Red Lobster 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notesto

Consolidated Financial Statements

is measured by the amount by which the carrying amount of the

assets exceeds their fair value. Fair value is generally determined

based on appraisals or sales prices of comparable assets. Restaurant

sites and certain other assets to be disposed of are reported at the

lower of their carrying amount or fair value, less estimated costs to

sell. Restaurant sites and certain other assets to be disposed of are

included in assets held for disposal when certain criteria are met.

These criteria include the requirement that the likelihood of dispos-

ing of these assets within one year is probable. Those assets whose

disposal is not probable within one year remain in land, buildings,

and equipment until their disposal is probable within one year.

Self-Insurance Accruals

We self-insure a significant portion of expected losses under our

workers’ compensation, employee medical, and general liability

programs. Accrued liabilities have been recorded based on our

estimates of the ultimate costs to settle incurred claims, both reported

and unreported.

Revenue Recognition

Revenue from restaurant sales is recognized when food and beverage

products are sold. Unearned revenues represent our liability for

gift cards and certificates that have been sold but not yet redeemed

and are recorded at their expected redemption value. When the

gift cards and certificates are redeemed, we recognize restaurant

sales and reduce unearned revenues.

Food and Beverage Costs

Food and beverage costs include inventory, warehousing, and related

purchasing and distribution costs. Vendor allowances received in

connection with the purchase of a vendor’s products are recognized

as a reduction of the related food and beverage costs as earned.

These allowances are recognized as earned in accordance with

the underlying agreement with the vendor and completion of the

earning process. Vendor agreements are generally for a period of

one year or less and payments received are recorded as a current

liability until earned.

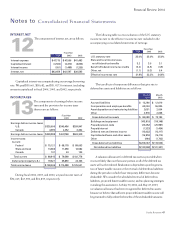

Income Taxes

We provide for federal and state income taxes currently payable as

well as for those deferred because of temporary differences between

reporting income and expenses for financial statement purposes

versus tax purposes. Federal income tax credits are recorded as a

reduction of income taxes. Deferred tax assets and liabilities are rec-

ognized for the future tax consequences attributable to differences

between the financial statement carrying amounts of existing assets

and liabilities and their respective tax bases. Deferred tax assets and

liabilities are measured using enacted tax rates expected to apply to

taxable income in the years in which those temporary differences

are expected to be recovered or settled. The effect on deferred tax

assets and liabilities of a change in tax rates is recognized in earn-

ings in the period that includes the enactment date.

Income tax benefits credited to equity relate to tax benefits

associated with amounts that are deductible for income tax purposes

but do not affect earnings. These benefits are principally generated

from employee exercises of non-qualified stock options and vesting

of employee restricted stock awards.

Derivative Instruments and Hedging Activities

We account for derivative financial instruments and hedging

activities in accordance with the Financial Accounting Standards

Board’s (FASB) Statement of Financial Accounting Standards

(SFAS) No. 133, “Accounting for Derivative Instruments and

Hedging Activities” and SFAS No. 138, “Accounting for Certain

Derivative Instruments and Certain Hedging Activities – an

Amendment of FASB Statement No. 133.” SFAS No. 133 and

SFAS No. 138 require that all derivative instruments be recorded

on the balance sheet at fair value. We use financial and commodi-

ties derivatives to manage interest rate and commodities pricing

risks inherent in our business operations. Our use of derivative

instruments is currently limited to interest rate hedges and com-

modities futures contracts. These instruments are structured as

hedges of forecasted transactions or the variability of cash flows to

be paid related to a recognized asset or liability (cash flow hedges).

No derivative instruments are entered into for trading or speculative

purposes. All derivatives are recognized on the balance sheet at fair

value. On the date the derivative contract is entered into, we document

all relationships between hedging instruments and hedged items, as

well as our risk-management objective and strategy for undertak-

ing the various hedge transactions. This process includes linking

all derivatives designated as cash flow hedges to specific assets and

liabilities on the consolidated balance sheet or to specific forecasted

transactions. We also formally assess, both at the hedge’s inception

and on an ongoing basis, whether the derivatives used in hedging

transactions are highly effective in offsetting changes in cash flows

of hedged items.

39

Financial Review 2004