Red Lobster 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

Adoption of New Accounting Standards

In June 2001, the FASB issued SFAS No. 143, “Accounting for

Asset Retirement Obligations.” SFAS No. 143 establishes account-

ing standards for the recognition and measurement of an asset

retirement obligation and its associated asset retirement cost. It

also provides accounting guidance for legal obligations associated

with the retirement of tangible long-lived assets. SFAS No. 143 is

effective for financial statements issued for fiscal years beginning

after June 15, 2002. We adopted SFAS No. 143 in the first quarter of

fiscal 2004. Adoption of SFAS No. 143 did not materially impact

our consolidated financial statements.

In January 2003, the FASB issued Interpretation No. 46,

“Consolidation of Variable Interest Entities, an interpretation of

ARB No. 51.” Interpretation No. 46, which was revised in

December 2003, addresses the consolidation by business enter-

prises of variable interest entities as defined in the Interpretation.

Interpretation No. 46 is effective for interests in structures that

are commonly referred to as special-purpose entities for periods

ending after December 15, 2003. Interpretation No. 46 is also

effective for all other types of variable interest entities for periods

ending after March 15, 2004. We do not have any interests that

would change our current consolidated reporting entity or require

additional disclosures required by Interpretation No. 46.

In April 2003, the FASB issued SFAS No. 149, “Amendment to

Statement 133 on Derivative Instruments and Hedging Activities.”

SFAS No. 149 amends and clarifies the financial accounting and

reporting for derivative instruments, including certain derivative

instruments embedded in other contracts and for hedging activi-

ties under SFAS No. 133, “Accounting for Derivative Instruments

and Hedging Activities.” This statement is effective for hedging

relationships designated and contracts entered into or modified

after June 30, 2003, except for the provisions that relate to SFAS

No. 133 implementation issues, which will continue to be applied

in accordance with their respective dates. We adopted SFAS No.

149 in the first quarter of fiscal 2004. Adoption of SFAS No. 149

did not materially impact our consolidated financial statements.

In May 2003, the FASB issued SFAS No. 150, “Accounting

for Certain Financial Instruments with Characteristics of Both

Liabilities and Equity.” SFAS No. 150 establishes accounting

standards for the classification and measurement of certain finan-

cial instruments with characteristics of both liabilities and equity.

It requires certain financial instruments that were previously classi-

fied as equity to be classified as assets or liabilities. SFAS No. 150

is effective for financial instruments entered into or modified after

May 31, 2003, and otherwise is effective at the beginning of the

first interim period starting after June 15, 2003. We adopted

SFAS No. 150 in the second quarter of fiscal 2004. Adoption

of SFAS No. 150 did not materially impact our consolidated

financial statements.

In December 2003, the FASB revised SFAS No. 132, “Employers’

Disclosures about Pensions and Other Postretirement Benefits.”

SFAS No. 132, as revised, establishes additional disclosures for

defined benefit pension and other postretirement plans. It requires

additional annual disclosures about the assets, obligations, cash

flows, net periodic benefit cost and other quantitative and quali-

tative information regarding defined benefit pension and other

postretirement plans. It also requires quarterly disclosures of the

components of the net periodic benefit cost recognized for each

period presented and significant changes in the estimated amount

of annual contributions previously disclosed for defined benefit

pension and other postretirement plans. The additional disclosure

requirements of SFAS No. 132, as revised, are effective for annual

periods ending after December 15, 2003, and interim periods

beginning after December 15, 2003. We adopted the additional

disclosure requirements of SFAS No. 132 in the fourth quarter

of fiscal 2004. Adoption of the additional disclosure requirements

of SFAS No. 132 did not materially impact our consolidated

financial statements.

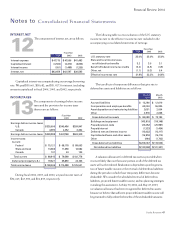

ACCOUNTSRECEIVABLE

2Our accounts receivable is primarily comprised of

receivables from national storage and distribution com-

panies with which we contract to provide services that

are billed to us on a per-case basis. In connection with

these services, certain of our inventory items are conveyed to these

storage and distribution companies to transfer ownership and risk

of loss prior to delivery of the inventory to our restaurants. We

reacquire these items when the inventory is subsequently delivered

to our restaurants. These transactions do not impact the consolidated

statements of earnings. Receivables from national storage and dis-

tribution companies amounted to $20,276 and $19,628 at May 30,

2004, and May 25, 2003, respectively. The allowance for doubtful

accounts associated with all of our receivables amounted to $350

and $330 at May 30, 2004, and May 25, 2003, respectively.

Notesto

Consolidated Financial Statements

42

Financial Review 2004