Red Lobster 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 Darden Restaurants, Inc. Annual Report 2007

Notes to Consolidated Financial Statements

N

Note3

Note4

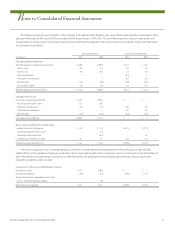

In September 2006, the FASB issued SFAS No. 158, “Employers’

Accounting for Defined Benefit Pension and Other Postretirement

Plans (an amendment of FASB Statements No. 87, 88, 106 and 132R).”

Effective May 27, 2007, we implemented the recognition and

measurement provision of SFAS No. 158. The purpose of SFAS

No. 158 is to improve the overall financial statement presentation of

pension and other postretirement plans, but SFAS No. 158 does not

impact the determination of net periodic benefit cost or measure-

ment of plan assets or obligations. SFAS No. 158 requires companies

to recognize the over or under funded status of the plan as an asset

or liability as measured by the difference between the fair value of

the plan assets and the benefit obligation and requires any unrecog-

nized prior service costs and actuarial gains and losses to be recog-

nized as a component of accumulated other comprehensive

income (loss). Additionally, SFAS No. 158 no longer allows compa-

nies to measure their plans as of any date other than as of the end of

their fiscal year. However, this provision is not effective for compa-

nies until fiscal years ending after December 15, 2008. The adoption

of SFAS No. 158 resulted in an after-tax adjustment to accumulated

other comprehensive income (loss) of $31.8 million related to a

reclassification of unrecognized actuarial gains and losses from

assets and liabilities to a component of accumulated other compre-

hensive income (loss), as well as a requirement to recognize over and

under funding of our pension and post-retirement health plan. See

Note 12 – Stockholders’ Equity and Note 16 – Retirement Plans for

additional information.

In September 2006, the Securities and Exchange Commission

issued Staff Accounting Bulletin (SAB) No. 108, “Considering the

Effects of Prior Year Misstatements when quantifying Misstatements

in Current Year Financial Statements.” SAB 108 is effective for the first

fiscal year ending after November 15, 2006. SAB 108 requires compa-

nies to evaluate the materiality of identified unadjusted errors on

each financial statement and related financial statement disclosure

using both the rollover approach and the iron curtain approach, as

those terms are defined in SAB 108. The rollover approach quantifies

misstatements based on the amount of the error in the current year

financial statements, whereas the iron curtain approach quantifies

misstatements based on the effects of correcting the misstatement

existing in the balance sheet at the end of the current year, irrespec-

tive of the misstatement’s year(s) of origin. Financial statements

would require adjustment when either approach results in quanti-

fying a misstatement that is material. Correcting prior year financial

statements for immaterial errors would not require previously filed

reports to be amended. If a company determines that an adjustment

to prior year financial statements is required upon adoption of SAB

108 and does not elect to restate its previous financial statements,

then it must recognize the cumulative effect of applying SAB 108 in

fiscal 2007 beginning balances of the affected assets and liabilities

with a corresponding adjustment to the fiscal 2007 opening balance

in retained earnings. The adoption of SAB 108 did not have a mate-

rial effect on our consolidated financial statements.

In March 2006, the Emerging Issues Task Force (EITF) issued EITF

Issue 06-3, “How Taxes Collected from Customers and Remitted to

Governmental Authorities Should Be Presented in the Income

Statement (That is, Gross versus Net Presentation).” Entities may

adopt a policy of presenting sales taxes in the income statement on

either a gross or net basis. If taxes are significant, an entity should

disclose its policy of presenting taxes and, if presented on a gross

basis, the amount of taxes. The guidance is effective for periods

beginning after December 15, 2006. We present sales tax on a net

basis in our consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157, “Fair Value

Measures”. SFAS No. 157 defines fair value, establishes a framework for

measuring fair value and enhances disclosures about fair value

measures required under other accounting pronouncements, but

does not change existing guidance as to whether or not an instru-

ment is carried at fair value. SFAS No. 157 is effective for fiscal years

beginning after November 15, 2007, which will require us to adopt

these provisions in fiscal 2009. We are currently evaluating the impact

SFAS No. 157 will have on our consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159 “The Fair Value

Option for Financial Assets and Financial Liabilities.” SFAS No. 159

provides companies with an option to report selected financial assets

and financial liabilities at fair value. Unrealized gains and losses on

items for which the fair value option has been elected are reported in

earnings at each subsequent reporting date. SFAS No. 159 is effective

for fiscal years beginning after November 15, 2007, which will require

us to adopt these provisions in fiscal 2009. We are currently evaluating

the impact SFAS No. 159 will have on our consolidated financial

statements.

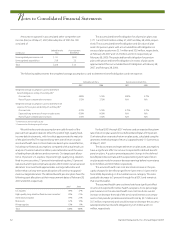

Note2

Discontinued Operations

On April 28, 2007, we closed nine under-performing Bahama Breeze

restaurants to focus more on the profitable locations and position

the concept for new unit growth. As a result of these closures, we

recorded long-lived asset impairment charges of $12.7 million in

fiscal 2007, as well as expenses of $1.3 million to accrue for ongoing

contractual operating lease obligations, $0.6 million in restaurant-

level closing costs, $0.5 million in employee termination benefits

and $0.3 million in other costs.

On May 5, 2007, we announced the closure of 54 Smokey Bones

and two Rocky River Grillhouse restaurants as well as our intention to

offer for sale the remaining 73 operating Smokey Bones restaurants.

During fiscal 2007, we recorded long-lived asset impairment charges

of $236.4 million, $229.5 million of which was recorded during the

fourth quarter as a result of these actions, as well as expenses of