Red Lobster 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

Darden Restaurants, Inc. Annual Report 2007 57

Notes to Consolidated Financial Statements

involved, either individually or in the aggregate, will not have a

material adverse effect on our financial position, results of opera-

tions or liquidity. The following is a brief description of the more

significant of these matters. In view of the inherent uncertainties of

litigation, the outcome of any unresolved matter described below

cannot be predicted at this time, nor can the amount of any poten-

tial loss be reasonably estimated.

Like other restaurant companies and retail employers, we have

been faced in a few states with allegations of purported class-wide

wage and hour violations. In August 2003, three former employees in

Washington filed a purported class action in Washington State Superior

Court in Spokane County alleging violations of Washington labor laws

with respect to providing rest breaks. The court stayed the action and

ordered the plaintiffs into our mandatory arbitration program.

Although we believe we provided the required rest breaks to our

employees, we resolved the case through mediation, and the settle-

ment agreement received preliminary court approval in June 2007.

In January 2004, a former food server filed a purported class

action in California state court alleging that Red Lobster’s “server

banking” policies and practices (under which servers settle guest

checks directly with customers throughout their shifts, and turn in

collected monies at the shift’s end) improperly required her and

other food servers and bartenders to make up cash shortages and

walkouts in violation of California law. The case was ordered to

arbitration. As a procedural matter, the arbitrator ruled that class-wide

arbitration is permissible under our dispute resolution program. We

have filed a petition opposing the arbitrator’s decision; no decision

on the petition has yet been rendered and no class has been certi-

fied. In January 2007, plaintiffs’ counsel filed in California state court

a second purported class action lawsuit on behalf of servers and

bartenders alleging that Olive Garden’s server banking policy and

its alleged failure to pay split shift premiums violated California law.

We believe that our policies and practices were lawful and that we

have strong defenses to both cases.

On March 23, 2006, we were notified that the staff of the U.S.

Federal Trade Commission (FTC) was conducting an inquiry into the

marketing of our gift cards. During the inquiry, we cooperated with

the staff, provided information and made some voluntary adjust-

ments to the disclosure of dormancy fees related to our gift cards. In

October 2006, we discontinued the imposition of dormancy fees. In

April 2007, without admitting liability, we entered into a consent

order with the FTC under which we agreed to make certain minimum

disclosures should we decide in the future to impose fees in connec-

tion with our gift cards, to maintain certain records related to gift

cards, and to restore dormancy fees previously imposed on the cards.

By its terms the consent order will remain in place until 2027.

Note18

Note19

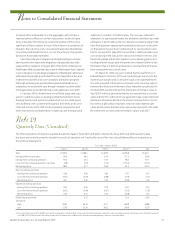

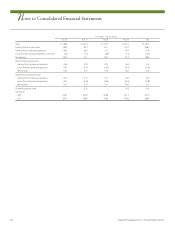

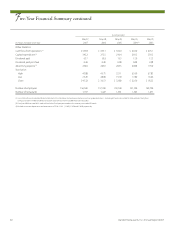

Quarterly Data (Unaudited)

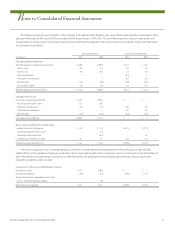

The following table summarizes unaudited quarterly data for fiscal 2007 and 2006, whereas the fiscal 2007 and 2006 quarterly data

has been presented to properly classify the results of operations of Smokey Bones and the nine closed Bahama Breeze restaurants as

discontinued operations:

Fiscal 2007 – Quarters Ended

Aug. 27 Nov. 26 Feb. 25 May 27

(1)

Total

S

ales $1,359.6 $1,298.1 $1,449.5 $1,459.8 $5,567.1

Earnings before income taxes 139.4 96.6 157.4 137.3 530.8

Earnings from continuing operations 93.3 67.6 117.7 98.5 377.1

Losses from discontinued operations, net of tax (4.8) (5.9) (11.3) (153.6) (175.7)

Net earnings (loss) 88.5 61.7 106.4 (55.1) 201.4

Basic net earnings per share:

Earnings from continuing operations 0.64 0.46 0.82 0.70 2.63

Losses from discontinued operations (0.03) (0.04) (0.08) (1.09) (1.23)

Net earnings (loss) 0.61 0.42 0.74 (0.39) 1.40

Diluted net earnings per share:

Earnings from continuing operations 0.62 0.45 0.79 0.67 2.53

Losses from discontinued operations (0.03) (0.04) (0.07) (1.05) (1.18)

Net earnings (loss) 0.59 0.41 0.72 (0.38) 1.35

Dividends paid per share – 0.23 – 0.23 0.46

Stock price:

High 39.40 44.19 42.71 45.88 45.88

Low 33.29 35.24 38.32 39.08 33.29

(1) During the fourth quarter of fiscal 2007, we closed 54 Smokey Bones, two Rocky River Grillhouse and nine Bahama Breeze restaurants resulting in impairment costs and closure costs in the fourth quarter of

fiscal 2007 of $229.5 million and $16.4 million, respectively. The amounts are included in losses from discontinued operations, net of tax, in the table above.