Red Lobster 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

Changes in the fair value of derivatives that are highly effec-

tive and that are designated and qualify as cash flow hedges

are recorded in other comprehensive income until earnings are

affected by the variability in cash flows of the designated hedged

item. Where applicable, we discontinue hedge accounting pro-

spectively when it is determined that the derivative is no longer

effective in offsetting changes in the cash flows of the hedged

item or the derivative is terminated. Any changes in the fair value

of a derivative where hedge accounting has been discontinued or

is ineffective are recognized immediately in earnings. Cash flows

related to derivatives are included in operating activities.

Pre-Opening Expenses

Non-capital expenditures associated with opening new restaurants

are expensed as incurred.

Advertising

Production costs of commercials are charged to operations in the

fiscal period the advertising is first aired. The costs of programming

and other advertising, promotion, and marketing programs are

charged to operations in the fiscal period incurred. Advertising

expense amounted to $210,989, $200,020, and $184,163, in fiscal

2004, 2003, and 2002, respectively.

Stock-Based Compensation

SFAS No. 123, “Accounting for Stock-Based Compensation,”

encourages the use of a fair-value method of accounting for stock-

based awards under which the fair value of stock options is deter-

mined on the date of grant and expensed over the vesting period.

As allowed by SFAS No. 123, we have elected to account for our

stock-based compensation plans under an intrinsic value method

that requires compensation expense to be recorded only if, on

the date of grant, the current market price of our common stock

exceeds the exercise price the employee must pay for the stock.

Our policy is to grant stock options at the fair market value of our

underlying stock on the date of grant. Accordingly, no compensa-

tion expense has been recognized for stock options granted under

any of our stock plans because the exercise price of all options

granted was equal to the current market value of our stock on the

grant date. In December 2002, the FASB issued SFAS No. 148,

“Accounting for Stock-Based Compensation.” SFAS No. 148 pro-

vides alternative methods of transition for voluntary change to the

fair value method of accounting for stock-based compensation.

In addition, SFAS No. 148 requires more prominent disclosures

in both annual and interim financial statements about the method

of accounting for stock-based compensation and the effect of the

method used on reported results.

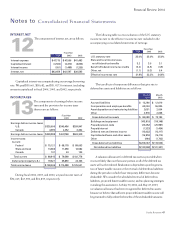

Had we determined compensation expense for our stock options

based on the fair value at the grant date as prescribed under SFAS

No. 123, our net earnings and net earnings per share would have

been reduced to the pro forma amounts indicated below:

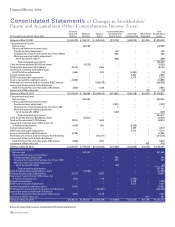

FiscalYear

2004 2003 2002

Netearnings,asreported $231,462$232,260 $237,788

Add:Stock-basedcompensation

expenseincludedinreported

netearnings,netofrelated

taxeffects 3,158 2,642 2,695

Deduct:Totalstock-based

compensationexpense

determinedunderfairvalue

basedmethodforallawards,

netofrelatedtaxeffects (17,980) (19,801) (18,386)

Proforma $216,640 $215,101 $222,097

Basicnetearningspershare

Asreported $1.42 $1.36$1.36

Proforma $1.33 $1.26 $1.27

Dilutednetearningspershare

Asreported $1.36 $1.31$1.30

Proforma $1.28 $1.22$1.21

To determine pro forma net earnings, reported net earnings

have been adjusted for compensation expense associated with stock

options granted that are expected to eventually vest. The preceding

pro forma results were determined using the Black Scholes option-

pricing model, which values options based on the stock price at the

grant date, the expected life of the option, the estimated volatility

of the stock, expected dividend payments, and the risk-free inter-

est rate over the expected life of the option. The dividend yield

was calculated by dividing the current annualized dividend by the

option exercise price for each grant. The expected volatility was

determined considering stock prices for the fiscal year the grant

occurred and prior fiscal years, as well as considering industry

volatility data. The risk-free interest rate was the rate available on

zero coupon U.S. government obligations with a term equal to the

expected life of each grant. The expected life of the option was esti-

mated based on the exercise history from previous grants.

Notesto

Consolidated Financial Statements

Financial Review 2004