Red Lobster 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7 7

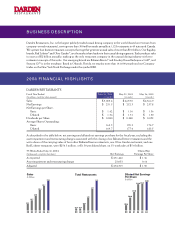

leaving 32 restaurants in operation at the end of the fiscal year.

Average annual sales per restaurant, excluding the closed restau-

rants, were $5.2 million in fiscal 2004 (on a 52-week basis).

• Smokey Bones’ total sales were $174 million, an 87 percent increase

from last year, as the company nearly doubled in size this year

by adding 30 new restaurants to its base of 39. Smokey Bones

continued to drive strong consumer acceptance through its unique

combination of slow-smoked barbeque and a variety of other

grilled favorites, served in a lively yet comfortable mountain-

lodge atmosphere, where guests can watch their favorite sports.

Annual sales averaged $3.2 million per restaurant (on a 52-week

basis) and expansion will continue in fiscal 2005 as it seeks to take

advantage of a compelling opportunity.

• Seasons 52, the casually sophisticated fresh grill and wine bar

we’re testing in Orlando, continued to post impressive results.

Plans are in place to open two to three more test restaurants in

fiscal 2005 to further explore the concept’s viability. Seasons 52

offers seasonally inspired menus with fresh ingredients, to create

great tasting, nutritionally balanced meals that are lower in cal-

ories than comparable restaurant meals.

• With our strong cash flow and balance sheet, we continued to

aggressively buy back shares of our common stock. We repur-

chased 10.7 million shares in fiscal 2004, which represented more

than $235 million in share repurchases. Since we began our

repurchase program in 1996, we have repurchased more than

109 million shares, or more than $1.5 billion of our common stock.

While we are proud of our achievements in fiscal 2004, we know

we must strengthen several important aspects of our business.

That’s the key to returning to the high level of performance that

will create strong long-term value for our shareholders. We approach

our improvement opportunities with a solid foundation, one that

features an excellent balance of proven and emerging brands. We

also have a clearly defined core purpose that motivates us every

day – . And we have a shared

goal throughout the Company – we want to be the best in casual

dining, now and for generations. We recognize that to achieve our

goal, we must build on this strong foundation with even greater

attention to two things: operating excellence and effective brand

building across the Company.

CASUALDININGISAGROWTHINDUSTRY

Our industry, casual dining, is large and continues to grow. In

calendar 2003, casual dining industry sales grew 2.6 percent. This

compares favorably to the quick-service and mid-scale segments

of the restaurant industry, which reported a 1.4 percent increase

in sales and a 1.9 percent decline in sales, respectively. However,

casual dining’s 2003 results are well below the industry’s 10-year

average growth rate of 7.4 percent.

Despite the slowdown in calendar 2003, industry experts continue

to forecast that annualized casual dining sales growth will be

between 5 percent and 7 percent over the next decade. The driving

factors have not changed and are as important as ever – growth in

total employment, growth in real disposable income, an increasing

number of women in the workforce, and the aging demographics

of the U.S. population.

These drivers, combined with changing lifestyles that place a

premium on the time-saving and social reconnection benefits of

dining out, give us great confidence that we are in the right indus-

try at the right time. Our confidence is buttressed by the fact that

supply and demand within the casual dining industry continue to

remain in balance, as they have for the past several years. Although

total casual dining visits were down 0.3 percent in calendar 2003,

there was an even steeper decline in the number of casual dining

units, which fell 2.2 percent. Against that backdrop, it’s important

to note that casual dining chains experienced a 1.0 percent increase

in units. This continues a trend we’ve seen in recent years and is a

strong indicator that well-managed casual dining chains continue to

grow and take market share from independent restaurant operators.

OURSOLIDFOUNDATION

As I’ve said, our business is built on a strong foundation, starting

with our compelling core purpose,

. Darden also has seven core values that have been forged over

our 65-year heritage, which started with the early businesses of

our late founder, Bill Darden. We value:

• Integrity and fairness

• Respect and caring

• Diversity

• Always learning / always teaching

• Being “of service”

• Teamwork

• Excellence