Red Lobster 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

Our current brands are operating more effectively and consistently so we

can grow them at rates that better capture their full market opportunities.

We believe Darden’s success is a result of our ability to

develop several winning combinations, and we highlight some

of these in this report. One of the most important has been

the combination of two foundational strengths – a proven

approach to managing and evolving casual dining brands,

and a strong, motivating culture. Together, these two strengths

form our operating platform. During the year, we were able

to strengthen that platform and deliver competitively strong

nancial results from continuing operations despite lower-than-

expected sales growth in the casual dining industry.

With our accomplishments, we ended scal 2007 in a

meaningfully stronger competitive position than we had

when the year began. More specifically, we are better

positioned to supplement the same-restaurant excellence

we’ve historically enjoyed with stronger new restaurant

growth going forward, all while maintaining solid protability.

We believe this is a combination that will create long-term

shareholder value over the next decade that matches or

exceeds what we’ve delivered the past 10-plus years.

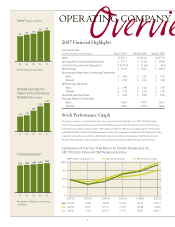

Fiscal 2007 Highlights

Strategic Highlights

Speaking of winning combinations, we’ve articulated many

times before what underlies our proven approach to the

business. It’s the power of combining strength in our four

strategic pillar areas – competitively superior leadership,

brand management excellence, restaurant operations

excellence and restaurant support excellence. We made

signicant strides in scal 2007 to strengthen our capabilities

in each of these areas. As a result, we are operating our current

brands more eectively and consistently, so we can grow

them at rates that better capture their market opportunities,

and we’re better prepared than ever to successfully bring on

additional brands.

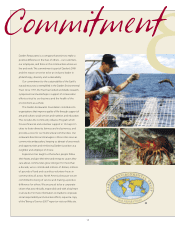

The Company’s strategic progress in 2007 has two

dimensions. First, each operating company delivered on

brand-specific initiatives to bolster their capabilities in

targeted strategic pillar areas. Second, the entire organization

successfully tackled a prioritized list of initiatives to

strengthen both the operational and cultural aspects of

our operating platform. These initiatives focused on improving

and increasing consistency across the Company in the

employee experience we provide, the effectiveness of

our talent assessment and development, and the level of

discipline with which we manage the brand and restau-

rant operations functions that are at the core of what we

do. The initiatives also included meaningfully enhancing

key support functions such as Supply Chain, Information

Technology, and Government and Community Aairs.

In scal 2007, we also established clearer direction for our

emerging businesses. This included making the dicult

but appropriate decision to dispose of Smokey Bones because

we were not making suciently rapid or protable progress

developing it into the nationally advertised brand we

intended. And, based on continued strong guest experiences

and financial results, we decided to restart growth at

Bahama Breeze and to move to the next stage of disciplined

expansion at Seasons 52.

To facilitate Bahama Breeze’s renewed growth and the

disposition of Smokey Bones, we closed nine low-performing

Bahama Breeze restaurants, 54 Smokey Bones restaurants

and two Rocky River Grillhouse restaurants that were part of

a new direction we developed for the potential conversion of

Smokey Bones. The remaining 73 Smokey Bones restaurants

continue to operate, and we’re oering them for sale. Results

for the nine Bahama Breeze restaurants that we closed and

for the Smokey Bones business are reported separately as

discontinued operations for nancial reporting purposes.

Shareholders