Red Lobster 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

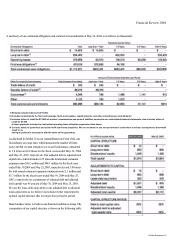

A summary of our contractual obligations and commercial commitments at May 30, 2004, is as follows (in thousands):

1) Excludes issuance discount of $1,054.

2) Includes commitments for food and beverage items and supplies, capital projects, and other miscellaneous commitments.

3) Includes letters of credit for $72,480 of workers' compensation and general liabilities accrued in our consolidated financial statements; also includes letters of

credit for $7,635

of lease payments included in contractual operating lease obligation payments noted above.

4) Consists solely of guarantees associated with sub-leased properties. We are not aware of any non-performance under these sub-lease arrangements that would

result in us

having to perform in accordance with the terms of the guarantees.

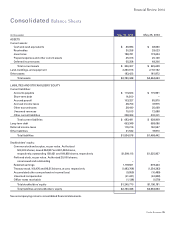

As disclosed in Exhibit 12 to our Annual Report on Form 10-K, our

fixed-charge coverage ratio, which measures the number of times

each year that we earn enough to cover our fixed charges, amounted

to 5.8 times and 6.0 times for the fiscal years ended May 30, 2004

and May 25, 2003, respectively. Our adjusted debt to adjusted total

capital ratio (which includes 6.25 times the total annual restaurant

minimum rent ($56.5 million and $48.1 million for the fiscal years

ended May 30,2004 and May 25,2003, respectively) and 3.00 times

the total annual restaurant equipment minimum rent ($. 1 million and

$5.7 million for the fiscal years ended May 30, 2004 and May 25,

2003, respectively) as components of adjusted debt and adjusted

total capital) was 45 percent at May 30, 2004 and May 25, 2003.

We use the lease-debt equivalent in our adjusted debt to adjusted

total capital ratio as we believe its inclusion better represents the

optimal capital structure that we target from period to period.

Based on these ratios, we believe our financial condition is strong. The

composition of our capital structure is shown in the following table.

Financial Review 2004

Darden Restaurants 29