Red Lobster 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUMMARYOFSIGNIFICANTACCOUNTINGPOLICIES

1Operations and Principles of Consolidation

The consolidated financial statements include the opera-

tions of Darden Restaurants, Inc. and its wholly owned

subsidiaries. We own and operate various restaurant con-

cepts located in the United States and Canada, with no franchising.

We also license 38 restaurants in Japan. All significant intercompany

balances and transactions have been eliminated in consolidation.

Fiscal Year

Our fiscal year ends on the last Sunday in May. Fiscal 2004 consisted

of 53 weeks of operation. Fiscal 2003 and 2002 both consisted of

52 weeks of operation.

Cash Equivalents

Cash equivalents include highly liquid investments such as U.S.

treasury bills, taxable municipal bonds, and money market funds that

have a maturity of three months or less. Amounts receivable from

credit card companies are also considered cash equivalents because

they are both short-term and highly liquid in nature and are typically

converted to cash within three days of the sales transaction.

Inventories

Inventories are valued at the lower of weighted-average cost or market.

Land, Buildings, and Equipment

Land, buildings, and equipment are recorded at cost less accumulated

depreciation. Building components are depreciated over estimated

useful lives ranging from seven to 40 years using the straight-line

method. Leasehold improvements, which are a component of

buildings, are amortized over the lesser of the lease term or the

estimated useful lives of the related assets using the straight-line

method. Equipment is depreciated over estimated useful lives

ranging from two to ten years also using the straight-line method.

Accelerated depreciation methods are generally used for income

tax purposes. Depreciation and amortization expense associated

with land, buildings, and equipment amounted to $203,349,

$184,963 and $162,784, in fiscal 2004, 2003, and 2002, respectively.

In fiscal 2004, 2003, and 2002, we had losses on disposal of land,

buildings, and equipment of $104, $2,456, and $1,803, respectively,

which were included in selling, general, and administrative expenses.

Capitalized Software Costs

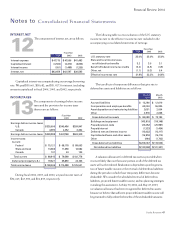

Capitalized software, which is a component of other assets, is

recorded at cost less accumulated amortization. Capitalized soft-

ware is amortized using the straight-line method over estimated

useful lives ranging from three to ten years. The cost of capitalized

software at May 30, 2004, and May 25, 2003, amounted to $46,629

and $44,018, respectively. Accumulated amortization as of May 30,

2004, and May 25, 2003, amounted to $14,301 and $9,963, respec-

tively. Amortization expense associated with capitalized software

amounted to $6,655, $6,255, and $3,045, in fiscal 2004, 2003, and

2002, respectively.

Trust-Owned Life Insurance

In August 2001, we caused a trust that we previously had established

to purchase life insurance policies covering certain of our officers

and other key employees (trust-owned life insurance or TOLI).

The trust is the owner and sole beneficiary of the TOLI policies.

The policies were purchased to offset a portion of our obligations

under our non-qualified deferred compensation plan. The cash

surrender value of the policies is included in other assets while

changes in cash surrender value are included in selling, general,

and administrative expenses.

Liquor Licenses

The costs of obtaining non-transferable liquor licenses that are

directly issued by local government agencies for nominal fees are

expensed as incurred. The costs of purchasing transferable liquor

licenses through open markets in jurisdictions with a limited num-

ber of authorized liquor licenses are capitalized. Annual liquor

license renewal fees are expensed.

Impairment of Long-Lived Assets

Land, buildings, and equipment and certain other assets, including

capitalized software costs and liquor licenses, are reviewed for

impairment whenever events or changes in circumstances indicate

that the carrying amount of an asset may not be recoverable.

Recoverability of assets to be held and used is measured by a

comparison of the carrying amount of the assets to the future undis-

counted net cash flows expected to be generated by the assets.

Identifiable cash flows are measured at the lowest level for which

they are largely independent of the cash flows of other groups of

assets and liabilities, generally at the restaurant level. If such assets

are determined to be impaired, the impairment recognized

38

Notesto

Consolidated Financial Statements

Financial Review 2004