Red Lobster 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

M

Darden Restaurants, Inc. Annual Report 2007 25

Management’s Discussion and Analysis of Financial Condition and

Results of Operations

and our $150.0 million of 6.375 percent notes on February 1, 2006.

In March 2007, we repaid, at maturity our $150.0 million unsecured

5.750 percent medium-term notes with cash from operations and

short-term borrowings.

At May 27, 2007, our long-term debt consisted principally of:

• $150.0 million of unsecured 4.875 percent senior notes due in

August 2010;

• $75.0 million of unsecured 7.450 percent medium-term notes

due in April 2011;

• $100.0 million of unsecured 7.125 percent debentures due in

February 2016;

• $150.0 million of unsecured 6.000 percent senior notes due

August 2035; and

• An unsecured, variable rate $19.1 million commercial bank

loan due in December 2018 that is used to support two loans

from us to the Employee Stock Ownership Plan portion of the

Darden Savings Plan.

Through our shelf registration statement on file with the SEC,

we may issue up to an additional $300.0 million of unsecured debt

securities from time to time. The debt securities may bear interest

at either fixed or floating rates and may have maturity dates of nine

months or more after issuance.

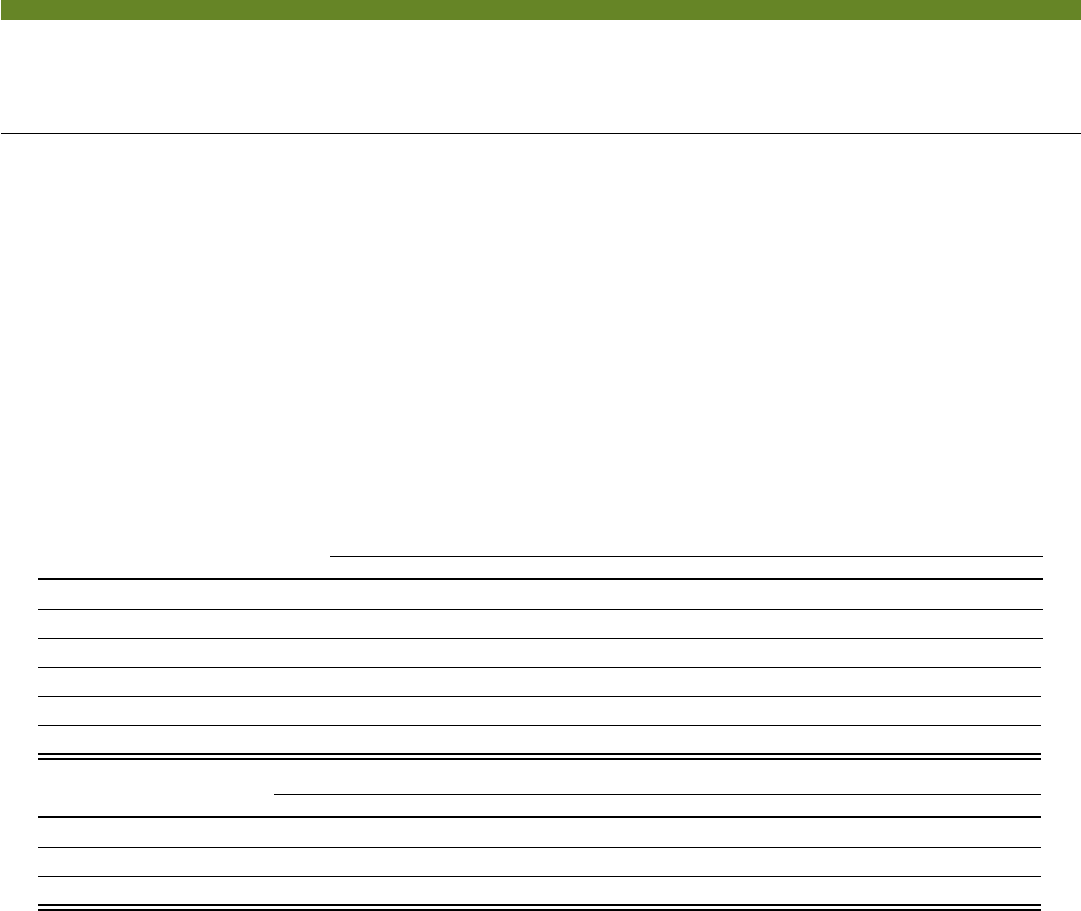

A summary of our contractual obligations and commercial commitments at May 27, 2007, is as follows (in millions):

Payments Due by Period

Contractual Obligations

(6)

Total Less than 1 Year 1-3 Years 3-5 Years More than 5 Years

Short-term debt $ 211.4 $211.4 $ – $ – $ –

Long-term debt (1) 861.6 33.4 65.5 273.3 489.4

Operating leases 435.3 81.5 135.0 96.3 122.5

Purchase obligations (2) 491.4 469.8 21.6 – –

Benefit obligations (3) 383.9 25.9 58.9 69.6 229.5

Total contractual obligations $2,383.6 $822.0 $281.0 $439.2 $841.4

Amount of Commitment Expiration per Period

Other Commercial Commitments Total Amounts Committed Less than 1 Year 1-3 Years 3-5 Years More than 5 Years

Standby letters of credit (4) $85.4 $85.4 $ – $ – $ –

Guarantees (5) 0.9 0.3 0.4 0.2 –

Total commercial commitments $86.3 $85.7 $0.4 $0.2 $ –

1) Includes interest payments associated with existing long-term debt, including the current portion. Variable-rate interest payments associated with the ESOP loan were estimated based on

the interest rate in effect at May 27, 2007 (5.645 percent). Excludes issuance discount of $2.5 million.

2) Includes commitments for food and beverage items and supplies, capital projects and other miscellaneous commitments.

3) Includes expected payments associated with our defined benefit plans, postretirement benefit plan and our non-qualified deferred compensation plan through fiscal 2016.

4) Includes letters of credit for $75.0 million of workers’ compensation and general liabilities accrued in our consolidated financial statements, letters of credit for $3.9 million of lease payments

included in contractual operating lease obligation payments noted above and other letters of credit totaling $6.5 million.

5) Consists solely of guarantees associated with leased properties that have been assigned to third parties. We are not aware of any non-performance under these arrangements that would

result in us having to perform in accordance with the terms of the guarantees.

6) Excludes contingencies related to uncertain tax positions we have taken or will take in our income tax returns.