Red Lobster 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review 2004

Management's Discussion and Analysis

of Financial Condition and Results of Operations

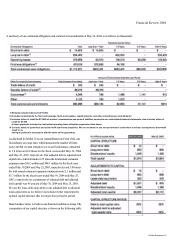

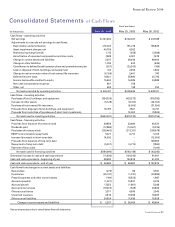

Net cash flows used in financing activities included our repurchase

of 10.7 million shares of our common stock for $235 million in fis-

cal 2004, compared to 10.7 million shares for $213 million in fiscal

2003, and 9.0 million shares for $209 million in fiscal 2002. Our

Board of Directors has authorized us to repurchase up to 115.4 mil-

lion shares of our common stock. At May 30, 2004, a total of

109.2 million shares have been repurchased under the authoriza-

tion. The repurchased common stock is reflected as a reduction of

stockholders' equity. Net cash flows used in financing activities also

included dividends paid to stockholders of $13 million, $14 million,

and $9 million in fiscal 2004, 2003, and 2002, respectively.

Net cash flows used in investing activities included capital expen-

ditures incurred principally for building new restaurants, replacing

equipment, and remodeling existing restaurants. Capital expendi-

tures were $354 million in fiscal 2004, compared to $423 million in

fiscal 2003, and $318 million in fiscal 2002. The decreased expen-

ditures in fiscal 2004 resulted primarily from decreased spending

associated with building fewer new restaurants and fewer remodels.

The increased expenditures in fiscal 2003 resulted primarily from

increased spending associated with building more new restaurants

and replacing equipment. We estimate that our fiscal 2005 capital

expenditures will approximate $360 million.

Net cash flows provided by operating activities for fiscal 2003

included a $20 million contribution to our defined benefit pension

plans, which enabled the plans to maintain a fully funded status

as of the plans' February 28,2003 annual valuation date. Less than

$0.1 million was required to fund our defined benefit pension

plans in fiscal 2004 and fiscal 2002. Our defined benefit and other

postretirement benefit costs and liabilities are calculated using

various actuarial assumptions and methodologies prescribed under

the Financial Accounting Standards Board's (FASB) Statement

of Financial Accounting Standards (SFAS) No. 87, "Employers'

Accounting for Pensions" and No. 106, "Employers' Accounting

for Postretirement Benefits Other Than Pensions". We use certain

assumptions including, but not limited to, the selection of a dis-

count rate, expected long-term rate of return on plan assets, and

expected health care cost trend rates. We set the discount rate

assumption annually for each plan at its valuation date to reflect the

yield of high quality fixed-income debt instruments, with lives that

approximate the maturity of the plan benefits. At May 30, 2004,

our discount rate was 6.0 percent. The expected long-term rate of

return on plan assets and health care cost trend rates are based upon

several factors, including our historical assumptions compared with

actual results, an analysis of current market conditions, asset alloca-

tions, and the views of leading financial advisers and economists.

Based on our analysis during fiscal 2003, we lowered our defined

benefit plans' expected long-term rate of return on plan assets for

fiscal 2004 from 10.4 percent to 9.0 percent. The change in our

defined benefit plans' expected long-term rate of return on plan

assets decreased earnings before income taxes by approximately

$2 million in fiscal 2004. At May 30,2004, our expected health care

cost trend rates ranged from 11.0 percent to 12.0 percent for fiscal

2005, depending on the medical service category. The rates gradu-

ally decrease to 5.0 percent through fiscal 2010 and remain at that

level thereafter.

The expected long-term rate of return on plan assets component

of our net periodic benefit cost is calculated based on the market-

related value of plan assets. Our target asset allocation is 35 percent

U.S. equities, 30 percent high-quality, long-duration fixed-income

securities, 15 percent international equities, 10 percent private

equities, and 10 percent real assets. We monitor our actual asset

allocation to ensure that it approximates our target allocation and

believe that our long-term asset allocation will continue to approxi-

mate our target allocation. Our historical ten-year rate of return

on plan assets, calculated using the geometric method average of

returns, is approximately 10.5 percent as of May 30,2004.

We have an unrecognized net actuarial loss for the defined ben-

efit plans and postretirement benefit plan as of May 30, 2004, of

$62 million and $6 million, respectively. The unrecognized net

actuarial loss represents changes in the amount of the projected

benefit obligation and plan assets resulting from differences in the

assumptions used and actual experience. The amortization of the

unrecognized net actuarial loss component of our fiscal 2005 net

periodic benefit cost for the defined benefit plans and postretire-

ment benefit plan is expected to be approximately $5 million and

$0.3 million, respectively.

We believe our defined benefit and postretirement benefit plan

assumptions are appropriate based upon the factors discussed above.

However, other assumptions could also be reasonably applied that

30 Darden Restaurants