Red Lobster 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

M

Darden Restaurants, Inc. Annual Report 2007 29

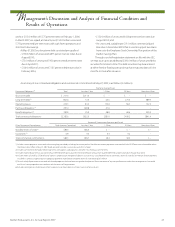

Management’s Discussion and Analysis of Financial Condition and

Results of Operations

its policy of presenting taxes and, if presented on a gross basis, the

amount of taxes. The guidance is effective for periods beginning

after December 15, 2006. We present sales tax on a net basis in our

consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157, “Fair Value

Measures.” SFAS No. 157 defines fair value, establishes a framework

for measuring fair value and enhances disclosures about fair value

measures required under other accounting pronouncements, but

does not change existing guidance as to whether or not an instru-

ment is carried at fair value. SFAS No. 157 is effective for fiscal years

beginning after November 15, 2007, which will require us to adopt

these provisions in fiscal 2009. We are currently evaluating the impact

SFAS No. 157 will have on our consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159 “The Fair Value

Option for Financial Assets and Financial Liabilities.” SFAS No. 159

provides companies with an option to report selected financial

assets and financial liabilities at fair value. Unrealized gains and

losses on items for which the fair value option has been elected are

reported in earnings at each subsequent reporting date. SFAS No.

159 is effective for fiscal years beginning after November 15, 2007,

which will require us to adopt these provisions in fiscal 2009. We

are currently evaluating the impact SFAS No. 159 will have on our

consolidated financial statements.

Forward-Looking Statements

Certain statements included in this report and other materials filed

or to be filed by us with the SEC (as well as information included in

oral or written statements made or to be made by us) may contain

statements that are forward-looking within the meaning of the

Private Securities Litigation Reform Act of 1995, as codified in Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. Words or phrases

such as “believe,” “plan,” “will,” “expect,” “intend,” “estimate,” and “project”

and similar expressions are intended to identify forward-looking

statements. All of these statements, and any other statements in

this report that are not historical facts, are forward-looking. These

forward-looking statements are based on assumptions concerning

important factors, risks and uncertainties that could significantly

affect anticipated results in the future and, accordingly, could cause

the actual results to differ materially from those expressed in the

forward-looking statements. These factors, risks and uncertainties

include, but are not limited to those discussed below and in Part I,

Item 1A, “Risk Factors” in our Annual Report on Form 10-K for the year

ended May 27, 2007:

• The intensely competitive nature of the restaurant industry,

especially pricing, service, location, personnel and type and

quality of food;

• Economic and business factors, both specific to the restaurant

industry and generally, that are largely out of our control, includ-

ing changes in consumer preferences, demographic trends,

severe weather conditions including hurricanes, a protracted

economic slowdown or worsening economy, energy prices,

interest rates, industry-wide cost pressures and public safety

conditions, including actual or threatened armed conflicts or

terrorist attacks;

• The price and availability of food, ingredients and utilities,

including the general risk of inflation;

• Labor and insurance costs, including increased labor costs as

a result of federal and state-mandated increases in minimum

wage rates and increased insurance costs as a result of

increases in our current insurance premiums;

• Increased advertising and marketing costs;

• Higher-than-anticipated costs to open, close, relocate or

remodel restaurants;

• Litigation by employees, consumers, suppliers, shareholders or

others, regardless of whether the allegations made against us

are valid or we are ultimately found liable;

• Unfavorable publicity relating to food safety or other concerns;

• A lack of suitable new restaurant locations or a decline in the

quality of the locations of our current restaurants;

• Federal, state and local regulation of our business, including

laws and regulations relating to our relationships with our

employees, zoning, land use, environmental matters and

liquor licenses;

• Growth objectives, including lower-than-expected sales and

profitability of newly-opened restaurants, our expansion of

newer concepts that have not yet proven their long-term

viability, our ability to develop new concepts, risks associated

with growth through acquisitions, and our ability to manage

risks relating to the opening of new restaurants, including

real estate development and construction activities, union

activities, the issuance and renewal of licenses and permits, the

availability and cost of funds to finance growth and our ability

to hire and train qualified personnel;

• Our plans to expand newer concepts like Bahama Breeze

and Seasons 52 that have not yet proven their long-term

viability; and

• Our ability to dispose of our closed Smokey Bones and Rocky

River Grillhouse restaurants and to sell the remaining operating

Smokey Bones restaurants.

Since it is not possible to foresee all such factors, risks and uncer-

tainties, investors should not consider these factors to be a complete

list of all risks or uncertainties.