Red Lobster 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

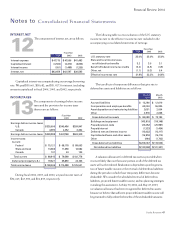

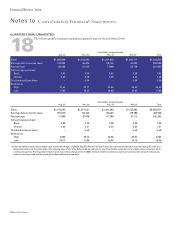

LONG-TERMDEBT

7The components of long-term debt are as follows:

May30, May25,

2004 2003

8.375%seniornotesdueSeptember2005 $150,000 $150,000

6.375%notesdueFebruary2006 150,000 150,000

5.75%medium-termnotesdueMarch2007 150,000 150,000

7.45%medium-termnotesdueApril2011 75,000 75,000

7.125%debenturesdueFebruary2016 100,000 100,000

ESOPloanwithvariablerateofinterest

(1.43%atMay30,2004)dueDecember2018 29,403 34,430

Totallong-termdebt 654,403 659,430

Lessissuancediscount (1,054) (1,344)

Totallong-termdebtlessissuancediscount 653,349 658,086

Lesscurrentportion – –

Long-termdebt,excludingcurrentportion $653,349 $658,086

In July 2000, we registered $500,000 of debt securities with the

Securities and Exchange Commission (SEC) using a shelf registra-

tion process. Under this process, we may offer, from time to time, up

to an aggregate of $500,000 of debt securities. In September 2000,

we issued $150,000 of unsecured 8.375 percent senior notes due in

September 2005. The senior notes rank equally with all of our other

unsecured and unsubordinated debt and will be senior in right of

payment to any future subordinated debt we may issue. In April 2001,

we issued $75,000 of unsecured 7.45 percent medium-term notes due

in April 2011. In March 2002, we issued $150,000 of unsecured

5.75 percent medium-term notes due in March 2007. At May 30,

2004, our shelf registration provides for the issuance of an additional

$125,000 of unsecured debt securities.

In January 1996, we issued $150,000 of unsecured 6.375 per-

cent notes due in February 2006 and $100,000 of unsecured

7.125 percent debentures due in February 2016. Concurrent with

the issuance of the notes and debentures, we terminated, and set-

tled for cash, interest-rate swap agreements with notional amounts

totaling $200,000, which hedged the movement of interest rates

prior to the issuance of the notes and debentures. The cash paid in

terminating the interest-rate swap agreements is being amortized

to interest expense over the life of the notes and debentures.

The effective annual interest rate is 7.57 percent for the notes and

7.82 percent for the debentures, after consideration of loan costs,

issuance discounts, and interest-rate swap termination costs.

We also maintain a credit facility that expires in October 2008,

with a consortium of banks under which we can borrow up to

$400,000. The credit facility allows us to borrow at interest rates

that vary based on a spread over (i) LIBOR or (ii) a base rate that

is the higher of the prime rate, or one-half of one percent above

the federal funds rate, at our option. The interest rate spread over

LIBOR is determined by our debt rating. The credit facility sup-

ports our commercial paper borrowing program. We are required

to pay a facility fee of 12.5 basis points per annum on the average daily

amount of loan commitments by the consortium. The amount of

interest and the annual facility fee are subject to change based on

our maintenance of certain debt ratings and financial ratios, such as

maximum debt to capital ratios. Advances under the credit facility

are unsecured. At May 30, 2004, and May 25, 2003, no borrowings

were outstanding under this credit facility.

The aggregate maturities of long-term debt for each of the

five fiscal years subsequent to May 30, 2004, and thereafter are

$0 in 2005, $300,000 in 2006, $150,000 in 2007, $0 in 2008 and

2009, and $204,403 thereafter.

DERIVATIVEINSTRUMENTSANDHEDGINGACTIVITIES

8We use interest rate-related derivative instruments to

manage our exposure on debt instruments, as well as

commodities derivatives to manage our exposure to

commodity price fluctuations. By using these instru-

ments, we expose ourselves, from time to time, to credit risk

and market risk. Credit risk is the failure of the counterparty to

perform under the terms of the derivative contract. When the fair

value of a derivative contract is positive, the counterparty owes

us, which creates credit risk for us. We minimize this credit risk

by entering into transactions with high quality counterparties.

Market risk is the adverse effect on the value of a financial instru-

ment that results from a change in interest rates or commodity

prices. We minimize this market risk by establishing and monitor-

ing parameters that limit the types and degree of market risk that

may be undertaken.

Futures Contracts and Commodity Swaps

During fiscal 2004 and 2003, we entered into futures contracts and

commodity swaps to reduce the risk of natural gas and coffee price

fluctuations. To the extent these derivatives are effective in offset-

ting the variability of the hedged cash flows, changes in the deriva-

tives’ fair value are not included in current earnings but are

Notesto

Consolidated Financial Statements

Financial Review 2004