferred compensation plan $146.9 $124.7

Sales and other taxes 42.3 43.7

Insurance related 54.4 40.6

Miscellaneous 31.7 36.7

Employee benefits 18.1 28.0

Accrued interest 11.6 9.6

Total other current liabilities $305.0 $283.3