Red Lobster 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

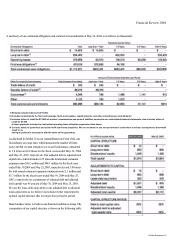

Financial Review 2004

This discussion and analysis below for Darden Restaurants, Inc.

Management's Discussion and Analysis

of Financial Condition and Results of Operations

should be read in conjunction with our consolidated financial

statements and related notes found elsewhere in this report.

For financial reporting, we operate on a 52/53 week fiscal year end-

ing on the last Sunday in May. Our 2004 fiscal year, which ended

on May 30, 2004, had 53 weeks. Our 2003 fiscal year, which ended

on May 25, 2003, and our 2002 fiscal year, which ended on May 26,

2002, each had 52 weeks. We have included in this discussion cer-

tain financial information for fiscal 2004 on a 52-week basis in order

to assist investors in making comparisons to our prior fiscal years.

OVERVIEW OF OPERATIONS

Our business operates in the casual dining segment of the restau-

rant industry, primarily in the United States. At May 30, 2004,

we operated 1,325 Red Lobster, Olive Garden, Bahama Breeze,

Smokey Bones Barbeque & Grill, and Seasons 52 restaurants in

the United States and Canada and licensed 38 Red Lobster res-

taurants in Japan. We own and operate all of our restaurants in the

United States and Canada, with no franchising.

Our sales were $5.00 billion in fiscal 2004 and $4.65 billion in fiscal

2003, a 7.5 percent increase. On a 52-week basis, after adjusting for

the $90 million of sales contributed by the additional 53rd operat-

ing week in fiscal 2004, total sales would have been $4.91 billion

for fiscal 2004, a 5.5 percent increase from fiscal 2003. Net earnings

for fiscal 2004 were $231 million ($1.36 per diluted share) com-

pared with net earnings for fiscal 2003 of $232 million ($1.31 per

diluted share). Net earnings for fiscal 2004 decreased 0.3 percent

and diluted net earnings per share increased 3.8 percent compared

to fiscal 2003. Although Red Lobster's string of 23 consecutive

quarters of U.S. same-restaurant sales gains ended during fiscal

2004, Red Lobster has made progress in some important areas. Red

Lobster improved its operating efficiency during fiscal 2004 through

improvements in labor management and other cost controls, as

well as implementing a less-disruptive promotional strategy in the

second half of fiscal 2004, which resulted in higher operating profit

than in fiscal 2003. Results from guest satisfaction surveys also

improved as the fiscal year progressed. Red Lobster retained a new

advertising agency in fiscal 2004 and is in the process of developing

a marketing plan designed to achieve more sustainable benefits

than have been obtained in prior years. Red Lobster also is develop-

ing new entree offerings in the $10-$ 15 price range to strengthen

the value offered to its guests. Olive Garden's sales gains in fiscal

2004, combined with lower food and beverage costs, restaurant

expenses, and selling, general and administrative expenses as a

percent of sales, more than offset increased restaurant labor

expenses as a percent of sales. This resulted in a double-digit

increase in operating profit for Olive Garden during fiscal 2004

along with record annual operating profit and return on sales.

In fiscal 2005, we expect to increase our number of restaurants by

approximately 50 to 60 restaurants. We expect combined same-

restaurant sales growth in fiscal 2005 of between one percent and

three percent for Red Lobster and Olive Garden. We believe we

can achieve diluted net earnings per share growth in the range of

8 percent to 12 percent for fiscal 2005. In fiscal 2005, we also expect

Bahama Breeze to be accretive to earnings, and Smokey Bones to

remain dilutive to earnings. However, we expect Smokey Bones to

be accretive to earnings in the second half of fiscal 2005. As with

same-restaurant sales growth, there can always be some quarter-to-

quarter variability in operating results, where specific factors put us

above or below the expected range of diluted net earnings per share

growth. We believe our strong balance sheet and cash flows will be

important factors in helping us reach our goals.

Our mission is to be the best in casual dining, now and for genera-

tions. To achieve this goal, we focus on four strategic imperatives:

leadership excellence, brand management excellence, service and

hospitality excellence, and culinary and beverage excellence.

From a financial perspective, we seek to increase sales and profits.

To evaluate our operations and assess our financial performance,

we use the following two key factors:

• Same-restaurant sales - a year-over-year comparison of each period's

sales volumes for restaurants that are open more than 16 months; and

• Operating margins - restaurant sales less restaurant-level cost

of sales (food and beverage costs, restaurant labor, and other

restaurant expenses).

Increasing same-restaurant sales can increase operating margins,

since these incremental sales provide better leverage of our fixed

costs. Same-restaurant sales increases can be generated by increases

in guest traffic, increases in the average guest check, or a combina-

tion of the two. The average guest check can be impacted by menu

price changes and by the mix of menu items sold. For each concept,

22 Darden Restaurants