Red Lobster 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 Darden Restaurants, Inc. Annual Report 2007

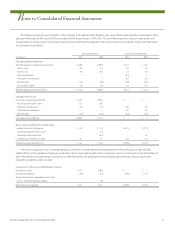

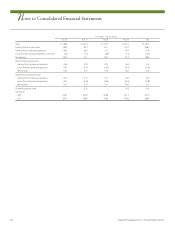

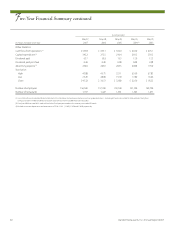

Five-Year Financial Summary continued

Fiscal Year Ended

May 27, May 28, May 29, May 30, May 25,

(In millions, except per share data) 2007 2006 2005 2004

(1)

2003

Other Statistics

Cash flows from operations

(1)

$ 569.8 $ 699.1 $ 550.0 $ 492.0 $ 495.1

Capital expenditures

(1)

345.2 273.5 210.4 269.3 350.3

Dividends paid 65.7 59.2 12.5 13.0 13.5

Dividends paid per share 0.46 0.40 0.08 0.08 0.08

Advertising expense

(1)

230.0 223.0 206.5 208.8 199.0

Stock price:

High 45.88 42.75 33.11 25.60 27.83

Low 33.29 28.80 19.30 17.80 16.46

Close $ 45.32 $ 36.51 $ 32.80 $ 22.50 $ 18.35

Number of employees 156,500 157,300 150,100 141,300 140,700

Number of restaurants 1,397 1,427 1,381 1,325 1,271

(1) Consistent with our consolidated financial statements, this information has been presented on a continuing operations basis. Accordingly, the activities related to Smokey Bones, Rocky River

Grillhouse and the nine Bahama Breeze restaurants that were closed in fiscal 2007 have been excluded.

(2) Fiscal year 2004 consisted of 53 weeks while all other fiscal years presented on this summary consisted of 52 weeks.

(3) Excludes restaurant depreciation and amortization of $186.4, $181.1, $180.2, $182.6 and $169.0, respectively.

S