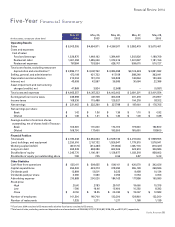

Red Lobster 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notesto

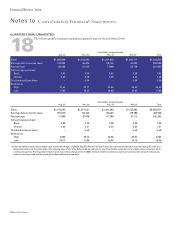

Consolidated Financial Statements

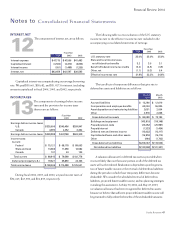

reported as other comprehensive income. These changes in fair

value are subsequently reclassified into earnings when the natural

gas and coffee are purchased and used by us in our operations.

Net gains (losses) of $(439) and $941 related to these derivatives

were recognized in earnings during fiscal 2004 and 2003, respec-

tively. The fair value of these contracts was a net gain of $106 at

May 30, 2004, and is expected to be reclassified from accumulated

other comprehensive income (loss) into food and beverage costs

or restaurant expenses during the next 12 months. To the extent

these derivatives are not effective, changes in their fair value are

immediately recognized in current earnings. Outstanding deriva-

tives are included in other current assets or other current liabilities.

At May 30, 2004, the maximum length of time over which we

are hedging our exposure to the variability in future natural gas cash

flows is 12 months. At May 30, 2004, we are not hedging our expo-

sure to the variability in future coffee cash flows. No gains or losses

were reclassified into earnings during fiscal 2004 or 2003 as a result

of the discontinuance of natural gas and coffee cash flow hedges.

Interest Rate Lock Agreement

During fiscal 2002, we entered into a treasury interest rate lock

agreement (treasury lock) to hedge the risk that the cost of a future

issuance of fixed-rate debt may be adversely affected by interest rate

fluctuations. The treasury lock, which had a $75,000 notional prin-

cipal amount of indebtedness, was used to hedge a portion of the

interest payments associated with $150,000 of debt subsequently

issued in March 2002. The treasury lock was settled at the time of

the related debt issuance with a net gain of $267 being recognized

in other comprehensive income. The net gain on the treasury lock is

being amortized into earnings as an adjustment to interest expense

over the same period in which the related interest costs on the new

debt issuance are being recognized in earnings. Amortization of

$53, $53, and $14 was recognized in earnings as an adjustment to

interest expense during fiscal 2004, 2003, and 2002, respectively.

It is expected that $53 of this gain will be recognized in earnings as

an adjustment to interest expense during the next 12 months.

Interest Rate Swaps

During fiscal 2004, we entered into interest rate swap agreements

(swaps) to hedge the risk of changes in interest rates on the cost of a

future issuance of fixed-rate debt. The swaps, which have a $75,000

notional principal amount of indebtedness, will be used to hedge a

portion of the interest payments associated with a forecasted issuance

of debt in fiscal 2006. To the extent the swaps are effective in offset-

ting the variability of the hedged cash flows, changes in the fair value

of the swaps are not included in current earnings but are reported as

other comprehensive income. The accumulated gain or loss at the

swap settlement date will be amortized into earnings as an adjustment

to interest expense over the same period in which the related interest

costs on the new debt issuance are recognized in earnings. The fair

value of the swaps at May 30, 2004 was a gain of $698 and is included

in accumulated other comprehensive income (loss) at May 30, 2004.

No amounts were recognized in earnings during fiscal 2004.

We had interest rate swaps with a notional amount of $200,000,

which we used to convert variable rates on our long-term debt to

fixed rates effective May 30, 1995. We received the one-month

commercial paper interest rate and paid fixed-rate interest ranging

from 7.51 percent to 7.89 percent. The interest rate swaps were

settled during January 1996 at a cost to us of $27,670. This cost

is being recognized as an adjustment to interest expense over the

term of our 10-year, 6.375 percent notes and 20-year, 7.125 percent

debentures (see Note 7).

FINANCIALINSTRUMENTS

9The fair values of cash equivalents, accounts receivable,

accounts payable, and short-term debt approximate

their carrying amounts due to their short duration.

The carrying value and fair value of long-term debt

at May 30, 2004, was $653,349 and $700,383, respectively. The

carrying value and fair value of long-term debt at May 25, 2003,

was $658,086 and $740,130, respectively. The fair value of long-

term debt is determined based on market prices or, if market prices

are not available, the present value of the underlying cash flows

discounted at our incremental borrowing rates.

STOCKHOLDERS’EQUITY

10Treasury Stock

Our Board of Directors has authorized us to

repurchase up to 115.4 million shares of our

common stock. In fiscal 2004, 2003, and

2002, we purchased treasury stock totaling $235,462, $213,311,

and $208,578, respectively. At May 30, 2004, a total of 109.2

million shares have been repurchased under the authorization.

The repurchased common stock is reflected as a reduction of

stockholders’ equity.

45

Financial Review 2004