Red Lobster 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 Darden Restaurants, Inc. Annual Report 2007

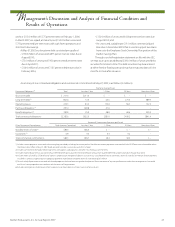

Management’s Discussion and Analysis of Financial Condition and

Results of Operations

M

Quantitative and Qualitative

Disclosures About Market Risk

We are exposed to a variety of market risks, including fluctuations in

interest rates, foreign currency exchange rates, compensation and

commodity prices. To manage this exposure, we periodically enter

into interest rate, foreign currency exchange, equity forwards and

commodity instruments for other than trading purposes (see Notes

1 and 10 of the Notes to Consolidated Financial Statements, included

elsewhere in this report).

We use the variance/covariance method to measure value

at risk, over time horizons ranging from one week to one year, at

the 95 percent confidence level. At May 27, 2007, our potential

losses in future net earnings resulting from changes in foreign

currency exchange rate instruments, commodity instruments,

equity forwards and floating rate debt interest rate exposures were

approximately $11.6 million over a period of one year (including the

impact of the interest rate swap agreements discussed in Note 10 of

the Notes to Consolidated Financial Statements, included elsewhere

in this report). The value at risk from an increase in the fair value of

all of our long-term fixed rate debt, over a period of one year, was

approximately $44.4 million. The fair value of our long-term fixed

rate debt during fiscal 2007 averaged $599.2 million, with a high

of $642.7 million and a low of $477.1 million. Our interest rate risk

management objective is to limit the impact of interest rate changes

on earnings and cash flows by targeting an appropriate mix of

variable and fixed rate debt.

Application of New

Accounting Standards

In June 2006, the FASB issued Interpretation No. 48, “Accounting

for Uncertainty in Income Taxes – an interpretation of SFAS No.

109” (FIN 48). FIN 48 clarifies the accounting for uncertain income

tax positions accounted for in accordance with SFAS No. 109. The

Interpretation stipulates recognition and measurement criteria in

addition to classification, interim period accounting and significantly

expanded disclosure provisions for uncertain tax positions that are

expected to be taken in a company’s tax return. FIN 48 is effective for

fiscal years beginning after December 15, 2006, and accordingly, we

adopted FIN 48 as of the first day of fiscal 2008. We do not believe the

adoption of FIN 48 will have a significant impact on our consolidated

financial statements.

In September 2006, the FASB issued SFAS No. 158, “Employers’

Accounting for Defined Benefit Pension and Other Postretirement

Plans (an amendment of FASB Statements No. 87, 88, 106 and 132R).”

Effective May 27, 2007, we implemented the recognition and

measurement provision of SFAS No. 158. The purpose of SFAS No. 158

is to improve the overall financial statement presentation of pension

and other postretirement plans, but SFAS No. 158 does not impact

the determination of net periodic benefit cost or measurement

of plan assets or obligations. SFAS No. 158 requires companies to

recognize the over or under funded status of the plan as an asset or

liability as measured by the difference between the fair value of the

plan assets and the benefit obligation and requires any unrecognized

prior service costs and actuarial gains and losses to be recognized as

a component of accumulated other comprehensive income (loss).

Additionally, SFAS No. 158 no longer allows companies to measure

their plans as of any date other than as of the end of their fiscal year.

However, this provision is not effective for companies until fiscal

years ending after December 15, 2008. The adoption of SFAS No. 158

resulted in an after-tax adjustment to accumulated other compre-

hensive income (loss) of $31.8 million related to a reclassification of

unrecognized actuarial gains and losses from assets to a component

of accumulated other comprehensive income (loss), as well as a

requirement to recognize over and under funding of our pension,

post-retirement health plan and employee severance accrual. See

Note 16 – Retirement Plans for additional information.

In September 2006, the Securities and Exchange Commission

issued Staff Accounting Bulletin (SAB) No. 108, “Considering the

Effects of Prior Year Misstatements when quantifying Misstatements

in Current Year Financial Statements.” SAB 108 is effective for the

first fiscal year ending after November 15, 2006. SAB 108 requires

companies to evaluate the materiality of identified unadjusted errors

on each financial statement and related financial statement disclosure

using both the rollover approach and the iron curtain approach, as

those terms are defined in SAB 108. The rollover approach quantifies

misstatements based on the amount of the error in the current year

financial statements, whereas the iron curtain approach quantifies

misstatements based on the effects of correcting the misstatement

existing in the balance sheet at the end of the current year, irrespective

of the misstatement’s year(s) of origin. Financial statements would

require adjustment when either approach results in quantifying

a misstatement that is material. Correcting prior year financial

statements for immaterial errors would not require previously filed

reports to be amended. If a company determines that an adjustment

to prior year financial statements is required upon adoption of SAB

108 and does not elect to restate its previous financial statements,

then it must recognize the cumulative effect of applying SAB 108 in

fiscal 2007 beginning balances of the affected assets and liabilities

with a corresponding adjustment to the fiscal 2007 opening balance

in retained earnings. The adoption of SAB 108 did not have a material

effect on our consolidated financial statements.

In March 2006, the Emerging Issues Task Force (EITF) issued

EITF Issue 06-3, “How Taxes Collected from Customers and Remitted

to Governmental Authorities Should Be Presented in the Income

Statement (That is, Gross versus Net Presentation).” Entities may adopt

a policy of presenting sales taxes in the income statement on either

a gross or net basis. If taxes are significant, an entity should disclose