Red Lobster 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review 2004

Management's Discussion and Analysis

of Financial Condition and Results of Operations

LIQUIDITY AND CAPITAL RESOURCES

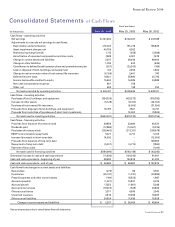

Cash flows generated from operating activities provide us with a

significant source of liquidity. Since substantially all our sales are for

cash and cash equivalents, and accounts payable are generally due

in five to 30 days, we are able to carry current liabilities in excess of

current assets. In addition to cash flows from operations, we use a

combination of long-term and short-term borrowings to fund our

capital needs.

We manage our business and our financial ratios to maintain

an investment grade bond rating, which allows flexible access

to financing at reasonable costs. Currently, our publicly issued

long-term debt carries "Baal" (Moody's Investors Service), "BBB+"

(Standard & Poor's), and "BBB+" (Fitch) ratings. Our commercial

paper has ratings of "P-2" (Moody's Investors Service), "A-2"

(Standard & Poor's), and "F-2" (Fitch). These ratings are as of the

date of this annual report and have been obtained with the under-

standing that Moody's Investors Service, Standard & Poor's, and

Fitch will continue to monitor our credit and make future adjust-

ments to these ratings to the extent warranted. The ratings may

be changed, superseded, or withdrawn at any time.

Our commercial paper program serves as our primary source of short-

term financing. At May 30, 2004, $ 15 million was outstanding under

the program. To support our commercial paper program, we have a

credit facility under a Credit Agreement dated October 17, 2003,

as amended, with a consortium of banks, including Wachovia Bank,

N.A., as administrative agent, under which we can borrow up to

$400 million. The credit facility allows us to borrow at interest rates

based on a spread over (i) LIBOR or (ii) a base rate that is the higher

of the prime rate, or one-half of one percent above the federal funds

rate, at our option. The interest rate spread over LIBOR is determined

by our debt rating. The credit facility expires on October 17, 2008,

and contains various restrictive covenants, including a leverage

test that requires us to maintain a ratio of consolidated total debt

to consolidated total capitalization of less than 0.55 to 1.00 and a

limitation of $25 million on priority debt, subject to certain excep-

tions. The credit facility does not, however, contain a prohibition on

borrowing in the event of a ratings downgrade or a material adverse

change in and of itself. None of these covenants are expected to

impact our liquidity or capital resources. At May 30, 2004, we were

in compliance with all covenants under the Credit Agreement.

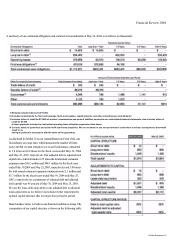

At May 30,2004, our long-term debt consisted principally of:

(l)$150millionof unsecured 8.3 75 percent senior notes due in

September 2005, (2) $ 150 million of unsecured 6.375 percent notes

due in February 2006, (3) $150 million of unsecured 5.75 percent

medium-term notes due in March 2007, (4) $75 million of unsecured

7.45 percent medium-term notes due in April 2011, (5) $ 100 mil-

lion of unsecured 7.125 percent debentures due in February 2016,

and (6) an unsecured, variable rate, $29 million commercial bank

loan due in December 2018 that supports two loans from us to

the Employee Stock Ownership Plan portion of the Darden Savings

Plan. Through a shelf registration on file with the Securities and

Exchange Commission (SEC), we may issue up to an additional

$ 125 million of unsecured debt securities from time to time. The debt

securities may bear interest at either fixed or floating rates, and may

have maturity dates of nine months or more after issuance.

28 Darden Restaurants