Red Lobster 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review 2004

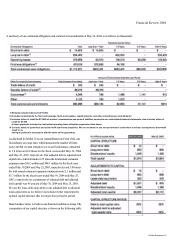

Selling, general, and administrative expenses increased $40 mil-

lion, or 9.4 percent, from $432 million to $472 million in fiscal

2004 compared to fiscal 2003. Selling, general, and administrative

expenses increased $15 million, or 3.5 percent, from $417million

to $432 million in fiscal 2003 compared to fiscal 2002. As a percent

of sales, selling, general, and administrative expenses increased

in fiscal 2004 primarily due to increased employee benefit costs,

an increase in the amount contributed to the Darden Restaurants,

Inc. Foundation, and an increase in litigation related costs, which

were only partially offset by the favorable impact of higher sales

volumes. As a percent of sales, selling, general, and administrative

expenses in fiscal 2003 were less than fiscal 2002 primarily as a

result of decreased bonus costs and the favorable impact of higher

sales volumes, which were partially offset by increased marketing

expense incurred in response to the challenging economic and

competitive environment.

Depreciation and amortization expense increased $ 19 million,

or 9.8 percent, from $ 191 million to $210 million in fiscal 2004

compared to fiscal 2003. Depreciation and amortization expense

increased $25 million, or 15.3 percent, from $166 million to

$191 million in fiscal 2003 compared to fiscal 2002. As a percent

of sales, depreciation and amortization increased in fiscal 2004 and

2003 primarily as a result of new restaurant and remodel activities,

which were only partially offset by the favorable impact of higher

sales volumes.

Net interest expense increased $1 million, or 2.5 percent, from

$43 million to $44 million in fiscal 2004 compared to fiscal 2003.

Net interest expense increased $6 million, or 16.4 percent, from

$37 million to $43 million in fiscal 2003 compared to fiscal 2002.

As a percent of sales, net interest expense in fiscal 2004 was compa-

rable to fiscal 2003, reflecting lower interest income in fiscal 2004,

offset by the favorable impact of higher sales volumes. As a per-

cent of sales, net interest expense in fiscal 2003 was comparable

to fiscal 2002 primarily because increased interest expense associ-

ated with higher average debt levels in fiscal 2003 was offset by the

favorable impact of higher sales volumes.

After a comprehensive analysis performed during the fourth quarter

of fiscal 2004 that examined restaurants not meeting our minimum

return-on-investment thresholds and other operating performance

criteria, we recorded a $36.5 million pre-tax ($22.4 million after-

tax) charge for long-lived asset impairments associated with the

closing of six Bahama Breeze restaurants and the write-down of

the carrying value of four other Bahama Breeze restaurants, one

Olive Garden restaurant, and one Red Lobster restaurant, which

continued to operate. We also recorded a $ 1.1 million pre-tax

($0.7 million after-tax) restructuring charge primarily related

to severance payments made to certain restaurant employees and

exit costs associated with the closing of the six Bahama Breeze

restaurants. During fiscal 2004, certain changes were made at

Bahama Breeze to improve its sales, financial performance, and

overall long-term potential, including the addition of lunch at most

restaurants and introduction of a new dinner menu. The decision

to close certain Bahama Breeze restaurants and write down the

carrying value of others was based on our on-going review of

each individual restaurant's performance against our expectations

and their ability to successfully implement these changes. Based on

our review of the other 28 Bahama Breeze restaurants, we believe

their locations and ability to execute these and future initiatives will

minimize the likelihood that additional impairment charges will

be required. The write-down of the carrying value of one Olive

Garden restaurant and one Red Lobster restaurant was a result of

less-than-optimal locations. We will continue to evaluate all of our

locations to minimize the risk of future asset impairment charges.

In addition to the fiscal 2004 fourth quarter action, we recognized

asset impairment charges in the amount of $5.7 million and

$4.9 million in fiscal 2004 and 2003, respectively, related to the

relocation and rebuilding of certain restaurants. Asset impairment

credits related to the sale of assets that were previously impaired

amounted to $1.4 million and $0.6 million in fiscal 2004 and 2003,

respectively. Pre-tax restructuring credits of $0.4 million and

$2.6 million were recorded in fiscal 2003 and 2002, respectively.

The credits resulted from lower than projected costs of lease ter-

minations in connection with our fiscal 1997 restructuring. All fiscal

1997 restructuring actions were completed as of May 25,2003.

INCOME TAXES

The effective income tax rates for fiscal 2004, 2003, and 2002 were

31.9 percent, 33.2 percent, and 34.6 percent, respectively. The

rate decrease in fiscal 2004 and fiscal 2003 was primarily a result

of favorable resolutions of prior year tax matters and an increase in

FICA tax credits for employee-reported tips.

Darden Restaurants 25