Red Lobster 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notesto

Consolidated Financial Statements

RESTRUCTURINGANDASSETIMPAIRMENTACTIVITIES

3During fiscal 2004, we recorded pre-tax asset impair-

ment charges of $36,526 for long-lived asset impair-

ments associated with the closing of six Bahama Breeze

restaurants and the write-down of the carrying value of

four other Bahama Breeze restaurants, one Olive Garden restaurant,

and one Red Lobster restaurant, which continued to operate. We

also recorded a restructuring charge of $1,112 primarily related

to severance payments made to certain restaurant employees and

exit costs associated with the closing of the six Bahama Breeze res-

taurants in accordance with SFAS No. 146, “Accounting for Costs

Associated with Exit or Disposal Activities.” Below is a summary of

the restructuring costs and the remaining liability for fiscal 2004:

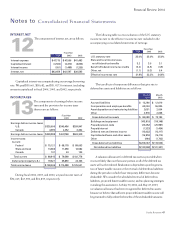

Balanceat Balanceat

May25,2003 Additions Utilizations May30,2004

One-time

terminationbenefits $– $433 $(384) $49

Leasetermination

costs – 113 (113) –

Otherexitcosts – 566 (255) 311

$– $1,112 $(752) $360

Asset impairment charges related to the decision to relocate

or rebuild certain restaurants amounted to $5,667 and $4,876

in fiscal 2004 and 2003, respectively. Asset impairment credits

related to assets sold that were previously impaired amounted to

$1,437 and $594 in fiscal 2004 and 2003, respectively. All impair-

ment amounts are included in asset impairment and restructuring

charges (credits) in the consolidated statements of earnings.

During fiscal 2003 and fiscal 2002, we recognized restructur-

ing credits of $358 and $2,568, respectively, resulting from lease

terminations completed on more favorable terms than previously

anticipated from our fiscal 1997 restructuring action. All restaurant

closings and other activities under this restructuring action were

completed as of May 25, 2003.

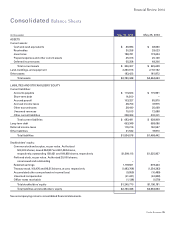

LAND,BUILDINGS,ANDEQUIPMENT

4The components of land, buildings, and equipment are

as follows:

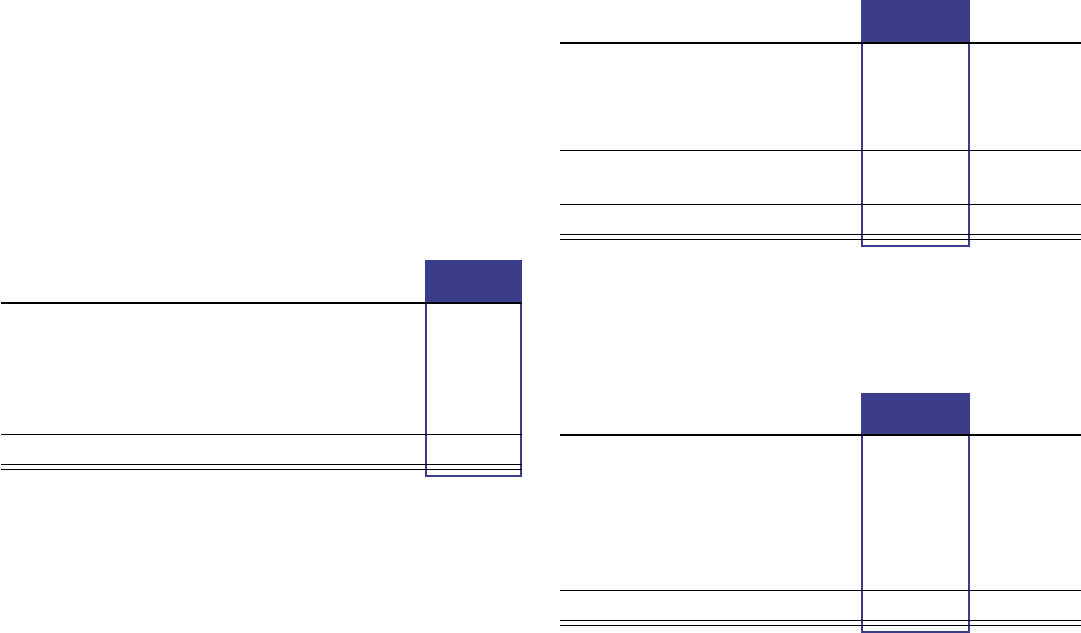

May30, May25,

2004 2003

Land $545,191 $505,444

Buildings 2,138,376 1,898,716

Equipment 1,008,133 922,592

Constructioninprogress 87,655 195,078

Totalland,buildings,andequipment 3,779,355 3,521,830

Lessaccumulateddepreciation (1,528,739) (1,364,698)

Netland,buildings,andequipment $2,250,616 $2,157,132

OTHERASSETS

5The components of other assets are as follows:

May30, May25,

2004 2003

Prepaidpensioncosts $67,077 $68,873

Trust-ownedlifeinsurance 40,422 34,316

Capitalizedsoftwarecosts,net 32,328 34,055

Liquorlicenses 22,201 21,219

Prepaidinterestandloancosts 12,396 14,863

Miscellaneous 9,001 8,546

Totalotherassets $183,425 $181,872

SHORT-TERMDEBT

6Short-term debt at May 30, 2004, and May 25, 2003,

consisted of $14,500 and $0, respectively, of unsecured

commercial paper borrowings with original maturities

of one month or less. The debt bore an interest rate of

1.09 percent at May 30, 2004.

43

Financial Review 2004