Red Lobster 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

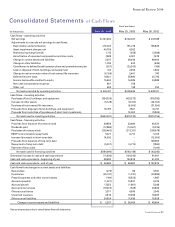

Financial Review 2004

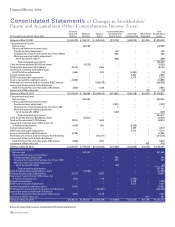

ConsolidatedStatementsof Changes in Stockholders’

Equity and Accumulated Other Comprehensive Income (Loss)

Common AccumulatedOther Total

Stockand Retained Treasury Comprehensive Unearned OfficerNotes Stockholders’

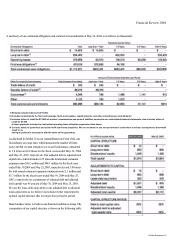

(Inthousands,exceptpersharedata)

Surplus Earnings Stock Income(Loss) Compensation Receivable Equity

BalanceatMay27,2001 $1,405,799 $532,121 $(840,254) $(13,102) $(49,322) $(1,924) $1,033,318

Comprehensiveincome:

Netearnings – 237,788 – – – – 237,788

Othercomprehensiveincome(loss):

Foreigncurrencyadjustment – – – 169 – – 169

Changeinfairvalueofderivatives,netoftaxof$234 – – – 380 – – 380

Minimumpensionliabilityadjustment,

netoftaxbenefitof$177 – – – (288) – – (288)

Totalcomprehensiveincome 238,049

Cashdividendsdeclared($0.053pershare) – (9,225) – – – – (9,225)

Stockoptionexercises(4,310shares) 34,742 – 1,364 – – – 36,106

Issuanceofrestrictedstock(438shares),

netofforfeitureadjustments 5,666 – 815 – (6,493) – (12)

Earnedcompensation – – – – 4,392 – 4,392

ESOPnotereceivablerepayments – – – – 5,315 – 5,315

Incometaxbenefitscreditedtoequity 24,989 – – – – – 24,989

Purchasesofcommonstockfortreasury(8,972shares) – – (208,578) – – – (208,578)

IssuanceoftreasurystockunderEmployee

StockPurchasePlanandotherplans(290shares) 2,858 – 1,738 – – – 4,596

Issuanceofofficernotes,net – – – – – (73) (73)

BalanceatMay26,2002 $1,474,054 $760,684 $(1,044,915) $(12,841) $(46,108) $(1,997) $1,128,877

Comprehensiveincome:

Netearnings – 232,260 – – – – 232,260

Othercomprehensiveincome(loss):

Foreigncurrencyadjustment – – – 2,579 – – 2,579

Changeinfairvalueofderivatives,netoftaxof$0 – – – 2 – – 2

Minimumpensionliabilityadjustment,

netoftaxbenefitof$141 – – – (229) – – (229)

Totalcomprehensiveincome 234,612

Cashdividendsdeclared($0.080pershare) – (13,501) – – – – (13,501)

Stockoptionexercises(3,133shares) 27,261 – 1,652 – – – 28,913

Issuanceofrestrictedstock(148shares),net

offorfeitureadjustments 4,429 – 600 – (5,029) – –

Earnedcompensation – – – – 3,579 – 3,579

ESOPnotereceivablerepayments – – – – 4,710 – 4,710

Incometaxbenefitscreditedtoequity 16,385 – – – – – 16,385

Purchasesofcommonstockfortreasury(10,746shares) – – (213,311) – – – (213,311)

IssuanceoftreasurystockunderEmployee

StockPurchasePlanandotherplans(280shares) 3,828 – 1,681 – – – 5,509

Issuanceofofficernotes,net – – – – – 418 418

BalanceatMay25,2003 $1,525,957 $979,443 $(1,254,293) $(10,489) $(42,848) $(1,579) $1,196,191

Comprehensiveincome:

Netearnings – 231,462 – – – – 231,462

Othercomprehensiveincome(loss):

Foreigncurrencyadjustment – – – 394 – – 394

Changeinfairvalueofderivatives,netoftaxof$51 – – – 205 – – 205

Minimumpensionliabilityadjustment,

netoftaxbenefitof$45 – – – (69) – – (69)

Totalcomprehensiveincome 231,992

Cashdividendsdeclared($0.080pershare) – (12,984) – – – – (12,984)

Stockoptionexercises(3,464shares) 30,972 – 3,685 – – – 34,657

Issuanceofrestrictedstock(409shares),net

offorfeitureadjustments 7,605 – 173 – (7,778) – –

Earnedcompensation – – – – 4,198 – 4,198

ESOPnotereceivablerepayments – – – – 5,027 – 5,027

Incometaxbenefitscreditedtoequity 15,650 – – – – – 15,650

Purchasesofcommonstockfortreasury(10,749shares) – – (235,462) – – – (235,462)

IssuanceoftreasurystockunderEmployee

StockPurchasePlanandotherplans(357shares) 3,931 – 2,129 – – – 6,060

Issuanceofofficernotes,net – – – – – 441 441

BalanceatMay30,2004 $1,584,115 $1,197,921 $(1,483,768) $(9,959) $(41,401) $(1,138) $1,245,770

Seeaccompanyingnotestoconsolidatedfinancialstatements.