Red Lobster 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

Darden Restaurants, Inc. Annual Report 2007 45

Notes to Consolidated Financial Statements

Note9

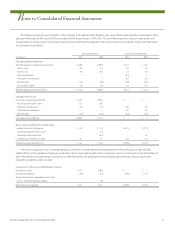

Long-Term Debt

The components of long-term debt are as follows:

(in millions) May 27, 2007 May 28, 2006

5.750% medium-term notes due March 2007 $ – $ 150.0

4.875% senior notes due August 2010 150.0 150.0

7.450% medium-term notes due April 2011 75.0 75.0

7.125% debentures due February 2016 100.0 100.0

6.000% senior notes due August 2035 150.0 150.0

ESOP loan with variable rate of interest

(5.645% at May 27, 2007) due December 2018 19.1 22.4

Total long-term debt 494.1 647.4

Less issuance discount (2.5) (2.8)

Total long-term debt less issuance discount 491.6 644.6

Less current portion – (149.9)

Long-term debt, excluding current portion $491.6 $ 494.7

In March 2007, we repaid at maturity our outstanding $150.0

million of 5.750 percent medium-term notes. On July 29, 2005, we

filed a registration statement with the SEC to register an additional

$475.0 million of debt securities using a shelf registration process as

well as to carry forward the $125.0 million of debt securities available

under our prior registration statement filed in July 2000. Under this

registration statement, which became effective on August 5, 2005, we

may offer, from time to time, up to $600.0 million of our debt securi-

ties. On August 12, 2005, we issued $150.0 million of unsecured 4.875

percent senior notes due in August 2010 and $150.0 million of

unsecured 6.000 percent senior notes due in August 2035 under

the registration statement. Discount and issuance costs, which

were $2.4 million and $2.9 million, respectively, are being amortized

over the terms of the senior notes using the straight-line method,

the results of which approximate those of the effective interest rate

method. The proceeds from the issuance of the senior notes were

used to repay at maturity our outstanding $150.0 million of 8.375

percent senior notes on September 15, 2005 and our outstanding

$150.0 million of 6.375 percent notes on February 1, 2006. Following

the issuance of the senior notes in fiscal 2006, we had $300.0 million

of capacity available for issuance of additional unsecured debt securi-

ties under our shelf registration statement.

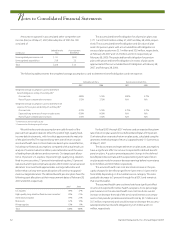

We also maintain a credit facility under a Credit Agreement

dated August 16, 2005 with a consortium of banks under which we

can borrow up to $500.0 million. As part of this credit facility, we

may request issuance of up to $100.0 million in letters of credit, the

outstanding amount of which reduces the net borrowing capacity

under the agreement. The credit facility allows us to borrow at

interest rates that vary based, at our option, on a spread over

(i) LIBOR or (ii) a base rate that is the higher of the prime rate or one-

half of one percent above the federal funds rate. The interest rate

spread over LIBOR is determined by our debt rating. We may also

request that loans be made at interest rates offered by one or more

of the banks, which may vary from the LIBOR or base rate. The credit

facility supports our commercial paper borrowing program and

expires on August 15, 2010. We are required to pay a facility fee of

10 basis points per annum on the average daily amount of loan

commitments by the consortium. The amount of interest and

annual facility fee are subject to change based on our maintenance

of certain debt ratings and financial ratios, such as maximum debt

to capital ratios. Advances under the credit facility are unsecured.

As of May 27, 2007 and May 28, 2006, no borrowings under the

credit facility were outstanding. However, as of May 27, 2007, there

was $211.4 million of commercial paper which was backed by this

facility. As of May 28, 2006, there was $44.0 million of commercial

paper and $15.0 million of letters of credit outstanding under the

facility. As of May 27, 2007, we were in compliance with all cove-

nants under the credit facility.

All of our long-term debt currently outstanding is expected to

be repaid entirely at maturity with interest being paid semi-annu-

ally over the life of the debt. The aggregate maturities of long-term

debt for each of the five fiscal years subsequent to May 27, 2007,

and thereafter are $0.0 million in 2008, 2009 and 2010, $225.0 million

in 2011, $0.0 million in 2012 and $269.1 million thereafter.

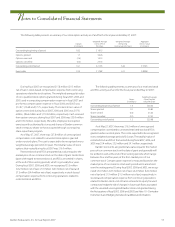

Note10

Derivative Instruments and

Hedging Activities

We use interest rate-related derivative instruments to manage our

exposure on debt instruments, as well as commodities derivatives to

manage our exposure to commodity price fluctuations. We also use

equity related derivative instruments to manage our exposure on

cash compensation arrangements indexed to the market price of our

common stock. By using these instruments, we expose ourselves,

from time to time, to credit risk and market risk. Credit risk is the failure

of the counterparty to perform under the terms of the derivative

contract. When the fair value of a derivative contract is positive, the

counterparty owes us, which creates credit risk for us. We minimize

this credit risk by entering into transactions with high quality counter-

parties. Market risk is the adverse effect on the value of a financial

instrument that results from a change in interest rates, commodity

prices, or market price of our common stock. We minimize this

market risk by establishing and monitoring parameters that limit the

types and degree of market risk that may be undertaken.

Note5

Note6

Note7

Note8