Red Lobster 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 Darden Restaurants, Inc. Annual Report 2007

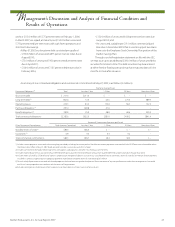

Management’s Discussion and Analysis of Financial Condition and

Results of Operations

M

anticipated ultimate costs to settle all claims, both reported and not

yet reported.

Our accounting policies regarding these insurance programs

include our judgments and independent actuarial assumptions

about economic conditions, the frequency or severity of claims and

claim development patterns and claim reserve, management and

settlement practices. Unanticipated changes in these factors may

produce materially different amounts of reported expense under

these programs.

Stock-Based Compensation

Beginning in fiscal 2007, we account for stock-based compensation

in accordance with the fair value recognition provisions of SFAS No.

123R. We use the Black-Scholes option pricing model, which requires

the input of subjective assumptions. These assumptions include

estimating the length of time employees will retain their vested

stock options before exercising them (expected term), the volatility

of our common stock price over the expected term and the number

of options that will ultimately not complete their vesting require-

ments (forfeitures). From year to year, our determination of these

subjective assumptions can materially affect the estimate of fair

value of stock-based compensation and consequently, the related

amount recognized in our consolidated statements of earnings

during each period.

Income Taxes

We estimate certain components of our provision for income taxes.

These estimates include, among other items, depreciation and

amortization expense allowable for tax purposes, allowable tax credits

for items such as taxes paid on reported employee tip income, effec-

tive rates for state and local income taxes and the tax deductibility of

certain other items. We adjust our annual effective income tax rate as

additional information on outcomes or events becomes available.

We base our estimates on the best available information at

the time that we prepare the provision. We generally file our annual

income tax returns several months after our fiscal year-end. Income

tax returns are subject to audit by federal, state and local governments,

generally years after the returns are filed. These returns could be subject

to material adjustments or differing interpretations of the tax laws.

Liquidity and Capital Resources

Cash flows generated from operating activities provide us with a

significant source of liquidity, which we use to finance the purchases

of land, buildings and equipment and to repurchase shares of our

common stock. Since substantially all our sales are for cash and cash

equivalents and accounts payable are generally due in five to 30 days,

we are able to carry current liabilities in excess of current assets. In

addition to cash flows from operations, we use a combination of

long-term and short-term borrowings to fund our capital needs.

We currently manage our business and our financial ratios to

maintain an investment grade bond rating, which allows flexible

access to financing at reasonable costs. Currently, our publicly issued

long-term debt carries “Baa1” (Moody’s Investors Service), “BBB+”

(Standard & Poor’s) and “BBB+” (Fitch) ratings. Our commercial paper

has ratings of “P-2” (Moody’s Investors Service), “A-2” (Standard &

Poor’s) and “F-2” (Fitch). These ratings are as of the date of this annual

report and have been obtained with the understanding that Moody’s

Investors Service, Standard & Poor’s and Fitch will continue to monitor

our credit and make future adjustments to these ratings to the extent

warranted. The ratings are not a recommendation to buy, sell or hold

our securities, may be changed, superseded or withdrawn at any time

and should be evaluated independently of any other rating.

Our commercial paper program serves as our primary source

of short-term financing. To support our commercial paper program,

we have a credit facility under a Credit Agreement dated August 16,

2005, with a consortium of banks, under which we can borrow up to

$500.0 million. As part of this credit facility, we may request issuance

of up to $100.0 million in letters of credit, the outstanding amount

of which reduces the net borrowing capacity under the Credit

Agreement. The borrowings and letters of credit obtained under the

Credit Agreement may be denominated in U.S. dollars or other curren-

cies approved by the banks. The Credit Agreement allows us to borrow

at interest rates that vary based, at our option, on a spread over

(i) LIBOR or (ii) a base rate that is the higher of the prime rate or

one-half of one percent above the federal funds rate. The interest

rate spread over LIBOR is determined by our debt rating. We may

also request that loans be made at interest rates offered by one or

more of the banks in the consortium, which may vary from the LIBOR

or the base rate. The Credit Agreement expires on August 15, 2010,

and contains various restrictive covenants, including a leverage

test that requires us to maintain a ratio of consolidated total debt to

consolidated total capitalization of less than 0.65 to 1.00 and a limit

on secured debt and debt owed by subsidiaries, subject to certain

exceptions, of 10 percent of our consolidated tangible net worth.

The Credit Agreement does not prohibit borrowing in the event of

a ratings downgrade or a Material Adverse Effect, as defined in the

Credit Agreement. We do not expect any of these covenants to limit

our liquidity or capital resources. As of May 27, 2007, there were no

borrowings outstanding under the Credit Agreement. However, as

of May 27, 2007, there was $211.4 million of commercial paper and

$0.0 million of letters of credit outstanding, which are backed by this

facility. As of May 27, 2007, we were in compliance with all covenants

of the Credit Agreement.

On August 12, 2005, we issued $150.0 million of unsecured

4.875 percent senior notes due in August 2010 and $150.0 million of

unsecured 6.000 percent senior notes due in August 2035 under our

shelf registration statement on file with the Securities and Exchange

Commission (SEC). The net proceeds of $295.4 million from the

issuance of these senior notes were used to repay at maturity our

$150.0 million of 8.375 percent senior notes on September 15, 2005