Red Lobster 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 Darden Restaurants, Inc. Annual Report 2007

Notes to Consolidated Financial Statements

N

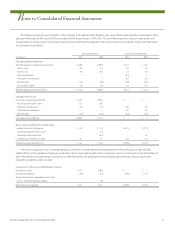

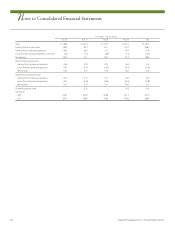

The following table presents a summary of our Darden stock

unit activity as of and for the fiscal year ended May 27, 2007:

Weighted-Average

Units Fair Value

(in millions) Per Unit

Outstanding beginning of period 0.7 $ 36.51

Units granted 0.4 34.75

Units vested – –

Units cancelled (0.1) 41.36

Outstanding end of period 1.0 $ 45.32

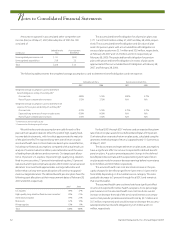

As of May 27, 2007, there was $13.5 million of unrecognized

compensation cost related to Darden stock units granted under our

incentive plans. This cost is expected to be recognized over a

weighted-average period of 3.5 years.

During fiscal 2007, we issued 0.29 million performance stock

units with a fair value on the date of grant of $35.81 per share that

will be settled in shares of our common stock upon vesting. The

performance stock units vest over a period of five years following

the date of grant, and the annual vesting target for each fiscal year is

20.0 percent of the total number of units covered by the award. The

number of units that actually vests each year will be determined

based on the achievement of Company performance criteria set forth

in the award agreement and may range from zero to 150.0 percent of

the annual target. Holders will receive one share of common stock for

each performance stock unit that vests. Compensation expense is

measured based on grant date fair value. During fiscal 2007, we recog-

nized $2.6 million ($1.6 million net of tax) of stock-based compensa-

tion expense related to the vesting of performance stock units. As of

May 27, 2007, there was $6.8 million of unrecognized compensation

cost related to unvested performance stock units granted under our

stock plans. This cost is expected to be recognized over a weighted-

average period of 4.0 years.

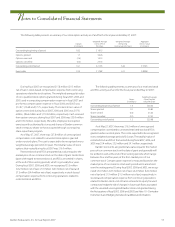

We maintain an Employee Stock Purchase Plan to provide

eligible employees who have completed one year of service

(excluding senior officers subject to Section 16(b) of the Securities

Exchange Act of 1934, and certain other employees who are

employed less than full time or own five percent or more of our

capital stock or that of any subsidiary) an opportunity to invest up

to $5.0 thousand per calendar quarter to purchase shares of our

common stock, subject to certain limitations. Under the plan, up

to an aggregate of 3.6 million shares are available for purchase by

employees at a purchase price that is 85.0 percent of the fair market

value of our common stock on either the first or last trading day of

each calendar quarter, whichever is lower. In connection with the

adoption of SFAS No. 123(R) in fiscal 2007 we recognized $1.3 million

($0.9 million net of tax) of stock-based compensation expense

related to the plan. Cash received from employees pursuant to the

plan during fiscal 2007, 2006 and 2005 was $5.8 million, $6.2 million

and $5.1 million, respectively.

During fiscal 2007, 2006 and 2005 we recognized $1.1 million

($0.7 million net of tax), $1.3 million ($0.8 million net of tax) and

$0.8 million ($0.5 million net of tax), respectively, of stock-based

compensation expense related to stock granted to Directors

pursuant to the Director Compensation Program and to employees

for performance awards under the 2002 Plan.

Note18

Commitments and Contingencies

As collateral for performance on contracts and as credit guarantees

to banks and insurers, we were contingently liable for guarantees of

subsidiary obligations under standby letters of credit. At May 27,

2007 and May 28, 2006, we had $75.0 million and $77.2 million,

respectively, of standby letters of credit related to workers’ compen-

sation and general liabilities accrued in our consolidated financial

statements. At May 27, 2007 and May 28, 2006, we had $10.4 million

and $12.6 million, respectively, of standby letters of credit related to

contractual operating lease obligations and other payments. All

standby letters of credit are renewable annually.

At May 27, 2007 and May 28, 2006, we had $0.9 million and

$1.3 million, respectively, of guarantees associated with leased proper-

ties that have been assigned to third parties. These amounts represent

the maximum potential amount of future payments under the guar-

antees. The fair value of these potential payments discounted at our

pre-tax cost of capital at May 27, 2007 and May 28, 2006, amounted to

$0.7 million and $1.0 million, respectively. We did not accrue for the

guarantees, as the likelihood of the third parties defaulting on the

assignment agreements was deemed to be less than probable. In the

event of default by a third party, the indemnity and default clauses in

our assignment agreements govern our ability to recover from and

pursue the third party for damages incurred as a result of its default.

We do not hold any third-party assets as collateral related to these

assignment agreements, except to the extent that the assignment

allows us to repossess the building and personal property. These

guarantees expire over their respective lease terms, which range

from fiscal 2008 through fiscal 2012.

We are subject to private lawsuits, administrative proceedings

and claims that arise in the ordinary course of our business. A

number of these lawsuits, proceedings and claims may exist at any

given time. These matters typically involve claims from guests,

employees and others related to operational issues common to the

restaurant industry, and can also involve infringement of, or chal-

lenges to, our trademarks. While the resolution of a lawsuit,

proceeding or claim may have an impact on our financial results for

the period in which it is resolved, we believe that the final disposition

of the lawsuits, proceedings and claims in which we are currently

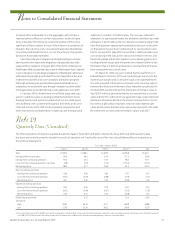

Note19